Page 1 of 1

Thanks in part to persistent high inflation, employees will be able to sock away a lot more money in their health savings accounts (HSAs) next year.

Annual health savings account contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the IRS announced May 16: The annual limit on HSA contributions for self-only coverage will be $4,150 in 2023, a 7.8 percent increase from the $3,850 limit in 2023. For family coverage, the HSA contribution limit jumps to $8,300 in 2023, up 7.1 percent from $7,750 in 2023.

Participants 55 and older can still contribute an extra $1,000 to their HSAs.

Meanwhile, for 2024, a high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage, up from $1,500 in 2023, or $3,200 for family coverage, up from $3,000, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,050 for self-only coverage in 2024, up from $7,500 in 2023, or $16,100 for family coverage, up from $15,000.

The increases are detailed in IRS Revenue Procedure 2023-23 and take effect in January 2024.

While expected, the increase in 2024 HSA limits is significant for passing certain symbolic financial thresholds. For the first time, including catch-up contributions for those age 55 and older, a couple on family coverage can now contribute more than $10,000, and a single person on self-only coverage can now contribute more than $5,000.

Many industry experts tout health savings accounts as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free. This is very good news to help more Americans understand and use HSAs as a powerful tool in their healthcare spending and long-term savings.

HSA enrollment continues to grow, and more employers also are offering contributions to employees’ accounts. At the end of 2022, Americans held $104 billion in 35.5 million health savings accounts, according to HSA advisory firm Devenir.

Despite the benefits, most holders aren’t taking full advantage of their accounts and are missing out on substantial rewards, according to the Employee Benefit Research Institute. The average account holder has a modest balance, contributes far less than the maximum and does not invest their HSA, recent EBRI data found.

The new 2023 limits are:

HSA – Single $3,850 / Family $7,750 per year

HDHP (self-only coverage) – $1,500 minimum deductible / $7,500 out-of-pocket limit

HDHP (family coverage) – $3,000 minimum deductible / $15,000 out-of-pocket limit

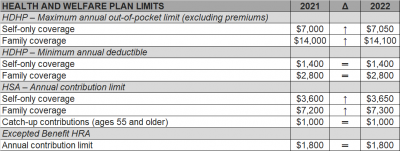

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.

The IRS has recently issued Notice 2019-45, which increases the scope of preventive care that can be covered by a high deductible health plan (“HDHP”) without eliminating the covered person’s ability to maintain a health savings account (“HSA”).

Since 2003, eligible individuals whose sole health coverage is a HDHP have been able to contribute to HSAs. The contribution to the HSA is not taxed when it goes into the HSA or when it is used to pay health benefits. It can for example be used to pay deductibles or copays under the HDHP. But it can also be used as a kind of supplemental retirement plan to pay Medicare premiums or other health expenses in retirement, in which case it is more tax-favored than even a regular retirement plan.

As the name suggests, a HDHP must have a deductible that exceeds certain minimums ($1,350 for self-only HDHP coverage and $2,700 for family HDHP coverage for 2019, subject to cost of living changes in future years). However, certain preventive care (for example, annual physicals and many vaccinations) is covered without having to meet the deductible. In general, “preventive care” has been defined as care designed to identify or prevent illness, injury, or a medical condition, as opposed to care designed to treat an existing illness, injury, or condition.

Notice 2019-45 expands the existing definition of preventive care to cover medical expenses which, although they may treat a particular existing chronic condition, will prevent a future secondary condition. For example, untreated diabetes can cause heart disease, blindness, or a need for amputation, among other complications. Under the new guidance, a HDHP will cover insulin, treating it as a preventative for those other conditions as opposed to a treatment for diabetes.

The Notices states that in general, the intent was to permit the coverage of preventive services if:

The Notice is in general good news for those covered by HDHPs. However, it has two major limitations:

Given the expansion of the types of preventive coverage that a HDHP can cover, and the tax advantages of an HSA to employees, employers who have not previously implemented a HDHP or HSA may want to consider doing so now. However, as with any employee benefit, it is important to consider both the potential demand for the benefit and the administrative cost.

