Page 1 of 8

On Tuesday, April 23, the U.S. Department of Labor announced a rule to significantly increase the salary level needed to qualify for the FLSA’s overtime exemptions applicable to executive, administrative and professional employees to $844 per week ($43,888 annualized). The rule will also increase the total compensation needed to qualify for exemption under the test for highly compensated employees to $132,964 per year. These figures will be effective on July 1, 2024, but will increase again as of January 1, 2025. On that date, the rule will increase the salary basis threshold to $1,128 per week ($58,656 annualized), and the threshold for exemption for highly compensated employees to $151,164 per year.

Under the rule, these salary levels will be subject to automatic increases every three years. While legal challenges to the new rule are expected, employers should not wait for those challenges to be resolved before assessing the rule’s impact on their operations and considering potential changes.

An “old faithful” reporting requirement deadline is right around the corner: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The due date for the filing and payment of PCORI fee is July 31 for required policy and plan years that ended during the 2022 calendar year. For plan years that ended Jan. 1, 2022 – Sept. 30, 2022, the fee is $2.79 per covered life. For plan years that ended Oct. 1, 2022 – Dec. 31, 2022 (including calendar year plans that ended Dec. 31, 2022), the fee is calculated at $3.00 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is due by July 31 of the year following the last day of the plan year to which the payment relates (i.e. filling for the 2022 PCORI fee is due by July 31, 2023)

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

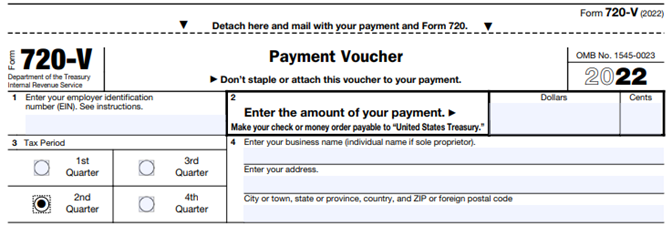

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

The U.S. Department of Labor Wage and Hour Division (WHD) published Field Assistance Bulletin No. 2023-02 providing guidance to agency officials responsible for enforcement of the “pump at work” provisions of the Fair Labor Standards Act (FLSA) including those recently enacted under the 2022 PUMP Act.

The PUMP Act was adopted along with the Pregnant Workers Fairness Act when President Biden signed the Consolidated Appropriations Act, 2023 in December 2022.

This guidance provides employers a glimpse into how the WHD understands and will enforce the rights now available to most employees under the Fair Labor Standards Act for reasonable break time and a place to express breast milk at work for a year after a child’s birth.

Here are a few highlights from the WHD’s bulletin.

The WHD also provides additional resources for employers on its Pump At Work webpage.

It has been previously discussed that President Biden announced an end to the COVID-19 Public Health Emergency (PHE) and National Emergency (NE) periods on May 11, 2023, and the practical ramifications for employer group health plan sponsors as they administer COBRA, special enrollment, and other related deadlines tied to the end of the NE. As discussed, this action generally meant that all applicable deadlines were tolled until the end of the NE plus 60 days, or July 10, 2023, with all regular (non-extended) deadlines taking effect for applicable events occurring after that.

A Change in the National Emergency End Date

A new wrinkle recently added a potential complication to calculating these deadlines. President Biden signed H.R. Res. 7 into law on April 10, 2023, after Congress jointly introduced H.R. Res. 7 as a one-line action to end the NE, effective immediately. The consequence is that the applicable end of the transition relief is now June 9, 2023 (60 days following April 10, 2023) instead of July 10, 2023, as previously anticipated. The Department of Labor (DOL), however, has informally announced that despite the statutory end of the NE being 30 days earlier than expected, to avoid potential confusion and changes to administrative processes already in progress, the deadline of July 10, 2023, will remain the relevant date for COBRA, special enrollment, and other related deadlines under previous guidance. Prophetically, updated FAQs, released March 29, 2023, by the DOL, Department of Treasury, and Department of Health and Human Services (the Agencies), provide, “the relief generally continues until 60 days after the announced end of the COVID-19 National Emergency or another date announced by DOL, the Treasury Department, and the IRS (the “Outbreak Period”). [emphasis added]” Further clarification and formal guidance are still expected.

Updated DOL FAQ Guidance

Most employers rely on third-party vendors and consultants to help administer COBRA, special enrollments, claims, appeals, etc. All should be aware of the impact the end of the NE and PHE has on all applicable deadlines. The FAQs provide at Q/A-5 specific examples to help employers, consultants, and administrators apply the end of NE and PHE deadlines and different scenarios related to COBRA elections and payments before and after the end of the Outbreak Period, special enrollment events, Medicaid election changes, etc. The FAQs also make clear that employers are encouraged to consider extending these deadlines for the current plan year. Employers should discuss the impact of this guidance with their vendors and consultants to ensure all parties comply with the upcoming transitional periods.

