Page 1 of 2

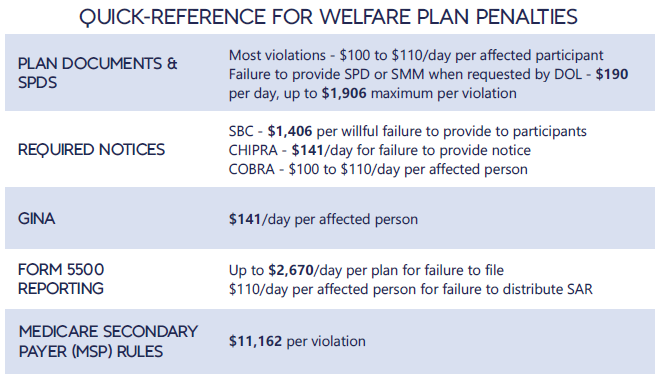

Each year in mid January, the Department of Labor (DOL) adjusts ERISA penalty amounts to account for inflation. This year’s increases are modest and amount to approximately 3%. Below summarizes a few of the penalty amounts that plan sponsors could see imposed on them for various federal law violations. The adjusted amounts apply to ERISA violations that occurred after November 2, 2015, if penalties are assessed after January 15, 2024, and before January 16, 2025.

*Notes: figures in bold are subject to annual adjustment

Below are the current inflation adjusted penalty amounts for failure to file forms 1094 and 1095 with the IRS and failure to provide form 1095 to applicable employees. Both penalties increase to $630 per form if failure is due to “intentional disregard” (criminal penalties may also apply).

An “old faithful” reporting requirement deadline is right around the corner: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The due date for the filing and payment of PCORI fee is July 31 for required policy and plan years that ended during the 2022 calendar year. For plan years that ended Jan. 1, 2022 – Sept. 30, 2022, the fee is $2.79 per covered life. For plan years that ended Oct. 1, 2022 – Dec. 31, 2022 (including calendar year plans that ended Dec. 31, 2022), the fee is calculated at $3.00 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is due by July 31 of the year following the last day of the plan year to which the payment relates (i.e. filling for the 2022 PCORI fee is due by July 31, 2023)

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

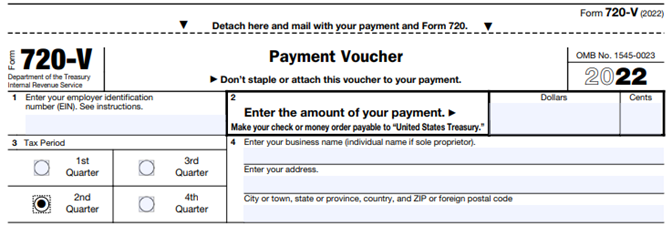

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

The COVID-19 Outbreak Period was declared effective on March 1, 2020. It had numerous impacts upon employee benefit plans, extending timelines with which plan participants and plan sponsors/employers had to perform certain benefit-related activities. On January 30, 2023, President Biden declared he would end the National Emergency effective May 11, 2023.

To recap, the declaration of the Outbreak Period impacted benefit plans in many ways by instructing ERISA plans and participants to disregard the Outbreak Period for:

However, it is important to note that ERISA contains language limiting timeline extensions to no more than one year. Thus for example, the normal 60-day timeframe for a an eligible Qualified Beneficiary to elect COBRA continuation coverage was extended by the Outbreak Period to one year plus 60 days.

With the declaration of the end of the National Emergency on May 11, 2023, the 60-day clock to end the Outbreak Period will start. This means that effective on July 10, 2023 (60 days after the end of the National Emergency) all of the pre-pandemic rules impacting the above items (and others) will go back to their normal timeframes.

As group health plan sponsors, employers are responsible for ensuring compliance with the prescription drug data collection (RxDC) reporting requirements added to ERISA by the Consolidated Appropriations Act of 2021 (CAA). Under ERISA section 725, enforced by the US Department of Labor (DOL), group health plans (not account-based plans, e.g., health reimbursement arrangements and health savings accounts, or excepted benefit arrangements) must report details regarding the plan’s prescription drug benefit utilization, including the drugs most frequently dispensed, the most expensive drugs, and the drugs with the highest cost increase for a given calendar year. Reporting is to be made annually to the US Department of Health and Human Services’ (HHS) CMS enterprise portal’s Health Insurance Oversight System (HIOS) module, starting with the report due by December 27, 2022, for the 2020 and 2021 calendar years. After that, annual reporting is due by June 1st following the calendar year (so, the 2022 calendar year report is due by June 1, 2023). The DOL must thereafter post aggregated information on its website so that the public can see trends in prescription drug utilization and pricing.