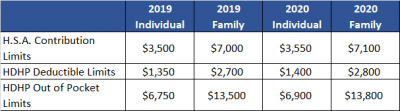

Late May 2019, the Internal Revenue Service (IRS) announced the 2020 limits for contributions to Health Savings Accounts (HSAs) and limits for High Deductible Health Plans (HDHPs). These inflation adjustments are provided for under Internal Revenue Code Section 223.

For the 2020 calendar year, an HDHP is a health plan with an annual deductible that is not less than $1,400 for self-only coverage and $2,800 for family coverage. 2020 annual out-of-pocket expenses (deductibles, copayments and other amounts, excluding premiums) cannot exceed $6,900 for self-only coverage and $13,800 for family coverage.

For individuals with self-only coverage under an HDHP, the 2020 annual contribution limit to an HSA is $3,550 and for an individual with family coverage, the HSA contribution limit is $7,100.

No change was announced to the HSA catch-up contribution limit. If an individual is age 55 or older by the end of the calendar year, he or she can contribute an additional $1,000 to his or her HSA. If married and both spouses are age 55, each individual can contribute an additional $1,000 into his or her individual account.

For married couples that have family coverage where both spouses are over age 55, each spouse can take advantage of the $1,000 catch-up, but in order to get the full $9,100 contribution, they will need to use two accounts. The contribution cannot be maximized with only one account. One individual would contribute the family coverage maximum plus his or her individual catch-up, and the other would contribute the catch-up maximum to his or her individual account.

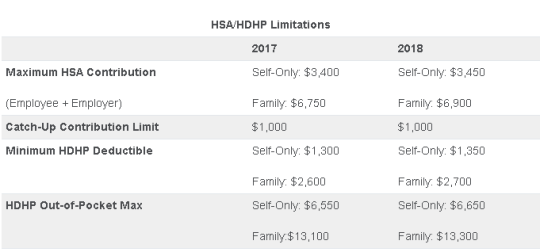

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.

The IRS released the 2016 cost-of-living adjustment amounts for health savings accounts (HSAs). Adjustments have been made to the HSA contribution limit for individuals with family high deductible health plan (HDHP) coverage and to some of the deductible and out-of-pocket limitations for HSA-compatible HDHPs.

The HSA contribution limit for an individual with self-only HDHP coverage remains at $3,350 for 2016. The 2016 contribution limit for an individual with family coverage is increased to $6,750. These limits do not include the additional annual $1,000 catch-up contribution amount for individuals age 55 and older, which is not subject to cost-of-living adjustments.

HSA-compatible HDHPs are defined by certain minimum deductible amounts and maximum out-of-pocket expense amounts. For HDHP self-only coverage, the minimum deductible amount is unchanged for 2016 and cannot be less than $1,300. The 2016 maximum out-of-pocket expense amount for self-only coverage is increased to $6,550. For 2016 family coverage, the minimum deductible amount is unchanged at $2,600 and the out-of-expense amount increases to $13,100.

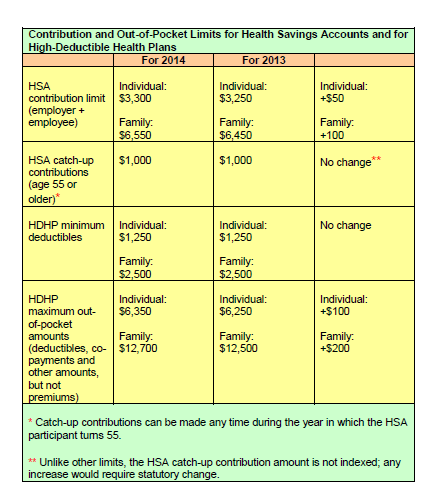

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who: