Page 1 of 2

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

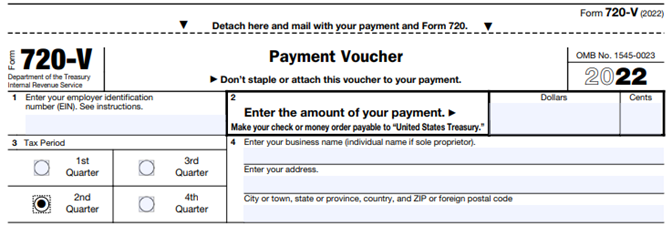

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

The IRS just released IRS Notice 2022-04 that provides the updated fee for Patient-Centered Outcomes Research Institute (PCORI) paid by fully insured and self-funded health plans for the upcoming tax reporting period.

Even though the original PCORI fee assessments under the Affordable Care Act were scheduled to end after September 30, 2019, Congress extended these fees to be assessed by the IRS under the Further Consolidated Appropriations Act of 2020 for another ten years, until at least September 30, 2029.

The updated PCORI fee is now $2.79 per covered life for all plan years ending on or after October 1, 2021, and before October 1, 2022, up from $2.66 for the prior period. As a reminder, fully insured plans are to be assessed the applicable PCORI fee amount through their monthly premium payments made to their health insurance carrier. Self-insured plans pay this fee as part of the annual IRS Form 720 filing due by July 31 of each year.

The IRS has released IRS Notice 2020-84 providing the adjusted $2.66 Patient-Centered Outcomes Research Institute (PCORI) fee per covered individual for health plan years ending on or after October 1, 2020 and before October 1, 2021, which includes 2020 calendar plan years. The fee has increased $0.12 per covered individual from last year (from $2.54).

As detailed in last year’s alert, Congress surprisingly extended the PCORI fee for another decade (until 2029). Despite the originally scheduled sunsetting of the fee in the 2019 filing (for calendar plan years), PCORI filings are now here to stay as a summer staple for the foreseeable future.

The annual PCORI fee must be reported and paid to the IRS by August 2, 2021 via the second quarter Form 720.

The fee is imposed on health insurance issuers and self-insured health plan sponsors in order to fund the Patient-Centered Outcomes Research Institute (PCORI). The mission of the institute is to improve healthcare delivery and outcomes by producing and promoting high-integrity evidence-based information that comes from research guided by patients, caregivers and the broader health community.

The institute currently maintains a robust portfolio of patient-centered outcomes research that addresses a variety of high priority conditions and topics.

PCORI research projects are also targeting certain populations of interest such as: racial and ethnic minorities, low socioeconomic status, women, older adults and individuals with multiple chronic conditions. The PCORI website lists current and completed research projects as well as outcomes.

Fully Insured Medical Plans: Health Insurers (aka insurance carriers) are responsible for paying the fee on fully insured health policies. This fee is built into the insurance premium, so there is no action required by employers.

Self-Insured Medical Plans (Including HRAs): The plan sponsor (aka the employer) is responsible for paying the PCORI fee for self-insured health plans. Self-insured plans include so-called “level funded” plans. The employer must file the Form 720 and pay the fee.

The PCORI fee generally applies only to major medical plans and health reimbursement arrangements (HRAs). (See below for an exception that applies to many HRAs.)

The PCORI fee does not apply to dental and vision coverage that are excepted benefits (whether through a stand-alone insurance policy or meeting the “not integral” test for self-insured coverage). Virtually all dental and vision plans are excepted benefits.

The PCORI fee also does not apply to health FSAs (which must be an excepted benefit to comply with the ACA) or HSAs (which are not a group health plan).

For a quick reference guide, the IRS has published a table which summarizes the applicability of the fee to common types of health and welfare benefits.

Yes, an HRA is a self-insured health plan. However, the PCORI rules provide an exception to the fee requirement for an HRA where it is offered along with a self-insured major medical plan that has the same plan year as the HRA. This avoids the need to pay the PCORI fee for both the HRA and the self-insured major medical plan (i.e., each person covered by both plans is counted only once for purposes of determining the PCORI fee).

There is no exception from the PCORI fee for an HRA offered along with fully insured major medical coverage. While the insurance carrier is responsible for paying the PCORI fee for the fully insured medical plan, the employer is responsible for paying the PCORI fee on the HRA. The IRS is essentially double-dipping in this scenario by imposing the PCORI fee on the same lives covered by both the major medical and the HRA. In recognition of this, the HRA PCORI fee paid by the employer is determined by counting only one life per employee participating in the plan (and not dependents).