What’s required. Under regulations issued jointly by HHS, DOL, and the US Treasury Department, plans must submit RxDC reports which include –

How to comply. HIOS issued specific reporting instructions which explain the reporting requirements in detail and assure plan sponsors that submission for a plan “is considered complete if CMS receives all required files, regardless of who submits the files.” Many group health plan vendors (insurers, third-party administrators, pharmacy benefit managers, etc.) have proactively contacted plan sponsors to assure them that the vendor will report at least some of the information on the plan’s behalf. However, not all vendors are willing to accept responsibility for the RxDC reporting requirements. Employers need to know which reporting obligations will be fulfilled by the group health insurer or other vendor and which reporting obligations must be satisfied by the plan sponsor. Most plan sponsors are wise to be prepared to upload at least some of the data to the HIOS module themselves, which means first setting up a HIOS account on the CMS portal. HIOS accounts can take a couple of weeks to set up, so it’s important for plan sponsors to act on this now if they’ve not already done so. CMS has provided detailed instructions for setting up the HIOS account.

Compliance issues. The statute and regulations impose the RxDC reporting requirements on group health plans, which, by default, usually means that requirements and liability for noncompliance are imposed on plan sponsors (generally, employers). Thus, each group health plan sponsor should ensure that all of the RxDC reporting requirements are satisfied for each group health plan subject to the reporting requirements. Employers should obtain written agreements from plan vendors identifying what data each vendor will upload. Note that the employer remains liable for noncompliance (and subject to excise tax and potential civil penalties), even if it has an enforceable agreement with its vendor to ensure compliance unless the plan is fully-insured and the agreement is with the insurer. Unfortunately, only the reporting entity can view the files it uploads to HIOS, so there is no way for an employer to confirm on the HIOS module that a vendor uploaded the file(s) it agreed to upload on behalf of the employer’s group health plan. Instead, the employer should obtain written assurance from the plan’s vendor(s) and rely on contractual provisions for recourse if a vendor fails to fulfill its RxDC reporting service as agreed.

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

The COVID-19 extensions that the DOL and IRS had issued last year as part of their “Joint Notice” were set to expire at midnight on February 28th. For weeks, many have been asking the DOL and IRS for guidance on how to handle the statutorily-mandated expiration, and as a result of the lack of guidance, most plans, TPAs, insurers, and COBRA administrators had to make a judgment call as to how to proceed.

But – with 2 days to spare – DOL finally issued Disaster Relief Notice 2021-01 on February 26th.

Notice 2021-01 sets forth the DOL and IRS’ position that the COVID-19 extensions will continue past February 28th, and that all such extensions must be measured on a person-by-person basis – which was not clear from the prior guidance. Plans, TPAs, insurers, and COBRA administrators may have to reconsider their administrative practices in light of this new direction.

The original Joint Notice (85 Fed. Reg. 26351 (May 4, 2020) required that health and retirement plans toll a number of deadlines for individuals during the COVID-19 National Emergency, plus a 60-day period (the “Outbreak Period”) starting March 1, 2020.

But, as described in Footnote 4 of the Joint Notice, ERISA and the Code limit DOL and Treasury’s ability to toll deadlines to one year (“Tolling Period”).

The deadlines impacted in the Joint Notice are:

When there has been disaster relief guidance in the past, these periods have not bumped up against the statutorily-imposed one-year limit, so this COVID-19 extension is new territory – hence all the requests for the agencies to issue guidance regarding the expiration date.

In this late-breaking Notice 2021-01, DOL says it coordinated with HHS and IRS, and the agencies are interpreting the Tolling Period to be read on a person-by-person basis.

Specifically, DOL says that the Tolling Period ends the earlier of:

This means that each individual has his or her own Tolling Period!

For example, a COBRA Qualified Beneficiary (QB) has 60 days to elect COBRA, counted from the later of their loss of coverage or the date their COBRA election notice is provided. Under the Joint Notice, a QB’s 60-day deadline was tolled as of March 1, 2020, until the end of the Outbreak Period (that is, until the end of the National Emergency + 60 days).