The FAQs also confirm (at Q/A 1-4) the impact of the end of the PHE on COVID-19-related testing and diagnostic procedures, noting that as of the end of the PHE on May 11, 2023, group health plans are no longer required to provide certain COVID-19 related coverage at 100 percent under the plan, but can revert to previous cost-sharing and deductible limitations that existed before the COVID-19 pandemic. Note that President Biden’s recent action approving the end of the NE on April 10, 2023, has no impact on the previously communicated end to the PHE on May 11, 2023. Employers should review changes in coverage of COVID-19 testing and other related treatment or procedures with their insurance carriers, consultants, and advisors, including any notices that may be required in connection with those changes. The DOL confirmed that while encouraged to do so, employers do not have to provide any separate notification of any changes in current coverage limits before the PHE end date unless the employer had previously disclosed a different level of coverage in its current Summary of Benefits and Coverage (SBC) provided during the most recent open enrollment period.

COVID-19 Testing and Treatment Under High Deductible Health Plan/Health Savings Accounts

Q/A-8 of the FAQs provides interim clarification regarding the impact of the end of the PHE on high-deductible health plans (HDHPs) that are tied to health savings accounts (HSAs) and the ability to provide medical coverage for COVID-19 testing or treatment without requiring an employee to satisfy applicable HDHP deductibles for HSA contribution purposes. Even though IRS Notice 2020-15 provided relief from general deductible limitations under Code Section 223(c)(1) through the end of the PHE, the Agencies have determined this relief will remain in effect after the end of the PHE and until the IRS issues further guidance.

The recorded presentation of AAG’s 2023 Educational Seminar held on April 11, 2023 is now available for viewing.

Guest Speaker and Attorney Keith Hammond, of Hammond Law Center, focused on changes in employment law that have occurred over the past year including a few new regulations that could affect your business which will go into effect this summer as well as non-competes and changes from the DOL, NLRB, and OSHA.

This seminar is also approved for 2 Professional Development Credits (PDCs) with SHRM for all attendees.

On February 23, 2023, the Departments of Labor, Health and Human Services and the Treasury (Departments) issued FAQs on the prohibition of gag clauses under the transparency provisions of the Consolidated Appropriations Act, 2021 (CAA). These FAQs require health plans and health insurance issuers to submit their first attestation of compliance with the CAA’s prohibition on gag clauses by December 31, 2023.

Effective December 27, 2020, the CAA forbids health plans and issuers from entering into contracts with health care providers, third-party administrators (TPAs) or other service providers that would restrict the plan or issuer from providing, accessing or sharing certain information about provider price and quality and deidentified claims.

Plans and issuers must annually submit an attestation of compliance with these requirements to the Departments. The first attestation is due by December 31, 2023, covering the period beginning December 27, 2020, through the date of attestation. Subsequent attestations, covering the period since the last attestation, are due by December 31 of each following year.

Employers should ensure any contracts with TPAs or other health plan service providers offering access to a network of providers do not violate the CAA’s prohibition of gag clauses. Additionally, employers with fully insured or self-insured health plans should prepare to provide the compliance attestation by December 31, 2023. If the issuer for a fully insured health plan provides the attestation, the plan does not also need to provide an attestation. Also, employers with self-insured health plans can enter into written agreements with their TPAs to provide the attestation, but the legal responsibility remains with the health plan.

A gag clause is a contractual term that directly or indirectly restricts specific data and information that a health plan or issuer can make available to another party. Effective December 27, 2020, the CAA generally prohibits group health plans and issuers offering group health insurance from entering into agreements with health care providers, TPAs or other service providers that include certain gag clause language. Specifically, these contracts cannot restrict a plan or issuer from:

For example, if a contract between a TPA and a health plan provides that the plan sponsor’s access to provider-specific cost and quality-of-care information is only at the discretion of the TPA, that contractual provision would be considered a prohibited gag clause.

Plans and issuers must ensure their agreements with health care providers, networks or associations of providers, TPAs or other service providers offering access to a network of providers do not contain provisions that violate the CAA’s prohibition on gag clauses.

Health plans and issuers must annually submit an attestation of their compliance with the CAA’s prohibition on gag clauses to the Departments. The first attestation must be submitted no later than December 31, 2023, covering the period beginning December 27, 2020, through the date of the attestation. Subsequent attestations are due by December 31 of each following year, covering the period since the last attestation.