Summary: The PCORI fee is required for an HRA unless it is paired with a self-insured major medical plan that has the same plan year as the HRA. Where the PCORI fee is required, the employer is responsible for filing the Form 720 and paying the PCORI fee for an HRA solely for the covered employees (not dependents).

Plan Sponsors of self-insured health plans (other than an HRA) calculate the fee based on the average number of total lives covered by the plan (both employees and dependents).

Plan Sponsors can use one of three alternative methods which are summarized by the IRS in its PCORI fee homepage and PCORI fee FAQs:

Upon reinstatement of the fee in 2020, the IRS allowed plan sponsors an alternative method of calculating the average number of covered lives. Plan sponsors were able to use any reasonable method to calculate the average number of covered lives. This guidance was not extended to the 2021 filing, and employers must use one of the above three methods.

For calendar plan years, the applicable rate for the 2020 plan year will be $2.66 per covered life.

Employers filing for a self-insured medical plan should keep in mind that the plan year is the ERISA plan year reflected in the plan document, SPD, and Form 5500 (if applicable). The PCORI fee also applies to short plan years, defined as any plan year less than 12 months.

The fee is due July 31st (August 2nd in 2021) of the year following the last day of the plan year, including short plan years.

Examples

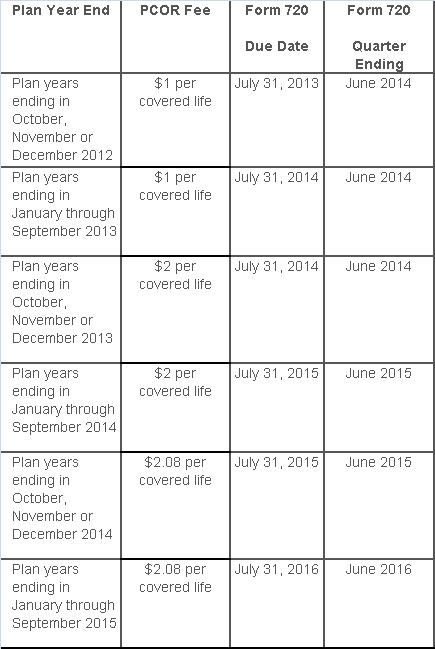

The IRS has published a table of the applicable filing deadline and rate for each plan year ending date.

The PCORI fee is filed on the second quarter IRS Form 720, which is due by August 2, 2021 (July 31st is a Saturday in 2021). Consult the IRS Instructions for Form 720 for direction on completing the form (see pages 8-9).

IRS Notice 2020-44 was issued last week as a reminder that Patient-Centered Outcomes Research Institute (PCORI) fees were extended under the Further Consolidated Appropriations Act of 2020 and are now not scheduled to expire until plan years ending after September 30, 2029. Annual PCORI fees will still need to be paid by insurers for employers with fully insured group health plans (and will remain to be included in annual premiums). Groups that offer self-insured plans are responsible for filing and paying the fee on IRS Forms 720, which must be filed by July 31 each year.

The IRS Notice also clarifies there is still a filing obligation owed for all such group health plan filings for plan years ending on or after October 1, 2019, and before October 1, 2020, with the PCORI Fee amount being $2.54 (up from $2.45 for the previous PCORI fee period). However, the guidance recognizes that insurers and self-funded plan sponsors may not have been accurately tracking the number of covered lives to be reported and paid for the plan year periods from October 1, 2019, through October 1, 2020, because the previous PCORI fee assessments under the Affordable Care Act were scheduled to end after September 30, 2019. To allow for ease in current reporting of covered lives information, the Notice clarifies that in addition to the other statutory methods of reporting covered lives, for the PCORI reporting periods for plan years ending from October 1, 2019, through October 1, 2020, the IRS will allow insurers and plan sponsors to use a “reasonable” method to calculate the average number of covered lives for this period.

Impact on Employers

Employers with fully insured health plan coverage provided by an insurance carrier may see a slight increase in future insurance premiums to account for this recent update from the IRS. Self-funded health plan sponsors need to ensure they timely file their annual Form 720 by July 31, 2020, using the appropriate PCORI fee amount (i.e., $2.45 per covered life for plan years ending on or before September 30, 2019, or $2.54 per covered life for plan years ending on or after October 1, 2019), based on the calculated covered lives formula alternatives (e.g., actual count method, snapshot method, Form 5500 method, or for the October 1, 2019, through October 1, 2020, periods, a “reasonable” method for average covered lives).

If you are feeling a sense that the rules around benefits haven’t changed enough in the last three months, this is a reminder of a change made during the long ago time of December 2019. We all thought the annual PCORI (Patient-Centered Outcomes Research Institute) was set to expire back in 2019 but the SECURE Act extended the PCORI fee for another 10 years, meaning the fee will be in effect until 2029 for most plans (2030 for others, depending on the plan’s year-end).

If your company had a self-insured group health plan in 2019, make sure you’ve set your calendar alerts to pay the PCORI fee for the 2019 plan year. As a reminder, the PCORI fee was put into place by the ACA to help fund the Patient Outcomes Research Institute and is based on the average number of covered lives under the plan. The fee and the related IRS Form 720 are due no later than July 31st.

For plan years ending before October 1, 2019, the fee is $2.45/person. The IRS has not announced the specific fee for plan years ending between October 1, 2019 and December 31, 2019; however, it is expected to be slightly higher than $2.45 per covered member. Remember, covered lives include spouses, dependents, retirees, and COBRA beneficiaries. If you have not been through this process before, or if you just need a quick refresher, the IRS has issued detailed guidance on the multiple methods you may use to calculate the PCORI fee, as well as instructions for completing the Form 720 and submitting your payment.

The Patient-Centered Outcomes Research Institute (PCORI) fee for 2018 is due by July 31, 2019. For groups whose plan year ended December 31, 2018 this will be the final PCORI payment they will have to make. Health plans whose plan year ended after December 31, 2018, but before October 1, 2019, will still have one final PCORI payment that will be due by July 31, 2020.

The PCORI fee is imposed under the Affordable Care Act (ACA) on issuers of certain health insurance policies and self-insured health plan sponsors to help fund the research institute. The fee amount is based on the average number of covered lives under the policy or plan, and the total (along with the fee) must be reported annually on the second quarter IRS Form 720 (Quarterly Federal Excise Tax Return) and paid by July 31. The fee due July 31, 2019 is calculated as $2.45 per covered life. Plan sponsors must pay the PCORI fee by July 31 of the calendar year immediately following the calendar year in which the plan year ends.

For fully insured health plans, the insurance carrier files Form 720 and pays the PCORI fee. So, employers with fully insured health plans have no filing requirement (but will be charged by the carrier for the fee). Employers that sponsor self-insured health plans are responsible for filing Form 720 and paying their due PCORI fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720.

The fee may not be paid from plan assets, so it must be paid out of the sponsor’s general assets. According to the IRS, however, the fee is a tax-deductible business expense for employers with self-insured plans.The Affordable Care Act (ACA) created PCORI to help patients, clinicians, payers and the public make informed health decisions by advancing comparative effectiveness research. PCORI’s research is to be funded, in part, by fees paid by either health insurers or sponsors of self-insured health plans. These fees are widely known as PCORI fees. Health insurers and self-insured plan sponsors are required to report and pay PCORI fees annually using IRS Form 720 (Quarterly Federal Excise Tax Return). The report and fees are due on July 31st with respect to the plan year that ended during the preceding calendar year. For instance, for calendar year plans, the fee that is due July 31, 2018 applies to the plan year that ended December 31, 2017.

Reporting PCORI fees on Form 720

Form 720 and completion instructions are posted on the IRS’ website. Insurers and self-insured plan sponsors must report the average number of lives covered under the plan. For fully insured plans, the carrier is responsible for reporting and paying the fee on the employers behalf. For a self-insured plan, the plan sponsor (employer) enters information for “self-insured health plans.” The number of covered lives is then multiplied by the applicable rate based on the plan year end date. Form 720 that is due July 31, 2018, will reflect payment for plan years ending in 2017. The applicable rate depends on the plan year end date:

The applicable rate may increase for inflation in future years. However, the program ends in 2019 and PCORI fees will not apply for plan years ending after September 30, 2019. Insurers or self-insured plan sponsors that file Form 720 only for the purpose of reporting PCORI fees do not need to file Form 720 for the first, third or fourth quarter of the year. Insurers or self-insured plan sponsors that file Form 720 to report quarterly excise tax liability (for example, to report the foreign insurance tax) should enter a PCORI fee amount only on the second quarter filing. See below for more information about affected plans and methods for calculating the number of participants and amount of the required PCORI fee.

(more…)

The health reform law imposes a number of fees, taxes and other assessments on health insurance companies and sponsors of self-funded health plans to help subsidize a number of endeavors. One such fee funds the Patient-Centered Outcomes Research Institute (PCORI).

