Page 1 of 1

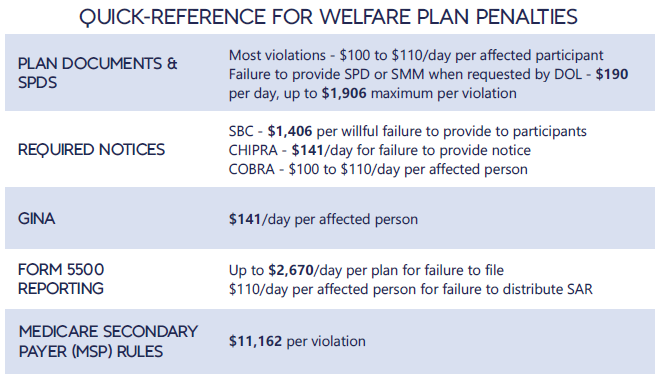

Each year in mid January, the Department of Labor (DOL) adjusts ERISA penalty amounts to account for inflation. This year’s increases are modest and amount to approximately 3%. Below summarizes a few of the penalty amounts that plan sponsors could see imposed on them for various federal law violations. The adjusted amounts apply to ERISA violations that occurred after November 2, 2015, if penalties are assessed after January 15, 2024, and before January 16, 2025.

*Notes: figures in bold are subject to annual adjustment

Below are the current inflation adjusted penalty amounts for failure to file forms 1094 and 1095 with the IRS and failure to provide form 1095 to applicable employees. Both penalties increase to $630 per form if failure is due to “intentional disregard” (criminal penalties may also apply).

On December 22, 2014, the Departments of Health and Human Services (HHS) issued proposed regulations for changes to the Summary of Benefits and Coverage (SBC).

The proposed regulations clarify when and how a plan administrator or insurer must provide an SBC, shortens the SBC template, adds a third cost example, and revises the uniform glossary. The proposed regulations provide new information and also incorporate several FAQs that have been issued since the final SBC regulations were issued in 2012.

These proposed changes are effective for plan years and open enrollment period beginning on or after September 1, 2015. Comments on the proposed regulations will be accepted until March 2,2015 and are encourages on many of the provisions.

New Template

The new SBC template eliminates a significant amount of information that the Departments characterized as not being required by law and/or as having been identified by consumer testing as less useful for choosing coverage.

The sample completed SBC template for a standard group health plan has been reduced from four double-sided pages to two-and-a-half double-sided pages. Some of the other changes include:

Glossary Revisions

Revisions to the uniform glossary have also been proposed. The glossary must be available to plan participants upon request. Some definitions have been changed and new medical terms such as claim, screening, referral and specialty drug have been added. Additional terms related to health care reform such as individual responsibility requirement, minimum value and cost-sharing reductions have also been added.

Paper vs Electronic Distribution

SBCs may continue to be provided electronically to group plan participants in connection with their online enrollment or online renewal of coverage. SBCs may also be provided electronically to participants who request an SBC online. These individuals must also have the option to receive a paper copy upon request.

SBCs for self-insured non-federal government plans may continue to be provided electronically if the plan conforms to either the electronic distribution requirements that apply ERISA plan or the rules that apply to individual health insurance coverage.

Types of Plans to Which SBCs Apply

The regulations confirm that SBCs are not required for expatriate health plans, Medicare Advantage plans or plans that qualify as excepted benefits. Excepted benefits include:

SBCs are required for:

Small businesses may participate in several federally facilitated Small Business Health Option Program (SHOP) exchanges – for example, if an employer has offices in different states – but each small employer is limited to establishing one FF-SHOP account per state.

If an employer has worksites in several states, it may (1) establish an account in each state where the company has a primary work location for workers; or (2) it may establish an account in one state and use that to provide health insurance for all members of the group. If it does establish accounts in several states, it must submit a separate report on the participation rate to each FF-SHOP.

An employer is considered to be a small employer eligible for SHOP coverage if its average number of employees is 50 or fewer. Employers participating in the FF-SHOP must offer coverage to all full-time employees, defined as those working 30 or more hours per week on average.

The SHOP system is a way for employers to help satisfy health reform’s mandate for individuals to obtain coverage or pay extra taxes. Furthermore, most (34 out of 50, not including the District of Columbia) states will house (but not run) FF-SHOP exchanges.

In March 2013, the CMS released final rules that described the 70% participation requirement for small employers. Under those rules, insurers may deny coverage to small employers that fail to meet the minimum participation requirements.

Minimum Participation

Insurers may impose a 70% workforce participation requirement for small employers to partake in FF-SHOP coverage. In the first open enrollment period (Nov. 15 through Dec. 15, 2013), however, workers can obtain coverage on an interim basis even if an employer falls below the minimum participation amount, according to CMS. On renewal one year later, however, insurers will be able to invoke the participation requirement. State law may impose a different minimum participation requirement. Small employers are required to keep records of coverage held by workers to substantiate minimum participation and to ensure that workers do not have double coverage.

Other Highlights

Here are a few other policies small employers will want to know when considering group coverage with an FF-SHOP:

The topic for this month focuses on Health Care Reform Updates. It covers regulations including the 2014 Play or Pay penalty as well as the new Summary of Benefits & Coverage (SBC) requirements.

Please contact us directly for more information on this topic.

The Patient Protection and Affordable Care Act (PPACA) requires group health plans to distribute four-page plan summaries to enrollees. These Summaries of Benefits and Coverage (SBCs) are subject to a “culturally and linguistically appropriate” standard, meaning that when the SBC is distributed to an enrollee at an address in a county where, according to the federal government, at least 10% of the citizens are fluent only in the same non-English language, the summary must include a prominent offer of language assistance in that non-English language.