Page 1 of 1

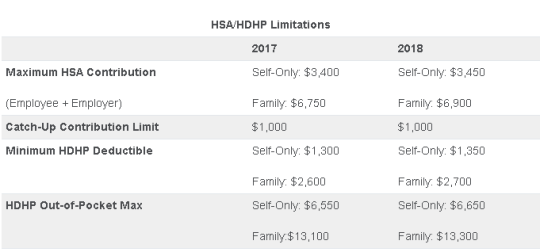

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.

On March 1, 2016, the Department of Health and Human Services (HHS) announced the finalized 2017 health plan out-of-pocket (OOP) maximums. Applicable to non-grandfathered health plans, the OOP limits for plan years beginning on or after January 1, 2017 are $7,150 for single coverage and $14,300 for family coverage, up from $6,850 single/$13,700 family in 2016. The OOP maximum includes the annual deductible and any in-network cost-sharing obligations members have after the deductible is met. Premiums, pre-authorization penalties, and OOP expenses associated with out-of-network benefits are not required to be included in the OOP maximums.

In addition to the new OOP maximum limits, employers offering high deductible health plans need to be particularly mindful of the embedded OOP maximum requirement. Beginning in 2016, all non-grandfathered health plans, whether self-funded or fully insured, must apply an embedded OOP maximum to each individual enrolled in family coverage if the plan’s family OOP maximum exceeds the ACA’s OOP limit for self-only coverage ($7,150 for 2017). The ACA-required embedded OOP maximum is a new and often confusing concept for employers offering a high deductible health plan (HDHP). Prior to ACA, HDHPs commonly imposed one overall family OOP limit on family coverage (called an aggregate OOP) without an underlying individual OOP maximum for each covered family member. Now, HDHPs must comply with the IRS deductible and OOP parameters for self-only and family coverage in addition to ACA’s OOP embedded single limit requirement.

The IRS is expected to announce the 2017 HDHP deductible and OOP limits in May 2016.

If you currently have an individual health insurance plan, you will be in for a big change when you sign up for your coverage in 2014.

Approximately 50% of the individual health plans that are currently being sold in the marketplace do not meet the standards of Obamacare to be sold in 2014. The reason for this is because the Affordable Care Act (ACA) sets new minimums for the basic coverage every individual health care plan must provide effective on renewals on or after January 1, 2014.

About 15 million Americans (or about 6% of non-elderly adults) currently have coverage in the individual health market. Beginning in the fall of 2013, they will be able to shop for and enroll in health insurance through state-based exchanges (aka SHOP or The Exchange) with coverage taking effect in January. By 2016, it is projected that around 24 million people will get their insurance through the exchanges, while another 12 million will continue to obtain individual coverage outside of the exchange.

Beginning in 2014, nearly all plans, both group and individual, will be required to cover an array of “essential” services regardless of if they are purchased within the exchange or not. These “essential” services will include medication, maternity, and mental health care. Many individual plans do not currently offer these benefits.

What will happen to the plans that do not meet the new minimum standards? They will more than likely disappear and you will not be allowed to renew your existing coverage on the plan you currently have. A handful of existing plans will be grandfathered in, but the qualifying criteria for a grandfathered plan is hard to meet. In order for your existing individual plan to be considered “grandfathered”, (1) you have to have been enrolled on this plan before the ACA was passed in 2010 and (2) the plan has to have maintained fairly steady co-pay, deductible and coverage rates until now.

Many insurers in the individual marketplace have already acknowledged that the majority of their existing individual plans do not meet Obamacare standards for 2014 and they are currently working to ready new product lineups for 2014.

In the future, consumers buying individual plans will be able to choose between four levels of coverage: platinum, gold, silver, and bronze.

Platinum plans will carry the highest premiums but will offer the lowest out of pocket expenses, with enrollees paying no more than 10%, on average. At the other end of the spectrum are the bronze plans, which will have the lowest monthly premiums but will have higher deductibles and copayments totaling up to 40% of the out of pocket costs on average.

Starting also in 2014, all Americans will be required to carry health care coverage or face fines. Those penalties will start at $95 per adult or 1% of the adjusted family income, whichever is greater, and will escalate in later years.

Individuals will annual incomes of up to 400% of the poverty line (or roughly $45,000 for an individual and about $92,000 for a family of four) will get federal subsidies to help defray the premium costs.

Most individual plans sold next year, even the lowest level bronze plans, are likely to charge higher premiums than today’s most “bare-bones” individual insurance plans. Many consumers feel the costs will be offset by having lower out of pocket costs and more comprehensive coverage than their current “bare-bones” plan offers.

In today’s marketplace, with deductibles of $10,000, an individual can buy a policy and then when they get sick, they may go broke because the policy leaves them with such a high level of out of pocket expenses to pay. Many insurance industry experts feel, however, that consumers may now wind up with more coverage–and higher monthly costs– than they want. As a result, some individuals may just choose to simply pay the fine instead of obtaining health insurance coverage they will not use or can not afford.