The PCORI fee for calendar year plans is $2.26 per covered life for the 2016 plan year, and must be reported on (and remitted with) IRS Form 720 by July 31, 2017. For non-calendar year plans, if the 2015-16 plan year ended on or before Sept. 30, 2016, the fee is $2.17 per covered life. If the 2015-16 plan year ended between Oct. 1 and Dec. 31, 2016, the fee is $2.26 per covered life. In either case, the filings are similarly due by July 31, 2017. (Note: The Form 720 must be filed by July 31 of the calendar year that begins after the last day of the plan year.)

For self-funded plans, the employer/plan sponsor will be responsible for submitting the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee is not permitted for self-funded plans. The process for remitting payment by sponsors of self-funded plans is described in more detail below.

The IRS will collect the fee from the insurer or, in the case of self-funded plans, the plan sponsor/employer in the same way many other excise taxes are collected. IRS regulations provide three options for determining the average number of covered lives (actual count, snapshot and Form 5500 method).

The U.S. Department of Labor believes the fee cannot be paid from plan assets. In other words, the PCORI fee must be paid by the plan sponsor; it is not a permissible expense of a self-funded plan and cannot be paid in whole or part by participant contributions. The IRS has indicated the fee is, however, a tax-deductible business expense for employers with self-funded plans.

The filing and remittance process to the IRS is straightforward and largely unchanged from last year. On page two of Form 720, under Part II, the employer needs to designate the average number of covered lives under its “applicable self-insured plan.” The number of covered lives is multiplied by the applicable amount ($2.26 or $2.17) to determine the total fee owed to the IRS. The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.” Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’s software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

The health reform law imposes a number of fees, taxes and other assessments on health insurance companies and sponsors of self-funded health plans to help subsidize a number of endeavors. One such fee funds the Patient-Centered Outcomes Research Institute (PCORI).

The PCORI fee is $2.17 per covered life for plan years ending on or after Oct. 1, 2015, and must be reported on (and remitted with) IRS Form 720 by Aug. 1, 2016 (the deadline is July 31, but since July 31 falls on a weekend, the form is due by the next business day, Aug. 1). For self-funded plans, the employer/plan sponsor will be responsible for submitting the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee is not permitted for self-funded plans.

The process for remitting payment by sponsors of self-funded plans is described in more detail below.

The IRS will collect the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. The fees are reported and paid annually on IRS Form 720 by July 31 of the year following the last day of the plan year. This year the fee is due by Aug. 1.

The fee due on Aug. 1, 2016 is $2.17 per covered life for plan years ending before Oct. 1, 2016, and on or after Oct. 1, 2015. For plan years ending before Oct. 1, 2015, the fee due on Aug. 1, 2016, is $2.08 per covered life under the plan. IRS regulations provide three options for determining the average number of covered lives (actual count, snapshot and Form 5500 method).

The Form 720 must be filed by July 31 (Aug. 1 in 2016) of the calendar year immediately following the last day of the plan year. For example, calendar year plans will owe a fee of $2.17 per covered life by Aug. 1, 2016. Plans that operate on years that begin the first day of any month from February through October will be paying a $2.08 per covered life fee with the Aug. 1, 2016, filing.

The U.S. Department of Labor believes the fee cannot be paid from plan assets. In other words, the PCORI fee must be paid by the plan sponsor; it is not a permissible expense of a self-funded plan and cannot be paid in whole or part by participant contributions. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for employers with self-funded plans.

The filing and remittance process to the IRS is straightforward and is largely unchanged from last year. On page two of Form 720, under Part II, the employer needs to designate the average number of covered lives under its “applicable self-insured plan.” The number of covered lives is multiplied by $2.17 (for plan years ending on or after Oct. 1, 2015) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.” Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’s software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

The Affordable Care Act added a patient-centered outcomes research (PCOR) fee on health plans to support clinical effectiveness research. The PCOR fee applies to plan years ending on or after Oct. 1, 2012, and before Oct. 1, 2019. The PCOR fee is due by July 31 of the calendar year following the close of the plan year. For plan years ending in 2014, the fee is due by July 31, 2015.

PCOR fees are required to be reported annually on Form 720, Quarterly Federal Excise Tax Return, for the second quarter of the calendar year. The due date of the return is July 31. Plan sponsors and insurers subject to PCOR fees but not other types of excise taxes should file Form 720 only for the second quarter, and no filings are needed for the other quarters. The PCOR fee can be paid electronically or mailed to the IRS with the Form 720 using a Form 720-V payment voucher for the second quarter. According to the IRS, the fee is tax-deductible as a business expense.

The PCOR fee is assessed based on the number of employees, spouses and dependents that are covered by the plan. The fee is $1 per covered life for plan years ending before Oct. 1, 2013, and $2 per covered life thereafter, subject to adjustment by the government. For plan years ending between Oct. 1, 2014, and Sept. 30, 2015, the fee is $2.08. The Form 720 instructions are expected to be updated soon to reflect this increased fee.