According to the Departments’ FAQs, health plans and issuers that do not submit their attestations by the deadline may be subject to enforcement action.

The attestation requirement applies to fully insured and self-insured group health plans, including ERISA plans, non-federal governmental plans and church plans. Additionally, this requirement applies regardless of whether a plan is considered “grandfathered” under the ACA. However, plans that only provide excepted benefits and account-based plans, such as health reimbursement arrangements (HRAs), are not required to submit an attestation.

With respect to fully insured group health plans, the health plan and the issuer are each required to submit a gag clause compliance attestation annually. However, when the issuer of a fully insured group health plan submits a gag clause compliance attestation on behalf of the plan, the Departments will consider the plan and issuer to have satisfied the attestation submission requirement.

Employers with self-insured health plans can satisfy the gag clause compliance attestation requirement by entering into a written agreement under which the plan’s service provider, such as a TPA, will provide the attestation on the plan’s behalf. However, even if this type of agreement is in place, the legal requirement to provide a timely attestation remains with the health plan.

The Departments launched a website through the Centers for Medicare and Medicaid Services for health plans and issuers to submit their gag clause compliance attestations. The Departments have also provided instructions for submitting the attestation, a system user manual, and a reporting entity Excel template for plans and issuers to submit the required attestation, all of which are available here.

The U.S. Department of Labor (DOL) has issued guidance on the application of the Fair Labor Standards Act (FLSA) and Family and Medical Leave Act (FMLA) to employees who telework from home or from another location away from the employer’s facility.

The Field Assistance Bulletin (FAB) 2023-1, released on February 9, 2023, is directed to agency officials responsible for enforcement and provides employers a glimpse into how the DOL applies existing law and regulations to common remote-work scenarios. FAB 2023-1 addresses FLSA regulations governing “hours worked,” rules related to break time and privacy for nursing employees, and FMLA eligibility factors.

Hours Worked

In the FAB, the DOL reviews the rules governing compensability of work time, explaining that, regardless of work location, short breaks (typically, 20 minutes or less) generally are counted as compensable hours worked, whereas, longer breaks “during which an employee is completely relieved from duty, and which are long enough to enable [the employee] to use the time effectively for [their] own purposes[,] are not hours worked.” Examples of short breaks, whether at home or in the office, include when an employee takes a bathroom or coffee break or gets up to stretch their legs.

Longer rest breaks and periods of time, when employees are completely relieved from duty and able to use the time for their own purposes, are not considered work time. Just as would be the case when an employee is working in the office, if during remote work an employee’s 30-minute lunch break is interrupted by several work-related phone calls, that 30-minute period would be counted as hours worked. Conversely, if an employee working from home takes a three-hour break to pick up their child or to perform household chores, that time does not count as work time under the FLSA. In short, the FAB reiterates the telework guidance set forth by the DOL in a Q&A series published during the height of the COVID-19 pandemic.

The FAB emphasizes that, regardless of whether an employee performs duties at home, at the worksite, or at some other location, if the employer knows or has reason to believe that work is being performed, the time must be counted as hours worked. Importantly, the FAB notes that an employer may satisfy its obligation to exercise reasonable diligence to acquire knowledge regarding employees’ unscheduled hours of work by providing a reasonable reporting procedure for employees to use when they work non-scheduled time and paying employees for all hours worked. This guidance was addressed in greater detail in FAB 2020-5.

Guidelines for Nursing Employees

The FAB further clarifies that, under the FLSA, an employer’s obligation to provide employees “reasonable break time,” as well as an appropriate place to express breast milk, extends to employees who are teleworking or working at an off-site location. Just as an employer has an obligation to provide an “appropriate place” for an employee to express milk while working at a client site, the employer should ensure a teleworking employee has privacy from a “computer camera, security camera, or web conferencing platform” to express milk.

Employers are not required to pay employees for otherwise unpaid breaks simply because the employee is expressing breast milk during the break, but if an employee is working while pumping (or if the pumping occurs during an otherwise paid break), they must be paid for that time. For example, in most cases, if a remote employee attends a call or videoconference off camera while pumping, that employee would be considered on duty and must be paid for that time.

The recently enacted PUMP Act expanded existing employer obligations under the FLSA to cover exempt employees, as well as non-exempt employees. The DOL has published more guidance on breast milk pumping during work.

Eligibility Under FMLA

The DOL also addresses FMLA eligibility requirements for remote employees both in terms of hours worked (employee must work 1,250 hours in the previously 12 months) and the small worksite exception (employee must work at a worksite with at least 50 employees in a 75-mile radius).

