Don’t Forget! An “old faithful” reporting requirement deadline is right around the corner: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The due date for the filing and payment of PCORI fee is July 31 for required policy and plan years that ended during the 2024 calendar year. For plan years that ended Jan. 1, 2024 – Sept. 30, 2024, the fee is $3.22 per covered life. For plan years that ended Oct. 1, 2024 – Dec. 31, 2024 (including calendar year plans that ended Dec. 31, 2024), the fee is calculated at $3.47 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is due by July 31 of the year following the last day of the plan year to which the payment relates (i.e. filling for the 2024 PCORI fee is due by July 31, 2025)

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2024 the plan year ended) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

Full instructions for Form 720 can be found here.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

The EEO-1 reporting portal just opened May 20, 2025 and the turn-around time is quick: this year employers only have until June 24th to submit their data. Private employers with at least 100 employees and federal contractors with at least 50 employees need to begin sorting data by employee job category, as well as sex and race/ethnicity, to turn over to the Equal Employment Opportunity Commission (EEOC) during the reporting window. Here’s what you need to know about filing your 2024 EEO-1 Component 1 data this year and the five steps you’ll want to take right away to file on time.

What’s New This Year?

The EEO-1 Reporting Portal welcomes users with message from the EEOC’s new Acting Chair Andrea Lucas. Here’s a breakdown of what Lucas says:

The message serves as a reminder that employers have never been permitted to use the EEO-1 report or the demographic data contained in the reports to violate Title VII of the Civil Rights Act.

| Key Dates and Resources– The 2024 EEO-1 Component 1 data collection window opened on May 20th. The deadline to file is June 24th at 11:00 PM Eastern Time. The 2024 EEO-1 instruction booklet is available here. The EEOC’s EEO-1 Component 1 online Filer Support Message Center also is now open. |

Your 5-Step Strategy Plan

1. Pick a Date

As in the past, EEO-1 reports require employers to pick a payroll end date between October 1, 2024, and December 31, 2024, as your “workforce snapshot period.” Employers will report all employees as of the selected payroll date. So, while you might have fewer than 100 employees on the payroll date selected, you still must report if you reached 100 or more employees during any point of the fourth quarter of 2024. This change to having 100 employees at any time during the fourth quarter was new last year and caught many smaller employers by surprise.

2. Categorize Your Workforce

Next, ensure that your job titles are categorized correctly and consistently. The EEO job categories are:

(1.1) Executive/Senior-level officials and managers

(1.2) First/Mid-level officials and managers

(2) Professionals

(3) Technicians

(4) Sales workers

(5) Administrative support workers

(6) Craft workers

(7) Operatives

(8) Laborers and helpers

(9) Service workers

Be sure you check your job titles carefully as each job title should only be associated with a single EEO-1 job category.

3. Let Your Employees Choose

Give your employees an opportunity to self-identify their sex and race/ethnicity – and provide a statement about the voluntary nature of the inquiry. The race/ethnicity categories are unchanged:

In this year’s instructions, only binary options for reporting sex are available in the EEO-1 reporting form. Do not report non-binary employees for 2024.

4. Choose a Point of Contact

Designate an employee as the “account holder” who will file the EEO-1 report through the EEO-1 Component 1 Online Filing System (OFS). Note that there are separate instructions for new filers and for those who are changing their point of contact. Account holders must submit the workforce demographic data electronically in the OFS through either manual data entry or data file upload. The employer’s certifying official must then certify the EEO-1 Component 1 report(s) in the OFS.

5. File on Time!

File by June 24th – or earlier! In the past, the EEO-1 reporting system has slowed down significantly as the deadline approached, which makes filing more challenging. You might want to allow yourself sufficient time before the deadline so you aren’t scrambling at the last minute with technical challenges. Typically, the EEOC does not provide for extensions.

OSHA’s long-awaited heat illness rule could be inching closer to reality, with a public hearing that could determine its fate now scheduled for June 16. While many predicted the Trump administration would stall or shelve the proposal entirely, political pressure from labor unions – and growing business support for a consistent federal standard – has kept it alive. Still, it remains uncertain whether the rule gets finalized, and is even possible we’ll see a scaled-back version to take shape in the coming months. No matter what happens in Washington, D.C., however, one thing is clear: employers can’t afford to wait to address heat risks in the workplace. Here’s a practical guide to protect your workforce this summer – whether or not a new federal standard is finalized.

Background and Update on National Heat Safety Rule

Here’s an update as to where things stand on the regulatory side of things.

7 Practical Steps to Protect Workers from Summer Heat

Regardless of what rules govern your workplace, here are seven steps you can take to best protect your workers as temperatures rise across the country.

1. Monitor the Heat Index – Not Just the Temperature

The heat index (temperature + humidity) is a better indicator of risk than temperature alone. Use free apps or local weather services to track conditions at your worksites.

2. Provide Ample Water and Easy Access to It

Hydration is your first line of defense.

3. Schedule Smart – And Be Flexible

Plan the most strenuous tasks for early mornings or cooler parts of the day.

4. Create a Heat Illness Prevention Plan

Don’t rely on chance to ensure that workers are best protected. Develop a plan in writing and review it with teams before summer peaks. Your plan should cover:

5. Implement Acclimatization for New and Returning Workers

The risk of heat illness is highest during the first few days on the job.

6. Train Supervisors to Recognize Red Flags

Train supervisors in emergency response procedures, and empower them to act quickly. Make sure frontline leaders can spot:

7. Document Everything

With OSHA’s heat emphasis program still active, enforcement will continue even without a final rule.

Article courtesy of Fisher & Phillips

As the weather gets warmer and you shift your focus to seasonal hiring, you’ll want to be sure to connect with Gen Z applicants, many of whom are college and high school students in search of summer jobs. These workers are “digital natives” who grew up with technology and social media, and as a result, have their own work preferences, influences, and slang that can be somewhat baffling to outsiders. Do you want to bridge the generational divide and create a welcoming and legally compliant workplace for all? Here’s your guide to hiring Gen Z this summer.

Gen Z Has Clocked In – and They Have Notes!

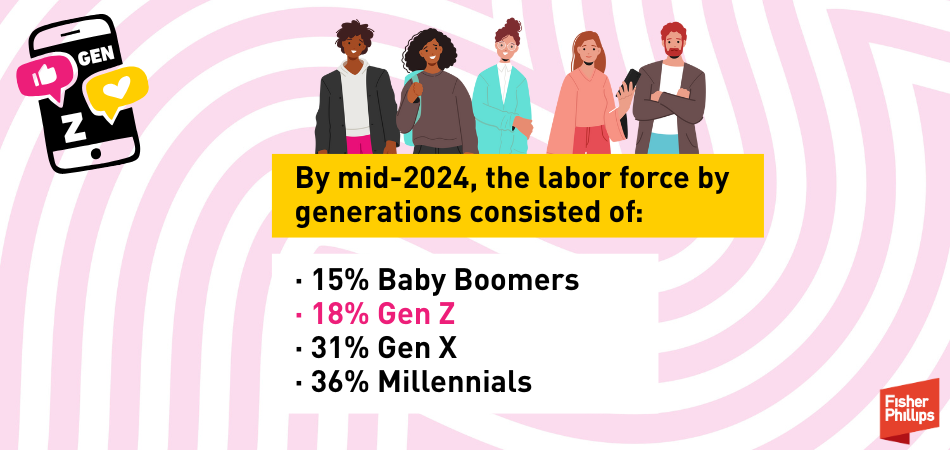

Gen Z is generally defined as people born between 1997 and 2012, which means members of this generation will turn 13 to 28 this year – and their presence in the workplace is growing rapidly. According to data from the U.S. Department of Labor, Gen Z surpassed Baby Boomers in the workforce for the first time in 2023. By mid-2024, the labor force by generations consisted of:

This means your hiring managers will want to understand what motivates Gen Z and what keeps them engaged. Here are six major points to keep in mind – with the caveat that every individual is different, some attributes are based on life-stage, and others are applicable to everyone, regardless of generation.

1. Sus Emails Are Not the Vibe – PERIODT

Gen Z has been communicating electronically since the womb, essentially. This means Gen Z workers are particularly attuned to subtleties and subtext within emails and texts. The biggest source of anxiety? The period – specifically, the “Thanks.” While it admittedly seems harmless, Gen Z workers might see the period as a means of passive aggressive “end of story” communication, even if it was once the go-to neutral punctuation. Using more exclamation points in communication might seem excessive to other generations, but it could make your newer Gen Z employees feel welcome and mitigate unnecessary stressors.

2. When We Excel, Let Us Know!

Gen Z doesn’t need to be coddled but making them feel like valued members of the team can go a long way. When providing coaching and training, consider doing so in a way that is constructive and growth minded. Everyone likes to know that the work they do is seen and appreciated. Even when feedback is negative, being thoughtful and constructive can encourage a team-oriented mindset that will help build confidence and ultimately lead to better work product.

3. Fully Remote Work Can Be Pretty Mid

COVID-19 may be in the rearview mirror, but it has forever changed the way we work. While Gen Z workers don’t necessarily want to be in the office five days a week, having a fully remote workforce also poses challenges. Remote work can be isolating, especially for workers who are just starting their careers. While every workplace is different, finding ways for new hires (of any generation, really) to meaningfully connect with their colleagues is generally a worthwhile effort. Consider developing mentorship pairings, hosting in-person social events, and taking an extra minute at the end of the day to check-in 1:1. This can help foster a sense of camaraderie that, in turn, produces better work. Plus, this is a great opportunity to make Gen Z workers feel like they are respected members of the team and to boost your retention efforts.

4. Lacking Work-Life Boundaries is Cringe

With technology connecting everyone, everywhere, all the time, respecting meaningful work-life balance is a priority for Gen Z. Simple things like delaying send on what would otherwise be a midnight email – or making it clear that workers are not obligated to respond after hours – can make a big difference. Work with them to set clear expectations on when they are expected to be in the office or online.

5. We Care About the Brand

One of the things to embrace about Gen-Z is their altruistic side. Employers who give back to the community through directed giving or volunteer work will not go unnoticed or unappreciated for their efforts. Engaging your new hires in these activities is also an excellent team-building opportunity.

6. There are Pros and Cons to Being Chronically Online

The association of Gen Z with social media is unavoidable. There can be incredible opportunity in wielding social media to your advantage. Your Gen Z employees likely know what’s trending and can be assets in building your online brand. However, you’ll want to set clear expectations. Does your employee handbook address the use of social media platforms? If not, now may be the time to contact your FP attorney to help you refresh your policies. Additionally, you can click here for four tips on updating your social media policies and staying on top of the latest trends.

At the end of the day, while Gen-Z is unique in many ways, all employees want to feel respected in their workplace. Creating a healthy, safe, and engaging environment for all employees is essential to maintaining a positive company culture. Read on for our specific tips for summer hiring.

What’s the Tea with Hiring Seasonal Workers?

Gen Z is represented by a range of workers who may approaching more senior levels of employment or still looking to land a summer job. If you’re looking to hire Gen Z workers when school lets out, you’ll want to keep the following tips in mind.

No Cap! A Bunch of Rules May Apply to Your Workplace

Here are six critical compliance items to add to your summer hiring checklist:

Give Your Policies and Procedures a Glow-Up

Have You Set Clear Expectations? Yes? Slay!

It’s hard to keep up with all the recent changes to labor and employment law, especially given the rapid pace at which the new administration has been moving on initiatives impacting the workplace and beyond. For the latest changes and a compliance action plan, here’s a quick review of some critical developments and a checklist of the essential items you should consider addressing in May and beyond.

| _____ | Check out the Fisher & Phillips First 100 Days Report for employers. The first 100 days of any new administration set the tone for what’s to come — and in 2025, that tone has been unmistakable: bold, fast-moving, and deeply consequential for employers. They created this special report —a snapshot of where things stand, where they’re headed, and what your organization should be doing to keep pace. |

| _____ | Stay tuned for more guidance on “disparate impact” claims. For decades, employers could face liability for policies and practices that didn’t intentionally discriminate but had a “disparate impact” on a group of job applicants or employees based on a protected characteristic, such as race or sex. The president is now aiming “to eliminate the use of disparate impact liability in all contexts to the maximum degree possible,” according to an April 23 executive order. Here’s what you need to know about this development and how it may impact your practices. |

| _____ | Prepare for EEO-1 reporting to begin. This year’s collection of EEO-1 reports could begin in less than a month – and will likely not allow employers to categorize workers as “non-binary.” Private employers with at least 100 employees and federal contractors with at least 50 employees should prepare to sort company data by employee job category, as well as by sex and race/ethnicity, to turn over to the EEOC between May 20 and June 24. While these dates are not yet set in stone, the compliance window will be here before you know it. |

| _____ | Safeguard your corporate leaders against rising security threats. Executives are increasingly at risk of becoming targets of violent acts or cyberattacks such as doxing or social engineering, and your organization must think ten steps ahead to ensure the safety of your people and the future of your business. Here’s an overview of executive protection programs and four key steps to help you build yours. |

| _____ | Consider alternatives to the H-1B visa for hiring foreign nationals. You may be disappointed if your candidate was not selected for an H-1B visa in the recent cap lottery – but not all hope is lost. If you employ foreign nationals, the good news is that you can explore certain short-term, long-term, and even some lesser-known solutions. Here are 11 alternatives your organization can use to retain top talent and critical staff, even if your candidate was not selected last month in the FY 2026 H-1B cap lottery. |

| _____ | Review your accommodation request process. A federal appeals court recently clarified that an employee may qualify for a reasonable accommodation under the Americans with Disabilities Act (ADA) even if they can perform essential job functions without such an accommodation. The 2nd Circuit’s March 25 decision in Tudor v. Whitehall Central School District reinforces that the ability to perform essential job functions is relevant – but not decisive – in ADA failure-to-accommodate claims. Here’s what employers need to know about this case. |

| _____ | Slay summer hiring. As the weather gets warmer and you shift your focus to seasonal hiring, you’ll want to be sure to connect with Gen Z applicants, many of whom are college and high school students in search of summer jobs. Here’s your guide to hiring Gen Z this summer. |

| _____ | Prepare for new state sick leave requirements in 2025. Over the past few years, we’ve seen a sharp increase in state-level legislation and ballot initiatives mandating employer-provided leave options for employees with strong voter support. Missouri’s new paid sick leave law took effect May 1, but there is still time to learn more here about how your company can manage this patchwork of state laws. |

| _____ | Track additional state law developments. With so many changes at the federal level, don’t forget to stay updated on state and local developments, too. For example: Now that we’re less than a year away from Colorado having the nation’s most stringent set of laws regulating the use of artificial intelligence in the workplace and elsewhere, some lawmakers are asking whether it’s better to take a step back and cool the jets. Click here to learn about a new bill that was introduced on April 28. Speaking of AI rules, California’s privacy regulator intends to advance sweeping new rules that would govern AI tools used for automated decision-making purposes – but Governor Newsom just stepped in and signaled concern that these rules could stifle innovation and drive AI companies out of the state. A California appellate court handed employers a wage and hour win on April 21 by ruling that meal period waivers prospectively signed by non-exempt employees are enforceable if certain criteria are met. A new law in Florida will make it the most enforcement-friendly state in the country for non-compete and garden leave agreements. Here is what employers should know about the CHOICE Act and three steps you can take to prepare. Ohio has taken a major step toward modernizing workplace compliance after finalizing a new law in April that will allow employers to post certain mandatory labor law notices electronically, as long as they are accessible to all employees. An April 1 decision in Massachusetts offers a textbook example of how employers can work with their trial counsel to limit their financial exposure – even after a trial loss – through thoughtful litigation strategy. |

Florida will soon be a place where businesses can operate with more peace of mind, thanks to a new law that will make it the most enforcement-friendly state in the country for non-compete and garden leave agreements. The “Florida Contracts Honoring Opportunity, Investment, Confidentiality, and Economic Growth (CHOICE) Act,” passed both the Florida House and Senate on April 24 and expected to be signed by Governor DeSantis, will reshape the state’s laws on restrictive covenants starting on July 1, 2025. The Act does not amend any current statutes, but instead provides more certainty to employers looking to enforce certain non-compete agreements and agreements offering “garden leave” (a period of time where an employee is not required to perform any work but is still paid their salary and benefits in return for not accepting employment elsewhere). Here is what employers should know about the CHOICE Act and three steps you can take to prepare.

Overview of the CHOICE Act

While many federal and state regulatory efforts seek to curb non-compete agreements, the CHOICE Act goes the other direction and creates a presumption that “covered” non-compete agreements and garden leave provisions are enforceable and do not violate public policy. Importantly, the law requires courts to issue an injunction unless the former employee or poaching employer can prove the new employment will not result in unfair competition.

Who is Covered?

The Act defines a “covered employee” as any employee or contractor who works primarily in Florida or works for an employer with their principal place of business in Florida who earns or is reasonably expected to earn a salary greater than twice the annual mean wage of either:

Notably, “salary” does not include discretionary incentives or awards or anticipated but indeterminable compensation, like bonuses or commissions. The Act excludes from this definition any person classified as a “healthcare practitioner” under Florida law.

What Agreements Are Covered?

The new law covers two types of agreements:

Type 1- Garden Leave Agreements

A garden leave agreement will be fully enforceable provided that:

Type 2- Non-Compete Agreements

Likewise, a non-compete agreement will be fully enforceable provided that:

Notably, there are no restrictions on the geographic scope of a covered non-compete agreement.

What Else?

Remedies Available

Of course, drafting and executing these agreements means very little if employers have to jump through hoops to enforce them. However, the CHOICE Act makes obtaining an injunction against a breaching employee a lot less burdensome because it requires courts to issue a preliminary injunction against a covered employee.

A judge may only modify or dissolve the injunction if the covered employee – or prospective employer – proves by clear and convincing evidence (which must be based on non-confidential information) that:

If the employee engages in “gross misconduct” against the covered employer, the covered employer may reduce the salary or benefits of the covered employee or “take other appropriate action” during the notice period, which would not be considered a breach of the garden leave agreement.

3 Key Steps For Employers

Assuming this bill is signed into law, Florida will become by far the most enforcement-friendly state in the country for non-competes and garden leave provisions starting July 1, 2025. (Arguably, it already was, but this law would go substantially further than the current Florida restrictive covenants statute.) Employers should prepare for this new day by considering the following three steps:

The Department of Justice (DOJ) withdrew 11 documents providing guidance to businesses on compliance with Title III of the Americans with Disabilities Act (Title III). The DOJ Guidance sets forth how the agency interprets certain issues addressed by Title III of the ADA. Although the guidance has been withdrawn, the law remains the same. Title III requires that covered businesses must provide people with disabilities with an equal opportunity to access the goods or services that they offer.

The DOJ says the documents were withdrawn in order to “streamline” ADA compliance resources for businesses consistent with President Trump’s January 20, 2025 Executive Order “Delivering Emergency Price Relief for American Families and Defeating the Cost-of-Living Crisis” . According to the DOJ’s press release, the “withdrawal of 11 pieces of unnecessary and outdated guidance will aid businesses in complying with the ADA by eliminating unnecessary review and focusing only on current ADA guidance. Avoiding confusion and reducing the time spent understanding compliance may allow businesses to deliver price relief to consumers.”

The DOJ identified the following guidance for withdrawal:

The DOJ is also “raising awareness about tax incentives for businesses related to their compliance with the ADA” by prominently featuring a link to a 2006 publication.

The withdrawn guidance was prepared before the most recent Title III regulations went into effect in 2011 or deals with COVID-19. It is not expected the DOJ’s withdrawal of the guidance to have significant impact on business operations, but we are closely monitoring the rapid developments from the federal agencies that impact our clients.

Courtesy of Fisher Phillips

While new presidents are typically judged based on their actions in their first 100 days, the current Trump administration has moved at such a rapid speed that we think another recap is needed at the halfway point. Here’s your employer cheat sheet on Trump’s first 50 days.

DEI and Equal Opportunity Compliance

Affirmative Action and Federal Contract Compliance

Department of Labor + Workplace Safety

Employee Defection and Trade Secrets

Artificial Intelligence

Education

Conclusion

The Trump administration has showed no signs of slowing down, and we expect that to continue throughout the next 50 days and beyond.

President Donald Trump is just 21 days into his second term in office, but you might already be struggling to keep up with the number of changes and policy shifts coming from the new administration. While new presidents are typically judged based on their actions in their first 100 days, Trump’s whirlwind first three weeks warrant taking a pause to make sure you’re caught up on all the changes impacting key workplace issues. Major policy shifts have already affected immigration, DEI programs, equal employment opportunity, labor relations, and artificial intelligence. Here’s your 21-day recap:

1. Immigration

2. Affirmative Action and Diversity, Equity, and Inclusion (DEI)

3. “Gender Ideology” and the Equal Employment Opportunity Commission

4. Labor Relations

5. Artificial Intelligence

Conclusion

President Trump’s second term kicked off at a rapid pace, and we expect to see a lot more to come during his first 100 days and beyond. We will continue to monitor developments related to all aspects of workplace law.

Courtesy of Fisher Phillips

As more employers incorporate wearable technology in the workplace, including those enhanced by artificial intelligence, the Equal Employment Opportunity Commission (EEOC)’s new fact sheet “Wearables in the Workplace: The Use of Wearables and Other Monitoring Technology Under Federal Employment Discrimination Laws,” offers important considerations for employers. The EEOC explains how employers can navigate the complexities of using wearable technologies while ensuring compliance, primarily, with the Americans with Disabilities Act (ADA), the Pregnant Workers Fairness Act (PWFA), and to a lesser extent, Title VII and GINA.

What Are Wearable Technologies?

Wearable technologies, or “wearables,” are electronic devices that are designed to be worn on the body. These devices are often embedded with sensors that can track bodily movements, collect biometric information, monitor environmental conditions and/or track GPS location. Common examples of wearables include:

Other examples of wearables that are beginning to be used in the workplace include smart glasses and smart helmets that can measure electrical activity of the brain referred to as electroencephalogram or “EEG” testing or detect emotions. Exoskeletons are also being used to provide physical support and reduce fatigue.

Wearables in the workplace may implicate federal and state employment, data privacy, AI, and potentially other laws when employers require employees to wear them or if the information collected from the employee’s wearable is reported to the employer.

Key Considerations From the EEOC Guidance

The EEOC’s new guidance outlines several important considerations for employers using wearable technologies with employees:

This overview highlights the key points from the EEOC’s new guidance. Employers should review the full guidance to ensure compliance and consult with legal counsel if they have specific questions or concerns. In addition to compliance with discrimination laws, the adoption of wearables and other emerging technologies in the workplace to manage human capital raises a number of additional legal compliance challenges including privacy, occupational safety and health, labor, benefits and wage-hour compliance to name a few.

Courtesy of Jackson Lewis P.C.