Page 1 of 1

Transparency in Coverage mandates and COVID-19 considerations continue to dominate the discussion in the employee benefits compliance space this summer, but an “old faithful” reporting requirement looms soon: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The typical due date for the PCORI fee is July 31, but because that date falls on a Sunday in 2022, the effective due date is pushed to the next business day, which is Aug. 1.

The filing and payment due by Aug. 1, 2022, is required for policy and plan years that ended during the 2021 calendar year. For plan years that ended Jan. 1, 2021 – Sept. 30, 2021, the fee is $2.66 per covered life. For plan years that ended Oct. 1, 2021 – Dec. 31, 2021 (including calendar year plans that ended Dec. 31, 2021), the fee is calculated at $2.79 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is typically due by July 31 of the year following the last day of the plan year to which the payment relates, but this year the due date pushes to Aug. 1.

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2021 the plan year ended) to determine the total fee owed to the IRS.

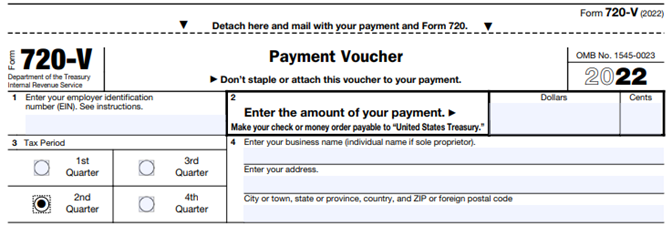

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

The IRS has released IRS Notice 2020-84 providing the adjusted $2.66 Patient-Centered Outcomes Research Institute (PCORI) fee per covered individual for health plan years ending on or after October 1, 2020 and before October 1, 2021, which includes 2020 calendar plan years. The fee has increased $0.12 per covered individual from last year (from $2.54).

As detailed in last year’s alert, Congress surprisingly extended the PCORI fee for another decade (until 2029). Despite the originally scheduled sunsetting of the fee in the 2019 filing (for calendar plan years), PCORI filings are now here to stay as a summer staple for the foreseeable future.

The annual PCORI fee must be reported and paid to the IRS by August 2, 2021 via the second quarter Form 720.

The fee is imposed on health insurance issuers and self-insured health plan sponsors in order to fund the Patient-Centered Outcomes Research Institute (PCORI). The mission of the institute is to improve healthcare delivery and outcomes by producing and promoting high-integrity evidence-based information that comes from research guided by patients, caregivers and the broader health community.

The institute currently maintains a robust portfolio of patient-centered outcomes research that addresses a variety of high priority conditions and topics.

PCORI research projects are also targeting certain populations of interest such as: racial and ethnic minorities, low socioeconomic status, women, older adults and individuals with multiple chronic conditions. The PCORI website lists current and completed research projects as well as outcomes.

Fully Insured Medical Plans: Health Insurers (aka insurance carriers) are responsible for paying the fee on fully insured health policies. This fee is built into the insurance premium, so there is no action required by employers.

Self-Insured Medical Plans (Including HRAs): The plan sponsor (aka the employer) is responsible for paying the PCORI fee for self-insured health plans. Self-insured plans include so-called “level funded” plans. The employer must file the Form 720 and pay the fee.

The PCORI fee generally applies only to major medical plans and health reimbursement arrangements (HRAs). (See below for an exception that applies to many HRAs.)

The PCORI fee does not apply to dental and vision coverage that are excepted benefits (whether through a stand-alone insurance policy or meeting the “not integral” test for self-insured coverage). Virtually all dental and vision plans are excepted benefits.

The PCORI fee also does not apply to health FSAs (which must be an excepted benefit to comply with the ACA) or HSAs (which are not a group health plan).

For a quick reference guide, the IRS has published a table which summarizes the applicability of the fee to common types of health and welfare benefits.

Yes, an HRA is a self-insured health plan. However, the PCORI rules provide an exception to the fee requirement for an HRA where it is offered along with a self-insured major medical plan that has the same plan year as the HRA. This avoids the need to pay the PCORI fee for both the HRA and the self-insured major medical plan (i.e., each person covered by both plans is counted only once for purposes of determining the PCORI fee).

There is no exception from the PCORI fee for an HRA offered along with fully insured major medical coverage. While the insurance carrier is responsible for paying the PCORI fee for the fully insured medical plan, the employer is responsible for paying the PCORI fee on the HRA. The IRS is essentially double-dipping in this scenario by imposing the PCORI fee on the same lives covered by both the major medical and the HRA. In recognition of this, the HRA PCORI fee paid by the employer is determined by counting only one life per employee participating in the plan (and not dependents).

Summary: The PCORI fee is required for an HRA unless it is paired with a self-insured major medical plan that has the same plan year as the HRA. Where the PCORI fee is required, the employer is responsible for filing the Form 720 and paying the PCORI fee for an HRA solely for the covered employees (not dependents).

Plan Sponsors of self-insured health plans (other than an HRA) calculate the fee based on the average number of total lives covered by the plan (both employees and dependents).

Plan Sponsors can use one of three alternative methods which are summarized by the IRS in its PCORI fee homepage and PCORI fee FAQs:

Upon reinstatement of the fee in 2020, the IRS allowed plan sponsors an alternative method of calculating the average number of covered lives. Plan sponsors were able to use any reasonable method to calculate the average number of covered lives. This guidance was not extended to the 2021 filing, and employers must use one of the above three methods.

For calendar plan years, the applicable rate for the 2020 plan year will be $2.66 per covered life.

Employers filing for a self-insured medical plan should keep in mind that the plan year is the ERISA plan year reflected in the plan document, SPD, and Form 5500 (if applicable). The PCORI fee also applies to short plan years, defined as any plan year less than 12 months.

The fee is due July 31st (August 2nd in 2021) of the year following the last day of the plan year, including short plan years.

Examples

The IRS has published a table of the applicable filing deadline and rate for each plan year ending date.

The PCORI fee is filed on the second quarter IRS Form 720, which is due by August 2, 2021 (July 31st is a Saturday in 2021). Consult the IRS Instructions for Form 720 for direction on completing the form (see pages 8-9).

If you are feeling a sense that the rules around benefits haven’t changed enough in the last three months, this is a reminder of a change made during the long ago time of December 2019. We all thought the annual PCORI (Patient-Centered Outcomes Research Institute) was set to expire back in 2019 but the SECURE Act extended the PCORI fee for another 10 years, meaning the fee will be in effect until 2029 for most plans (2030 for others, depending on the plan’s year-end).

If your company had a self-insured group health plan in 2019, make sure you’ve set your calendar alerts to pay the PCORI fee for the 2019 plan year. As a reminder, the PCORI fee was put into place by the ACA to help fund the Patient Outcomes Research Institute and is based on the average number of covered lives under the plan. The fee and the related IRS Form 720 are due no later than July 31st.

For plan years ending before October 1, 2019, the fee is $2.45/person. The IRS has not announced the specific fee for plan years ending between October 1, 2019 and December 31, 2019; however, it is expected to be slightly higher than $2.45 per covered member. Remember, covered lives include spouses, dependents, retirees, and COBRA beneficiaries. If you have not been through this process before, or if you just need a quick refresher, the IRS has issued detailed guidance on the multiple methods you may use to calculate the PCORI fee, as well as instructions for completing the Form 720 and submitting your payment.

Under the Affordable Care Act, (ACA) a fund for a new nonprofit corporation to assist in clinical effectiveness research was created. To aid in the financial support for this endeavor, certain health insurance carriers and health plan sponsors are required to pay fees based on the average number of lives covered by welfare benefits plans. These fees are referred to as either Patient-Centered Outcome Research Institute (PCORI) or Clinical Effectiveness Research (CER) fees.

The applicable fee was $2.26 for plan years ending on or after October 1, 2016 and before October 1, 2017. For plan years ending on or after October 1, 2017 and before October 1, 2018, the fee is $2.39. Indexed each year, the fee amount is determined by the value of national health expenditures. The fee phases out and will not apply to plan years ending after September 30, 2019.

As a reminder, fees are required for all group health plans including Health Reimbursement Arrangements (HRAs), but are not required for health flexible spending accounts (FSAs) that are considered excepted benefits. To be an excepted benefit, health FSA participants must be eligible for their employer’s group health insurance plan and may include employer contributions in addition to employee salary reductions. However, the employer contributions may only be $500 per participant or up to a dollar for dollar match of each participant’s election.

HRAs exempt from other regulations would be subject to the CER fee. For instance, an HRA that only covered retirees would be subject to this fee, but those covering dental or vision expenses only would not be, nor would employee EAPs, disease management programs and wellness programs be required to pay CER fees.

The Patient-Centered Outcomes Research Institute (PCORI) fee was established under the Affordable Care Act (ACA) to advance comparative clinical effectiveness research. The PCORI fee is assessed on issuers of health insurance policies and sponsors of self-insured health plans. The fees are calculated using the average number of lives covered under the policy or plan, and the applicable dollar amount for that policy or plan year. The past PCORI fees were—

The new adjusted PCORI fee is—

Employers and insurers will need to file Internal Revenue Service (IRS) Form 720 and pay the updated PCORI fee by July 31, 2016

Transitional Reinsurance Fee

Like the PCORI fee, the transitional reinsurance fee was established under the ACA. It was designed to reinsure the marketplace exchanges. Contributing entities are required to make contributions towards these reinsurance payments. A “contributing entity” is defined as an insurer or third-party administrator on behalf of a self-insured group health plan. The past transitional reinsurance fees were

The new adjusted transition reinsurance fee is—

The IRS has released the 2014 Form 720 that plan sponsors of self-insured group health plans will use to report and pay the Patient Centered Outcomes Research Institute (PCORI) fee. The fee is due by July 31, 2014 for plan years ending in 2013.

The Affordable Care Act (ACA) imposes a fee on health insurers and plan sponsors of self-insured group health plans to help fund the Patient Centered Outcomes Research Institute. PCORI is responsible for conducting research to evaluate and compare the health outcomes and clinical effectiveness, risks, and benefits of medical treatments, services, procedures, and drugs.

The PCORI fee is assessed for plan years ending after September 30, 2012. The initial fee is $1 times the average number of covered lives for the first plan year ending before October 1, 2013 and $2 per covered life for the plan year ending after October 1, 2013 and before October 1, 2014. Fees for subsequent years are subject to indexing. The PCORI fee will not be assessed for plan years ending after September 30, 2019, which means that for a calendar year plan, the last plan year for assessment is the 2018 calendar year.

Plan sponsors must pay the PCORI fee by July 31 of the calendar year immediately following the last day of that plan year. All plan sponsors of self-insured group health plans will pay the fee in 2014, but the amount of the fee varies depending on the plan year.

The IRS has released the 2014 Form 720 with instructions for plan sponsors to use to report and pay the PCORI fee. Although the Form 720 is a quarterly federal excise tax return, if the Form 720 is filled only to report the PCORI fee, no filing is required in other quarters unless other fees or taxes have to be reported.

Please contact our office for information on the Affordable Care Act (ACA) and how it affects your business.