This chart summarizes the fee schedule based on the plan year end and shows the Form 720 due date. It also contains the quarter ending date that should be reported on the first page of the Form 720 (month and year only per IRS instructions). The plan year end date is not reported on the Form 720.

For insured plans, the insurance company is responsible for filing Form 720 and paying the PCOR fee. Therefore, employers with only fully- insured health plans have no filing requirement.

If an employer sponsors a self-insured health plan, the employer must file Form 720 and pay the PCOR fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720. A self-insured health plan is any plan providing accident or health coverage if any portion of such coverage is provided other than through an insurance policy.

Since the fee is a tax assessed against the plan sponsor and not the plan, most funded plans subject to ERISA must not pay the fee using plan assets since doing so would be considered a prohibited transaction by the U.S. Department of Labor (DOL). The DOL has provided some limited exceptions to this rule for plans with multiple employers if the plan sponsor exists solely for the purpose of sponsoring and administering the plan and has no source of funding independent of plan assets.

Plans sponsored by all types of employers, including tax-exempt organizations and governmental entities, are subject to the PCOR fee. Most health plans, including major medical plans, prescription drug plans and retiree-only plans, are subject to the PCOR fee, regardless of the number of plan participants. The special rules that apply to Health Reimbursement Accounts (HRAs) and Health Flexible Spending Accounts (FSAs) are discussed below.

Plans exempt from the fee include:

If a plan sponsor maintains more than one self-insured plan, the plans can be treated as a single plan if they have the same plan year. For example, if an employer has a self-insured medical plan and a separate self-insured prescription drug plan with the same plan year, each employee, spouse and dependent covered under both plans is only counted once for purposes of the PCOR fee.

The IRS has created a helpful chart showing how the PCOR fee applies to common types of health plans.

Health Reimbursement Accounts (HRAs) - Nearly all HRAs are subject to the PCOR fee because they do not meet the conditions for exemption. An HRA will be exempt from the PCOR fee if it provides benefits only for dental or vision expenses, or it meets the following three conditions:

Health Flexible Spending Accounts (FSAs) - A health FSA is exempt from the PCOR fee if it satisfies an availability condition and a maximum benefit condition.

Additional special rules for HRAs and FSAs . Once an employer determines that its HRA or FSA is subject to the PCOR fee, the employer should consider the following special rules:

The IRS provides different rules for determining the average number of covered lives (i.e., employees, spouses and dependents) under insured plans versus self-insured plans. The same method must be used consistently for the duration of any policy or plan year. However, the insurer or sponsor is not required to use the same method from one year to the next.

A plan sponsor of a self-insured plan may use any of the following three

methods to determine the number of covered lives for a plan year:

1. Actual count method. Count the covered lives on each day of the plan year and divide by the number of days in the plan year.

Example: An employer has 900 covered lives on Jan. 1, 901 on Jan. 2, 890 on

Jan. 3, etc., and the sum of the lives covered under the plan on each day of

the plan year is 328,500. The average number of covered lives is 900 (328,500 ÷

365 days).

2. Snapshot method. Count the covered lives on a single day in each quarter (or more than one day) and divide the total by the number of dates on which a count was made. The date or dates must be consistent for each quarter. For example, if the last day of the first quarter is chosen, then the last day of the second, third and fourth quarters should be used as well.

Example: An employer has 900 covered lives on Jan. 15, 910 on April 15, 890 on

July 15, and 880 on Oct. 15. The average number of covered lives is 895 [(900 +

910+ 890+ 880) ÷ 4 days].

As an alternative to counting actual lives, an employer can count the number of

employees with self-only coverage on the designated dates, plus the number of

employees with other than self-only coverage multiplied by 2.35.

3. Form 5500 method. If a Form 5500 for a plan is filed before the due date of the Form 720 for that year, the plan sponsor can determine the number of covered lives based on the Form 5500. If the plan offers just self-only coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) and divides by 2. If the plan also offers family or dependent coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) without dividing by 2.

Example: An employer offers single and family coverage with a plan year ending

on Dec. 31. The 2013 Form 5500 is filed on June 5, 2014, and reports 132

participants on line 5 and 148 participants on line 6d. The number of covered

lives is 280 (132 + 148).

To evaluate liability for PCOR fees, plan sponsors should identify all of their plans that provide medical benefits and determine if each plan is insured or self-insured. If any plan is self-insured, the plan sponsor should take the following actions: