Page 1 of 53

Don’t Forget! An “old faithful” reporting requirement deadline is right around the corner: the Patient-Centered Outcomes Research Institute (PCORI) filing and fee. The Affordable Care Act imposes this annual per-enrollee fee on insurers and sponsors of self-funded medical plans to fund research into the comparative effectiveness of various medical treatment options.

The due date for the filing and payment of PCORI fee is July 31 for required policy and plan years that ended during the 2023 calendar year. For plan years that ended Jan. 1, 2023 – Sept. 30, 2023, the fee is $3.00 per covered life. For plan years that ended Oct. 1, 2023 – Dec. 31, 2023 (including calendar year plans that ended Dec. 31, 2023), the fee is calculated at $3.22 per covered life.

Insurers report on and pay the fee for fully insured group medical plans. For self-funded plans, the employer or plan sponsor submits the fee and accompanying paperwork to the IRS. Third-party reporting and payment of the fee (for example, by the self-insured plan sponsor’s third-party claim payor) is not permitted.

An employer that sponsors a self-insured health reimbursement arrangement (HRA) along with a fully insured medical plan must pay PCORI fees based on the number of employees (dependents are not included in this count) participating in the HRA, while the insurer pays the PCORI fee on the individuals (including dependents) covered under the insured plan. Where an employer maintains an HRA along with a self-funded medical plan and both have the same plan year, the employer pays a single PCORI fee based on the number of covered lives in the self-funded medical plan and the HRA is disregarded.

The IRS collects the fee from the insurer or, in the case of self-funded plans, the plan sponsor in the same way many other excise taxes are collected. Although the PCORI fee is paid annually, it is reported (and paid) with the Form 720 filing for the second calendar quarter (the quarter ending June 30). Again, the filing and payment is due by July 31 of the year following the last day of the plan year to which the payment relates (i.e. filling for the 2023 PCORI fee is due by July 31, 2024)

IRS regulations provide three options for determining the average number of covered lives: actual count, snapshot and Form 5500 method.

Actual count: The average daily number of covered lives during the plan year. The plan sponsor takes the sum of covered lives on each day of the plan year and divides the number by the days in the plan year.

Snapshot: The sum of the number of covered lives on a single day (or multiple days, at the plan sponsor’s election) within each quarter of the plan year, divided by the number of snapshot days for the year. Here, the sponsor may calculate the actual number of covered lives, or it may take the sum of (i) individuals with self-only coverage, and (ii) the number of enrollees with coverage other than self-only (employee-plus one, employee-plus family, etc.), and multiply by 2.35. Further, final rules allow the dates used in the second, third and fourth calendar quarters to fall within three days of the date used for the first quarter (in order to account for weekends and holidays). The 30th and 31st days of the month are both treated as the last day of the month when determining the corresponding snapshot day in a month that has fewer than 31 days.

Form 5500: If the plan offers family coverage, the sponsor simply reports and pays the fee on the sum of the participants as of the first and last days of the year (recall that dependents are not reflected in the participant count on the Form 5500). There is no averaging. In short, the sponsor is multiplying its participant count by two, to roughly account for covered dependents.

The U.S. Department of Labor says the PCORI fee cannot be paid from ERISA plan assets, except in the case of union-affiliated multiemployer plans. In other words, the PCORI fee must be paid by the plan sponsor; it cannot be paid in whole or part by participant contributions or from a trust holding ERISA plan assets. The PCORI expense should not be included in the plan’s cost when computing the plan’s COBRA premium. The IRS has indicated the fee is, however, a tax-deductible business expense for sponsors of self-funded plans.

Although the DOL’s position relates to ERISA plans, please note the PCORI fee applies to non-ERISA plans as well and to plans to which the ACA’s market reform rules don’t apply, like retiree-only plans.

The filing and remittance process to the IRS is straightforward and unchanged from last year. On Page 2 of Form 720, under Part II, the employer designates the average number of covered lives under its “applicable self-insured plan.” As described above, the number of covered lives is multiplied by the applicable per-covered-life rate (depending on when in 2023 the plan year ended) to determine the total fee owed to the IRS.

The Payment Voucher (720-V) should indicate the tax period for the fee is “2nd Quarter.”

Failure to properly designate “2nd Quarter” on the voucher will result in the IRS’ software generating a tardy filing notice, with all the incumbent aggravation on the employer to correct the matter with IRS.

An employer that overlooks reporting and payment of the PCORI fee by its due date should immediately, upon realizing the oversight, file Form 720 and pay the fee (or file a corrected Form 720 to report and pay the fee, if the employer timely filed the form for other reasons but neglected to report and pay the PCORI fee). Remember to use the Form 720 for the appropriate tax year to ensure that the appropriate fee per covered life is noted.

The IRS might levy interest and penalties for a late filing and payment, but it has the authority to waive penalties for good cause. The IRS’s penalties for failure to file or pay are described here.

The IRS has specifically audited employers for PCORI fee payment and filing obligations. Be sure, if you are filing with respect to a self-funded program, to retain documentation establishing how you determined the amount payable and how you calculated the participant count for the applicable plan year.

Depression is no longer one of the top mental health issues in the workplace. However, the condition is surging among women and young workers, according to new analysis, as 38% of depression cases in the past two years were found in workers aged 20-29, while 60% of cases were found in women across all age groups.

That’s according to mental health services provider ComPsych, which analyzed a sampling of more than 80,000 depression cases from its U.S. 2022 and 2023 book of business.

Depression is now the fifth most common presenting issue in the American workforce, while anxiety has skyrocketed to the No. 1 issue nationally, according to ComPsych.

“On the one hand, it’s encouraging to see that depression has decreased in prevalence across the American workforce,” said Richard Chaifetz, founder, CEO and chairman of ComPsych. “However, our data shows that’s not the case for everyone.”

The data is the latest in a set of studies that look at how mental health issues are afflicting employees and serve as a call to action for employers. Industry experts, including Chaifetz, contend that organizations would be well served to take a hard look at their mental health benefits and resources—making sure they are robust and well utilized by employees. And women and younger employees should be an important target for extra resources.

“As business leaders look to support their workers, I’d urge them to invest strategically in the groups who are struggling the most with this issue, emphasizing resources for younger age groups and in particular, women,” Chaifetz said.

Below are some additional stories from SHRM Online about the state of mental health in the workplace.

Nearly 1 in 3 employees say their job frequently causes them stress, according to new research from SHRM.

The data, released during Mental Health Awareness Month in May, shows that 30% of 1,405 surveyed employees say their job often makes them feel stressed, 26% often feel “overwhelmed” by their job, and 22% often feel disengaged from their job.

“Negative emotions are exceptionally more salient than positive emotions, and entirely more difficult for employees to let go of,” said Daroon Jalil, a senior researcher at SHRM who led the mental health research initiative. “When employees are experiencing these negative emotions, and experiencing them often, which is the real concern, it can lead to long-term negative consequences for the employee and the organization.”

The research also found that more than 1 in 3 employees (35%) said their job has a negative effect on their mental health, although nearly as many (34%) said their job has a positive effect on their mental health.

ComPsych’s data on depression comes shortly after it released data on anxiety in the workplace.

Its recent analysis of more than 300,000 U.S. cases found that nearly a quarter of people (24 percent) who reached out to ComPsych for mental health assistance in 2023 did so to get help with anxiety. That makes anxiety the No. 1 presenting issue reported by U.S. workers, topping depression, stress, relationship issues, family issues, addiction and grief, ComPsych said.

Anxiety has risen dramatically over the years, ComPsych said. In 2017, for instance, anxiety didn’t rank in the top five presenting issues for Americans.

ComPsych also recently reported that mental health-related leaves of absence are surging in the workplace, up 33 percent in 2023 over 2022.

Employee leaves of absence for mental health issues are up a whopping 300 percent from 2017 to 2023. A leave of absence, ComPsych said, can vary from a few days to weeks.

Female employees and younger workers, in particular, are driving the surge. In 2023, 69 percent of mental health-related leaves of absence were taken by women. Of these, 33 percent were taken by Millennial women, followed by Generation X women, who accounted for 30 percent of mental health-related leaves.

Although employers are making progress in mental health efforts, with more employers and employees seeking out mental health benefits, there is still much work to be done, said Colleen Marshall, chief clinical officer at Two Chairs in San Francisco.

“To have truly integrated mental health in organizations, there would be specific efforts to ensure employee wellness and mental health is a priority,” she said. “This looks different for different people and different industries. It usually includes making sure the job itself is reasonable and manageable and that employees are able to manage their mental health the same way they can manage their physical health.”

Evaluating mental health offerings, offering onsite or easy-to-access mental health professionals, giving employees paid time off to attend therapy appointments, organizing mindfulness groups in the workplace and more are some measures that can help lower barriers to mental health care, Marshall said.

Leadership should also communicate frequently and consistently that employee wellness and mental health are important to the organization, Marshall said.

The U.S. Department of Labor has increased the Fair Labor Standards Act’s (FLSA’s) annual salary-level threshold from $35,568 to $58,656 as of Jan. 1, 2025, for white-collar exemptions to overtime requirements. Effective July 1, 2024, the salary threshold will increase to $43,888. Employees making less than the salary-level threshold, such as hourly workers, can be eligible for overtime if they work enough hours.

Starting July 1, 2027, the department also will automatically increase the overtime threshold every three years..

To be exempt from overtime under the FLSA’s “white collar” executive, administrative and professional exemptions—the so-called white-collar exemptions—employees must be paid a salary of at least the threshold amount and meet certain duties tests. If they are paid less or do not meet the tests, they must be paid 1 1/2 times their regular hourly rate for hours worked in excess of 40 in a workweek.

Takeaway for employers: Employers now must decide whether to raise the salary of those employees who earn above the overtime threshold under the old standard but below it under the new standard so they remain exempt. Employers that choose not to raise these employees’ salaries should be prepared to pay overtime to these employees when they work more than 40 hours in a workweek. Schedules for those employees whose salaries are not raised above the new threshold may need adjusting to limit overtime costs. Careful communication should be rolled out to explain why employees formerly categorized as exempt are now nonexempt.

Employees will be able to sock away more money in their health savings accounts (HSAs) next year, thanks to rising inflation.

The annual limit on HSA contributions for self-only coverage in 2025 will be $4,300, a 3.6 percent increase from the $4,150 limit in 2024, the IRS announced May 9. For family coverage, the HSA contribution limit will jump to $8,550, up 3 percent from $8,300 in 2024.

Meanwhile, for 2025, a high-deductible health plan (HDHP) must have a deductible of at least $1,650 for self-only coverage, up from $1,600 in 2024, or $3,300 for family coverage, up from $3,200, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,300 for self-only coverage in 2025, up from $8,050 in 2024, or $16,600 for family coverage, up from $16,100.

The IRS also announced that the excepted-benefit HRA limit will be $2,150 in 2025, up from $2,100.

Many industry experts tout HSAs as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free.

The increased annual limits from the IRS come as HSA enrollment continues to grow, and as more employers offer contributions to employees’ accounts. HSA assets hit a record in 2023, surging to $123.3 billion last year, up nearly 19 percent from the previous record of $104 billion in 2022, according to an annual report by Devenir Group, an HSA research firm and investment consultant firm.

Jon Robb, senior vice president of research and technology at Devenir, said that growth of HSA assets “project a strong, upward trajectory for the future, indicating a steady and significant expansion of the HSA market.”

SHRM’s 2023 Employee Benefits Survey found that 64 percent of employer respondents offer a high-deductible health plan that is linked with a savings or spending account, like an HSA. That is the second most common type of health plan offered, behind a preferred provider organization plan, offered by 82 percent of employers. Among employers that do offer HSAs, 63 percent offer contributions to their employees’ accounts. The average individual-only annual contribution is $1,012, according to SHRM, while the average family annual contribution is $1,585.

Another recent report from the Employee Benefit Research Institute found that employer involvement in HSAs has a positive effect on employee’s account success. HSA holders who received employer contributions had higher balances and were more likely to invest.

HSA annual limits are released every April or May by the IRS—ahead of other limits such as flexible spending accounts and 401(k) contributions— giving employers and HSA administrators plenty of time to adjust their systems. Employers often promote HSAs and encourage employees to boost their contributions during open enrollment, though it would be a good idea for HR and benefits leaders to start that conversation now.

On Tuesday, April 23, the U.S. Department of Labor announced a rule to significantly increase the salary level needed to qualify for the FLSA’s overtime exemptions applicable to executive, administrative and professional employees to $844 per week ($43,888 annualized). The rule will also increase the total compensation needed to qualify for exemption under the test for highly compensated employees to $132,964 per year. These figures will be effective on July 1, 2024, but will increase again as of January 1, 2025. On that date, the rule will increase the salary basis threshold to $1,128 per week ($58,656 annualized), and the threshold for exemption for highly compensated employees to $151,164 per year.

Under the rule, these salary levels will be subject to automatic increases every three years. While legal challenges to the new rule are expected, employers should not wait for those challenges to be resolved before assessing the rule’s impact on their operations and considering potential changes.

This seminar is also approved for 2 Professional Development Credits (PDCs) with SHRM for all attendees.

Under a new Florida law, employers will need to turn to state and federal agencies – rather than local governments – for guidance on certain key workplace rules. On April 11th, Governor Ron DeSantis signed HB 433 which preempts local governments from passing laws related to workplace heat safety protocols and curbs their ability to use contracting power to influence private employer wage rates and employee benefits. The new law also prohibits local governments from making their own rules about workplace scheduling or “predictive scheduling” for private employers. Here are the three top takeaways for employers as you prepare for compliance.

1. Heat Safety Protocols

Florida falls under federal OSHA jurisdiction, which covers most private-sector workers in the state. The new statute bans counties and municipalities from requiring private employers to offer heat safety protections to employees beyond what’s required under the Occupational Health and Safety Act (OSH Act).

For example, the Miami-Dade County Commission recently withdrew a bill that would have required employers to provide outdoor construction and farm workers with 10-minute breaks in the shade every two hours. Going forward, Florida employers should continue to ensure their practices comply with the federal OSH Act.

To provide a safe workplace, consider taking the following steps before summer:

This part of the new law will take effect on July 1.

2. Wages and Employee Benefits

Under HB 433, local governments will be prohibited from using their purchasing or contracting power to control the wages or employment benefits of entities they do business with. They will also be barred from awarding preferences to entities that offer more favorable wages and benefits to employees. Additionally, HB 433 moves local governments’ ability to:

Notably, counties such as Broward and Miami-Dade – which have living wage ordinances mandating higher pay than the state minimum wage for service contractors and subcontractors – will be impacted the most by the wage requirement revisions.

These revisions to the Florida Statutes will go into effect for contracts entered after September 29, 2026.

3. Scheduling and Predictive Scheduling

Finally, HB 433 impacts a local government’s ability to force private employers to implement scheduling and predictive scheduling policies. Predictive scheduling laws require employers to provide work schedules to employees in advance. In some instances, predictive scheduling laws also require employers to provide additional benefits to employees. For instance, Oregon requires employers in the retail, hospitality, and food industries (with at least 500 employees worldwide) to provide schedules posted in an obvious location at least 14 days in advance, pay employees a penalty for shift changes with no notice, permit employees to provide input on availability and to reject shifts not on schedule, and allow employees at least 10 hours between shifts on back-to-back days.

Under Florida’s new legislation, effective July 1, any predictive scheduling requirement will have to be enacted by the Florida Legislature and Governor.

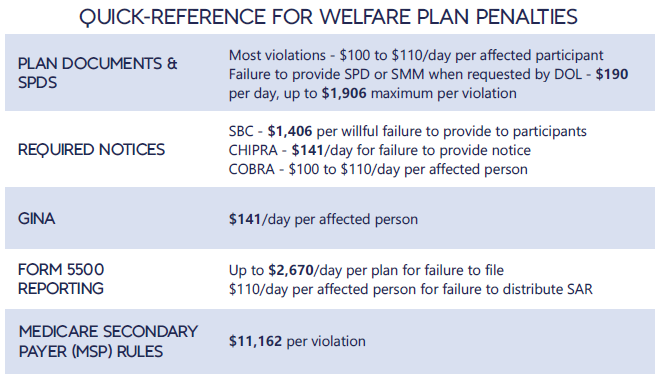

Each year in mid January, the Department of Labor (DOL) adjusts ERISA penalty amounts to account for inflation. This year’s increases are modest and amount to approximately 3%. Below summarizes a few of the penalty amounts that plan sponsors could see imposed on them for various federal law violations. The adjusted amounts apply to ERISA violations that occurred after November 2, 2015, if penalties are assessed after January 15, 2024, and before January 16, 2025.

*Notes: figures in bold are subject to annual adjustment

Below are the current inflation adjusted penalty amounts for failure to file forms 1094 and 1095 with the IRS and failure to provide form 1095 to applicable employees. Both penalties increase to $630 per form if failure is due to “intentional disregard” (criminal penalties may also apply).

The Equal Employment Opportunity Commission (EEOC) has issued final regulations and Interpretative Guidance to implement the Pregnant Workers Fairness Act (PWFA). The PWFA went into effect on June 27, 2023. The PWFA requires that employers with at least 15 employees provide reasonable accommodations, absent undue hardship, to qualified employees and applicants with known limitations related to, affected by, or arising out of pregnancy, childbirth, or related medical conditions.

The PWFA required the EEOC to publish final regulations by December 29, 2023. However, the EEOC did not issue final regulations until April 15, 2024. The final regulations are slated to be published in the Federal Register on April 19, and will go into effect 60 days after publication. The final regulations were issued after over 100,000 public comments were submitted in response to the proposed regulations.

In the final regulations the EEOC clarifies, and in some instances, expands upon the circumstances in which an employer must reasonably accommodate an employee, absent undue hardship. The following is a list of some of the issues addressed in the 400+ pages of final regulations.

If you have any questions about the PWFA or the implications of the regulations for your organization please let us know.

The Florida Legislature just passed a bill to loosen existing work restrictions for minors who are at least 16 years old. Governor DeSantis signed the bill on March 22, and it will take effect on July 1, 2024. You should note that both federal and state laws restrict the time of day and number of hours that minors can work, the type of work that minors can perform, and the equipment they can use. Although the federal Fair Labor Standards Act (FLSA) governs child labor and sets the minimum standards, states can enact more restrictive child labor laws. Florida is one of the states that has enacted more restrictive child labor laws — but the new legislation lightens up on restrictions for older teens, allowing those workers and their employers more flexibility. Here’s what employers need to know about HB 49 and the top five questions to consider when hiring teenagers.

The New Rules

5 Questions to Consider

If you’re thinking about hiring younger workers or increasing the hours that your minor employees work, you should ask yourself these five questions:

While HB 49 relaxes some work restrictions for minors, Florida employers should continue to ensure compliance with child labor laws by regularly reviewing hiring and employment practices with respect to minors, providing detailed training to managers, and performing internal audits to ensure compliance with both Florida and federal child labor laws.