At the end of the Outbreak Period, the deadlines would start running again, and the QB would have their normal 60-day COBRA election period (or the balance of their election period if it started before March 1, 2020).

BUT – with the 1-year expiration, DOL’s new Notice 2021-01 says that the one-year period does not end on February 28, 2021 for all individuals, but rather each individual has his/her own one-year Tolling Period.

Examples:

For all of these examples, the tolling would end earlier if the National Emergency ends. In that case, the election period would end 60 days after the end of the National Emergency.

Notice 2021-01 also says that DOL recognizes that enrollees may continue to encounter COVID issues, even after the one-year Tolling Period expiration. DOL says that the “guiding principle” is for plans to act reasonably, prudently, and in the interest of the workers and their families. DOL says that plan fiduciaries should make “reasonable accommodations to prevent the loss of or undue delay in payment of benefits . . . and should take steps to minimize the possibility of individuals losing benefits because of a failure to comply with pre-established time frames.”

Notice 2021-01 does not provide any direction regarding what would constitute a “reasonable accommodation.” It sounds like plans may need a process to consider whether to continue to waive deadlines on a case-by-case basis, but without any guidance as to what parameters to apply. And DOL suggests that failure to do so could be a fiduciary issue.

Regarding communicating these changes to enrollees, DOL says:

DOL seems to be saying that plans may need to notify each individual when his or her one-year extension is about to be up and should include information about the Health Insurance Marketplace. In addition, plans may need to update prior communications that did not anticipate this new DOL interpretation.

DOL says it acknowledges that there may be instances when plans or service providers themselves may not be able to fully and timely comply with pre-established timeframes and disclosure requirements. DOL says that where fiduciaries have acted in “good faith and with reasonable diligence under the circumstances,” DOL’s approach to enforcement will be “marked by an emphasis on compliance assistance,” including grace periods or other relief.

In a proposed regulation, federal agencies suggest a rule that would require employer-sponsored group health plans to provide plan enrollees with estimates of their out-of-pocket expenses for services from different health care providers. Plans would make this information available through an online self-service tool so enrollees could shop and compare costs for services before receiving care.

Comments are due by Jan. 14, 2020, on the transparency-in-coverage rule issued by the departments of Health and Human Services, Labor and the Treasury. The unpublished rule was released on Nov. 15, when the agencies also posted a fact sheet summarizing the proposal.

Some feel that the rule, if finalized, would be the most dramatic expansion of disclosure obligations for group health plans since the ERISA was passed in 1974.

The proposal is part of the Trump administration’s attempt to create price competition in the health care marketplace. It follows the November release of a final rule requiring hospitals to publish their prices online for standard charges, including negotiated rates with providers. That rule, to take effect Jan. 1, 2021, is expected to be challenged in court by hospital industry groups.

The new proposal would apply to all health plans except those that are grandfathered under the Affordable Care Act. Among other obligations, group health plans and health insurance carriers would be required to do the following:

Information about employees’ out-of-pocket expenses and cost-sharing under employer plans is already disclosed in pre-service and post-service benefit claim determinations. However, “the proposed rules would take these disclosure requirements a step further by requiring individually tailored cost estimates prior to the receipt of services,” noted Susan Nash, a partner at law firm Winston & Strawn in Chicago.

While transparency in health care pricing is generally welcomed by employers, she observed, “employers may balk at the cost of preparing the online or mobile app-based cost-estimator tools, or purchasing such tools from vendors.”

In addition, because much of the information required to be disclosed is specific to the participant and the benefit option in which the participant is enrolled, the disclosures “will require greater coordination among employers and third-party administrators, pharmacy benefit managers, [and] disease management, behavioral health, utilization review, and other specialty vendors and will require amendments to existing agreements,” Nash explained.

The rules around public disclosure will likely be opposed by health insurance carriers who view their price negotiation as confidential and part of the service that they provide as carriers, and insurers are likely to challenge them in court, as hospital systems are expected to do with the final rule on disclosing their prices.

Advocates claim a newly issued regulation could transform how employers pay for employee health care coverage.

On June 13, the U.S. Departments of Health and Human Services, Labor and the Treasury issued a final rule allowing employers of all sizes that do not offer a group coverage plan to fund a new kind of health reimbursement arrangement (HRA), known as an individual coverage HRA (ICHRA). The departments also posted FAQs on the new rule.

Starting Jan. 1, 2020, employees will be able to use employer-funded ICHRAs to buy individual-market insurance, including insurance purchased on the public exchanges formed under the Affordable Care Act (ACA).

Under IRS guidance from the Obama administration (IRS Notice 2013-54), employers were effectively prevented from offering stand-alone HRAs that allow employees to purchase coverage on the individual market.

“Using an individual coverage HRA, employers will be able to provide their workers and their workers’ families with tax-preferred funds to pay all or a portion of the cost of coverage that workers purchase in the individual market,” said Joe Grogan, director of the White House Domestic Policy Council. “The departments estimate that once employers fully adjust to the new rules, roughly 800,000 employers will offer individual coverage HRAs to pay for insurance for more than 11 million employees and their family members, providing them with more options for selecting health insurance coverage that better meets their needs.”

The new rule “is primarily about increasing employer flexibility and worker choice of coverage,” said Brian Blase, special assistant to the president for health care policy. “We expect this rule to particularly benefit small employers and make it easier for them to compete with larger businesses by creating another option for financing worker health insurance coverage.”

The final rule is in response to the Trump administration’s October 2017 executive order on health care choice and competition, which resulted in an earlier final rule on association health plans that is now being challenged in the courts, and a final rule allowing low-cost short-term insurance that provides less coverage than a standard ACA plan.

New Types of HRAs

Existing HRAs are employer-funded accounts that employees can use to pay out-of-pocket health care expenses but may not use to pay insurance premiums. Unlike health savings accounts (HSAs), all HRAs, including the new ICHRA, are exclusively employer-funded, and, when employees leave the organization, their HRA funds go back to the employer. This differs from HSAs, which are employee-owned and portable when employees leave.

The proposed regulations keep the kinds of HRAs currently permitted (such as HRAs integrated with group health plans and retiree-only HRAs) and would recognize two new types of HRAs:

What ICHRAs Can Do

Under the new HRA rule:

The rule also includes a disclosure provision to help ensure that employees understand the type of HRA being offered by their employer and how the ICHRA offer may make them ineligible for a premium tax credit or subsidy when buying an ACA exchange-based plan. To help satisfy the notice requirements, the IRS issued an Individual Coverage HRA Model Notice.

QSEHRAs and ICHRAs

Currently, qualified small-employer HRAs (QSEHRAs), created by Congress in December 2016, allow small businesses with fewer than 50 full-time employees to use pretax dollars to reimburse employees who buy nongroup health coverage. The new rule goes farther and:

The legislation creating QSEHRAs set a maximum annual contribution limit with inflation-based adjustments. In 2019, annual employer contributions to QSEHRAs are capped at $5,150 for a single employee and $10,450 for an employee with a family.

The new rule, however, doesn’t cap contributions for ICHRAs.

As a result, employers with fewer than 50 full-time employees will have two choices—QSEHRAs or ICHRAs—with some regulatory differences between the two. For example:

“QSEHRAs have a special rule that allows employees to qualify for both their employer’s subsidy and the difference between that amount and any premium tax credit for which they’re eligible,” said John Barkett, director of policy affairs at consultancy Willis Towers Watson.

While the ability of employees to couple QSEHRAs with a premium tax credit is appealing, the downside is QSEHRA’s annual contribution limits, Barkett said. “QSEHRA’s are limited in their ability to fully subsidize coverage for older employees and employees with families, because employers could run through those caps fairly quickly,” he noted.

For older employees, the least expensive plan available on the individual market could easily cost $700 a month or $8,400 a year, Barkett pointed out, and “with a QSEHRA, an employer could only put in around $429 per month to stay under the $5,150 annual limit for self-only coverage.”

Similarly, for employees with many dependents, premiums could easily exceed the QSEHRA’s family coverage maximum of $10,450, whereas “all those dollars could be contributed pretax through an ICHRA,” Barkett said.

An Excepted-Benefit HRA

In addition to allowing ICHRAs, the final rule creates a new excepted-benefit HRA that lets employers that offer traditional group health plans provide an additional pretax $1,800 per year (indexed to inflation after 2020) to reimburse employees for certain qualified medical expenses, including premiums for vision, dental, and short-term, limited-duration insurance.

The new excepted-benefit HRAs can be used by employees whether or not they enroll in a traditional group health plan, and can be used to reimburse employees’ COBRA continuation coverage premiums and short-term insurance coverage plan premiums.

Safe Harbor Coming

With ICHRAs, employers still must satisfy the ACA’s affordability and minimum value requirements, just as they must do when offering a group health plan. However, “the IRS has signaled it will come out with a safe harbor that should make it straightforward for employers to determine whether their ICHRA offering would comply with ACA coverage requirements,” Barkett said.

Last year, the IRS issued Notice 2018-88, which outlined proposed safe harbor methods for determining whether individual coverage HRAs meet the ACA’s affordability threshold for employees, and which stated that ICHRAs that meet the affordability standard will be deemed to offer at least minimum value.

The IRS indicated that further rulemaking on these safe harbor methods is on its agenda for later this year.

On June 19, 2018, the Trump administration took the first step in a three-part effort to expand affordable health plan options for consumers when the U.S. Department of Labor (DOL) finalized a proposed rule designed to make it easier for a group of employers to form and offer association health plans (AHP). A final rule relaxing rules around short-term, limited duration insurance and a proposed rule addressing health reimbursement arrangements are expected in the upcoming months. In cementing proposed changes to its January 2018 proposed rule, “Definition of ‘Employer’ Under Section 3(5) of ERISA — Association Health Plans,” the administration seeks to broaden health options for individuals who are self-employed or employed by smaller businesses. The final rule will be applicable in three phases starting on September 1, 2018.

Under the rule, it will be substantially easier for a group of employers tied by a “commonality of interest” to form a bona fide association capable of offering a single multi-employer benefit plan under the Employee Retirement Income Security Act of 1974 (ERISA). The rule outlines two primary bases for establishing this “commonality of interest”: (1) having a principal place of business in the same region (e.g., a state or metropolitan area), or (2) operating in the same industry, trade, line of business or profession. An association also may establish additional membership criteria enabling entities with a sufficient “commonality of interest” to participate in the AHP, such as being minority-owned or sharing a common moral or religious conviction, so long as the criteria are not a subterfuge for discrimination based on a health factor. Further, the final rule clarifies how the association must be governed and controlled by its employer-members in order to be considered a bona fide association capable of offering a single-employer health benefit plan.

Meeting the criteria for a bona fide group or association of employers in the final rule allows the AHP to be treated as a single-employer ERISA plan. Thus, assuming the association is comprised of employer-members with more than 50 total full-time employees, it will be considered a large group and exempt from key Affordable Care Act (ACA) market reforms, such as the essential health benefits requirements and modified community rating rules, that would otherwise apply to a health plan offered by any of its individual employer-members with less than 50 full-time employees. This is important because the ACA applies certain requirements only to small group (and individual) health insurance products and not to large group plans.

(more…)

Earlier this week, President Obama signed the 21st Century Cures Act (“Act”). This Act contains provisions for “Qualified Small Business Health Reimbursement Arrangements” (“HRA”). This new HRA would allow eligible small employers to offer a health reimbursement arrangement funded solely by the employer that would reimburse employees for qualified medical expenses including health insurance premiums.

The maximum reimbursement that can be provided under the plan is $4,950 or $10,000 if the HRA provided for family members of the employee. An employer is eligible to establish a small employer health reimbursement arrangement if that employer (i) is not subject to the employer mandate under the Affordable Care Act (i.e., less than 50 full-time employees) and (ii) does not offer a group health plan to any employees.

To be a qualified small employer HRA, the arrangement must be provided on the same terms to all eligible employees, although the Act allows benefits under the HRA to vary based on age and family-size variations in the price of an insurance policy in the relevant individual health insurance market.

Employers must report contributions to a reimbursement arrangement on their employees’ W-2 each year and notify each participant of the amount of benefit provided under the HRA each year at least 90 days before the beginning of each year.

This new provision also provides that employees that are covered by this HRA will not be eligible for subsidies for health insurance purchased under an exchange during the months that they are covered by the employer’s HRA.

Such HRAs are not considered “group health plans” for most purposes under the Code, ERISA and the Public Health Service Act and are not subject to COBRA.

This new provision also overturns guidance issued by the Internal Revenue Service and the Department of Labor that stated that these arrangements violated the Affordable Care Act insurance market reforms and were subject to a penalty for providing such arrangements.

The previous IRS and DOL guidance would still prohibit these arrangements for larger employers. The provision is effective for plan years beginning after December 31, 2016. (There was transition relief for plans offering these benefits that ends December 31, 2016 and extends the relief given in IRS Notice 2015-17.)