Page 1 of 1

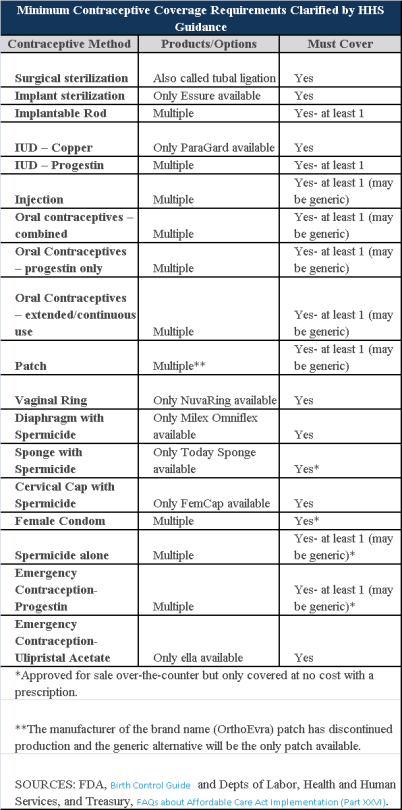

Plans and insurers must cover all 18 contraception methods approved by the U.S. Food and Drug Administration, according to a new set of questions and answers on the Affordable Care Act’s preventive care coverage requirements.

“Reasonable medical management” still may be used to steer members to specific products within those methods of contraception. A plan or insurer may impose cost-sharing on non-preferred items within a given method, as long as at least one form of contraception in each method is covered without cost-sharing.

However, an individual’s physician must be allowed to override the plan’s drug management techniques if the physician finds it medically necessary to cover without cost-sharing an item that a given plan or insurer has classified as non-preferred, according to one of the frequently asked questions from the U.S. Departments of Labor, Health and Human Services and the Treasury.

The ACA mandated all plans and insurers to cover preventive care items, as defined by the Public Health Service Act, without cost-sharing. Eighteen forms of female contraception are included under the preventive care list. The individual FAQs on contraception clarified the following requirements.

The FAQ comes just weeks after reports and news coverage detailed health plan violations of the women coverage provisions of the ACA.

Testing and Dependent Care Answers

In questions separate from contraception, plans and insurers were told they must cover breast cancer susceptibility (BRCA-1 or BRCA-2) testing without cost-sharing. The test identifies whether the woman has genetic mutations that make her more susceptible to BRCA-related breast cancer.

Another question stated that if colonoscopies are performed as preventive screening without cost-sharing, then plans could not impose cost-sharing on the anesthesia component of that service.

The Obama administration is giving certain employers extra time before they must offer health insurance to almost all of their full time workers.

Under new rules announced Monday by Treasury Department officials, employers with 50 to 99 workers will be given until 2016 (two years longer than originally envisioned under the Affordable Care Act) before they risk a federal penalty for not complying.

Companies with 100+ workers or more are getting a different kind of one-year grace period. Instead of being required in 2015 to offer coverage to 95% of full time workers, these bigger employers can now avoid a fine by offering insurance to at least 70% of workers next year.

Administration officials had already announced in July 2013 that the employer requirements would be postponed until 2015 and this recent announcement has caught officials by surprise.

Obama administration officials said the Treasury Department decided to allow medium-size businesses more latitude because “they need a little more time to adjust to providing coverage”.

The Affordable Care Act (ACA) states that anyone who works 30 hours or more is a full time employee, and it compels many employers to offer affordable insurance to those workers and their dependents. (Please note that Florida law currently defines a full time worker as anyone who works 25 or more hours). It also defines affordable as premiums of no more than 9.5% of an employee’s income, and employers must pay for the equivalent of 60% of the actuarial value of a worker’s coverage. Businesses that fail to do so will eventually face a fine of up to $2000 for each employee not offered coverage, though workers are not required to sign up for the benefits.

For questions on how these recent changes will affect your business or for help complying with the ever-changing ACA requirements, please contact our office.

Employers struggling with how to meet the Affordable Care Act (ACA) regulations received some relief in July 2013 when the U.S. Treasury announced a one-year delay on implementation of the “pay or play” mandate. This mandate would have required most employers with the at least 50 full-time equivalent employees to provide affordable, minimum value health insurance coverage to their full-time employees by January 1, 2014, or pay a penalty.

However, the delay on implementation of the “pay or play” mandate did not delay the individual mandate, which will require most individuals to purchase health insurance coverage in 2014, or pay a tax penalty. The Treasury has also indicated that the delay in the employer mandate will not affect an employee’s access to the premium tax credits available to individuals who purchase coverage through the Exchange beginning January 1, 2014.

There are many other ACA provisions that will require compliance by January 1, 2014, including:

So, What Should Employers Be Doing Now?

Employers should first make sure their plans comply, or will comply in 2014, with all ACA provisions that have not been delayed. Next, employers should plan for eventual application of the pay or play mandate to their workforce. This should include:

The one-year delay also gives employers more time to see whether changes in the law may relieve them from expanding coverage to workers who average more than 30 hours per week or perform only seasonal labor. As of mid -September, at least four bills had been introduced to change the full-time employee standard to 40 hours. At this point, the chances of passage are unclear, so this will be an important issue to watch.

While the delay in the pay or play mandate gives employers additional time, the clock is ticking for many other ACA compliance efforts, and employers should be prepared and seek guidance now.

The U.S Department of Treasury and the Internal Revenue Service (IRS) ruled on August 29, 2013 that same sex couples who are legally married in jurisdictions that recognize their same sex marriage, will be treated as married for federal tax purposes. The ruling applies regardless of whether the couple lives in a jurisdiction that recognizes same-sex marriage or not.

Under the ruling, same-sex couples will be treated as married for all federal tax purposes, including income as well as gift and estate taxes. The ruling applies to all federal tax provisions where marriage is a factor, including filing status, claiming personal and dependency exemptions, taking deductions, employee benefits, contributing to an IRA and claiming the earned income tax credit or child tax credit.

Any same-sex marriage legally entered into in one of the 50 states, the District of Columbia, a U.S. territory or a foreign country will be covered by the ruling. However, the ruling does not apply to registered domestic partnerships, civil unions or similar formal relationships recognized under state law.