As with the FLSA, it is important for employers to have a system to track their remote workers’ hours. With respect to hours worked, the FAB reiterates that the 1,250 hours determination for remote worker is based on compensable hours of work under FLSA principles.

With respect to the worksite size determination, the FMLA regulations explain that an employee’s personal residence is not a worksite. Instead, whether a remote employee is FMLA-eligible is based on the size of the worksite from which “they report to” or “their assignments are made.” If a remote employee reports into or receives assignments from a site with 50 or more employees working at that site (or reporting to or receiving assignments from that site) or within 75 miles, then that employee would meet that eligibility factor.

The DOL provided two examples of this rule:

Employers are reminded to review state and local wage and hour laws, paid and unpaid leave laws, and lactation accommodation laws. If you have any questions about applying the FLSA, the FMLA, or state and local laws to your remote workers or any other questions about remote work considerations, please reach out to any Jackson Lewis attorney.

The Departments of Labor, Treasury, and Health and Human Services (the Departments) issued reporting relief for health plans and issuers facing difficulty meeting the December 27th, 2022, deadline of reporting prescription drug and health care spending information.

The Consolidated Appropriations Act, 2021, (CAA) requires that health plans and issuers report, on an annual basis, certain prescription drug and health care spending information. The first reporting (for 2020 and 2021) was originally due in December 2021 but was delayed to December 27, 2022. The reporting has proved to be a challenge for many plan sponsors and issuers.

As such, the Departments announced two important pieces of relief:

As group health plan sponsors, employers are responsible for ensuring compliance with the prescription drug data collection (RxDC) reporting requirements added to ERISA by the Consolidated Appropriations Act of 2021 (CAA). Under ERISA section 725, enforced by the US Department of Labor (DOL), group health plans (not account-based plans, e.g., health reimbursement arrangements and health savings accounts, or excepted benefit arrangements) must report details regarding the plan’s prescription drug benefit utilization, including the drugs most frequently dispensed, the most expensive drugs, and the drugs with the highest cost increase for a given calendar year. Reporting is to be made annually to the US Department of Health and Human Services’ (HHS) CMS enterprise portal’s Health Insurance Oversight System (HIOS) module, starting with the report due by December 27, 2022, for the 2020 and 2021 calendar years. After that, annual reporting is due by June 1st following the calendar year (so, the 2022 calendar year report is due by June 1, 2023). The DOL must thereafter post aggregated information on its website so that the public can see trends in prescription drug utilization and pricing.

What’s required. Under regulations issued jointly by HHS, DOL, and the US Treasury Department, plans must submit RxDC reports which include –

How to comply. HIOS issued specific reporting instructions which explain the reporting requirements in detail and assure plan sponsors that submission for a plan “is considered complete if CMS receives all required files, regardless of who submits the files.” Many group health plan vendors (insurers, third-party administrators, pharmacy benefit managers, etc.) have proactively contacted plan sponsors to assure them that the vendor will report at least some of the information on the plan’s behalf. However, not all vendors are willing to accept responsibility for the RxDC reporting requirements. Employers need to know which reporting obligations will be fulfilled by the group health insurer or other vendor and which reporting obligations must be satisfied by the plan sponsor. Most plan sponsors are wise to be prepared to upload at least some of the data to the HIOS module themselves, which means first setting up a HIOS account on the CMS portal. HIOS accounts can take a couple of weeks to set up, so it’s important for plan sponsors to act on this now if they’ve not already done so. CMS has provided detailed instructions for setting up the HIOS account.

Compliance issues. The statute and regulations impose the RxDC reporting requirements on group health plans, which, by default, usually means that requirements and liability for noncompliance are imposed on plan sponsors (generally, employers). Thus, each group health plan sponsor should ensure that all of the RxDC reporting requirements are satisfied for each group health plan subject to the reporting requirements. Employers should obtain written agreements from plan vendors identifying what data each vendor will upload. Note that the employer remains liable for noncompliance (and subject to excise tax and potential civil penalties), even if it has an enforceable agreement with its vendor to ensure compliance unless the plan is fully-insured and the agreement is with the insurer. Unfortunately, only the reporting entity can view the files it uploads to HIOS, so there is no way for an employer to confirm on the HIOS module that a vendor uploaded the file(s) it agreed to upload on behalf of the employer’s group health plan. Instead, the employer should obtain written assurance from the plan’s vendor(s) and rely on contractual provisions for recourse if a vendor fails to fulfill its RxDC reporting service as agreed.

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.