Page 1 of 1

The IRS and Social Security Administration released the 2015 cost-of-living (COLA) adjustments that apply to health flexible spending accounts (FSAs) in Revenue Procedure 2014-61. The new annual limit for health FSAs, including general-purpose and limited-purpose health FSAs, is $2,550 for plan years starting on or after January 1, 2015.

The $2,550 limit is prorated for short plan years (plan years that are shorter than 12 months) and any carry over amount from participants’ previous plan years may be added to the limit. For instance, participants may elect $2,550 for the 2015 plan year and carry over a maximum of $500 from the previous plan year, making their total account value $3,050 for the 2015 plan year. In other words, the $500 carryover does not count against or affect the $2,550 salary reduction limit. Please note that an employer must decide to allow to either offer participants a option of a max $500 carryover OR the 2.5 month extension to use funds. An employer can not offer both options under their plan.

The IRS has released the 2013 version of Form 8941, which eligible small employers will need to use to calculate their small business health care tax credit.

Employers may qualify for a tax credit of up to 35% (or up to 25% for eligible tax exempt organizations) of nonelective employer contributions under a qualifying health insurance arrangement, if they have fewer than 25 employees AND pay average annual wages of less than $50,000 per employee. A qualifying health insurance plan generally requires the employer to pay a uniform percentage of the premium (not less than 50%) for each enrolled employee’s health coverage. Once calculated, the tax credit is claimed as a general business credit on Form 3800 (or for tax exempt small employers as a refundable credit on Form 990-T).

There are important changes to the tax credit that become effective beginning with 2014 taxable years that are important to note:

1. the maximum credit amount increases from 35% to 50% of employer paid premiums

2. coverage under a qualifying arrangement must be offered through a SHOP Exchange

3. the credit can be claimed for only 2 consecutive years beginning in or after 2014, and

4. due to the cost-of-living adjustment, the tax credit will be reduced if an employer’s average annual wages exceed $25,400 and will be eliminated if average annual wages exceed $50,800

Employers who plan on claiming the small business tax credit for 2014 will need to make sure they are familiar with these new requirements.

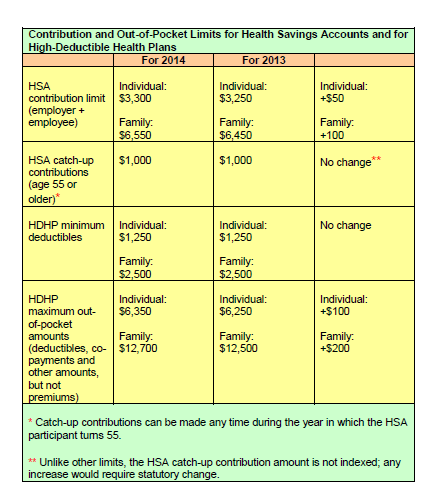

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who: