Page 1 of 1

The holidays aren’t all parties and presents or candy canes and champagne. For workers, this time of year—brimming with looming end-of-year deadlines, financial and social obligations, and more—can cause a serious decline in mental well-being.

Research shows the majority of U.S. workers (61%) say their mental health is negatively impacted during the holiday season, with 44% feeling more stressed than usual and 17% reporting a decline in their overall well-being. That’s on top of the high levels of stress and burnout workers are already experiencing. According to recent study conducted by Aflac, well over half of U.S. employees (57%) are experiencing at least a moderate level of burnout.

One of the reasons why burnout and workplace stress intensifies during the holiday season is because of the pressure to meet year-end deadlines during a shortened work month. Additional family, financial and personal obligations also exacerbate burnout symptoms and workplace stress at the end of the year.

That heightened stress will likely make its way into the office—creating not only unproductive and unhealthy employees, but also ones who may not feel valued by their employer and are therefore more likely to leave.

That’s why, experts said, it’s in employers’ and HR leaders’ best interest to address the issue by touting available benefits, helping manage workloads and rethinking holiday celebrations, among other steps.

Employers and HR leaders need to help address this time of high stress and anxiety because first and foremost, employees are people first and workers second. High stress and anxiety can lead to burnout, illness and more. As for the employer piece, intense stress and anxiety can result in poor productivity, errors, lower morale and engagement, and more.

Here are 10 ways to help, according to HR and benefits experts.

1.Remind employees about financial education offerings to assist them with holiday budget concerns. Many employees are already stressed about finances—long-lasting high inflation has pushed financial wellness to an all-time low for many so the holidays, which are associated with gifts, extra commitments and travel that drive up spending, can cause greater stress for employees.

A September survey by Paycom found that three in four Americans say they must make accommodations to afford increased holiday expenses, including having side hustles or seasonal jobs, taking on credit card debt or payday loans, and saving throughout the year.

Many organizations offer financial wellness programs for employees, so HR leaders may want to send out information about available resources that employees can access to help with budgeting, saving and more.

Organizations should also look at their pay processes and make sure employees are paid on time and correctly for any end-of-year bonuses, regular salary and overtime hours.

2. Check in about workload—especially regarding end-of-year deadlines. The end of the calendar year is especially busy for many employees, and in some sectors, it might even be the busiest time of the year. “As the end of the year approaches, employees are trying to finalize budgets, wrap up projects, meet goals and tie up loose ends,” said Jennifer Moss, author of The Burnout Epidemic: The Rise of Chronic Stress and How We Can Fix It (Harvard Business Review Press, 2021). That’s why it’s vital that managers talk with employees about their workload and try to come up with solutions together about how to manage it, she said.

From now until the end of the year, managers should frequently check in with employees so they feel seen and heard.

Managers can say something like, “I want to check in to see how you’re doing. It’s such a hectic time of year and stress can become more intense than usual. How are you? How can I best support you?” Employers should be open to hearing their workers’ concerns—maybe they need more flexible schedules right now; maybe they need additional help—perhaps tapping resources from other departments who have lighter workloads this time of year.

3.Think about mental health help. HR and benefits leaders would be well-served to ramp up communication about mental health tips, as well as resources available through the company. HR leaders might want to send messages to employees to encourage them to take advantage of wellness programs such as employee assistance programs.

4.Encourage employees to take paid time off (PTO)—and actually step away from work. Utilizing PTO is vital in helping employees take a breather, recharge and come back to the office ready to work and be productive. The majority of workers (65%) admit to working on their days off to solve time-sensitive deliverables or to support their manager or other co-workers who ask questions or require their response.

Employers should reassure workers they don’t have to work on their days off. Bosses should lead by example and not check emails while they’re out of the office to set the message of truly unplugging. In turn, this means when they know their workers are on personal time or holiday time out of the office, bosses should not reach out to their direct reports and expect them to respond.

By having bosses do this, they can put a worker’s mind at ease. They can feel that their boss truly supports their taking time off without any negative ramifications. It can also help alleviate the stress and anxiety workers feel to constantly work 24/7 during a time of year that’s intended for people to slow down and pause.

In the long term, advocating for employees to enjoy time off can help strengthen retention and boost productivity when they return to work after a break feeling recharged.

5.Talk about health concerns and good practices. COVID-19, flu, RSV (respiratory syncytial virus) and other illnesses are spreading rapidly right now, which can be a stressor for employees—especially those who work in an office near other people or have a holiday party to attend. HR leaders might want to tell their workforce about potential ways to combat virus spread and encourage them to use PTO or to work remotely when they’re sick to “help avoid spreading illness, which can increase stress”.

Likewise, it might be a best practice to not make an office holiday party mandatory to ease concerns of workers who might be concerned about catching COVID-19 or other illnesses.

6.Consider offering a companywide break. PTO is helpful, but a companywide break—when a company shuts down most of its operations and allows employees to take the same time off can be a big help in reducing employee stress.

It also appears to be a growing trend, especially around the holidays: According to Sequoia Consulting Group, an HR consulting and services company based in San Francisco, 35% of companies give employees the week between Christmas and New Year’s Day off.

While this may take significant planning, employers can get ready to do it next year.

7.Give employees a choice when it comes to holiday gatherings. Holiday parties can be fun and a great morale booster—but they can cause stress for workers already stretched thin with lots of commitments or for any employee who would prefer to skip out on big events due to illness concerns.

Check in with your people to find out if they are still on board with the big holiday party or if they want to do something else this year. Go with the majority, but if there are people who might feel left out, offer a different option. Organizations should ensure that events are accessible by having spaces that consider employees with disabilities. Neurodiverse employees, for instance, may need spaces that respect sensory sensitivities.

It can appear tone-deaf if employees are feeling constantly under-resourced and exhausted from burnout, and the cost of the holiday party could have paid for those resources. Just because it comes out of another budget, it doesn’t mean employees won’t notice.

8.Offer opportunities to volunteer or give back. Giving back and helping others during this time of year may boost employees’ feelings of happiness. Employers can offer employees an opportunity to volunteer or participate in charitable giving. Employers can also consider offering workers a day of PTO to volunteer for a cause they are passionate about.

Offering employees an opportunity to give back to their communities can also bolster a sense of community and well-being.

9.Remember that employee situations are unique. The holidays can be a joyful time of year for many people, but they can be especially rough for many others.

The holidays can be hard for people—particularly if they are attached to grief. It may feel like the pandemic is in the rearview, but the catastrophic impacts are still felt by many, especially at this time of the year. Also, the holiday season can feel exclusive for anyone who doesn’t celebrate it. Plus, loneliness is at an all-time high during the holiday season, which can make people feel even more excluded. Employers need to be sensitive to the unique experiences everyone is going through.

Employers and HR leaders could benefit from training managers to recognize the signs of high stress and anxiety among their workforces. These signs include but are not limited to absenteeism, irritability, lack of concentration and lower work quality, as well as withdrawn behaviors.

10.Celebrate employees during the holidays. Some employers give gifts to employees—from larger things such as an end-of-year bonus and extra PTO to smaller things such as a gift card or other present. But gifts are not the only way to celebrate employees. Recognizing their contributions, even with a letter or in-person praise, can boost employee confidence.

Celebrating employees during the holidays—in large and small ways—is important. It doesn’t have to be an extravagant holiday party; simply thanking employees for their efforts over the past 12 months can help to build morale.

Did you know that 88% of Americans report feeling stressed at some point during the holidays. During this episode of Myra’s Minutes, we share tips on how to battle holiday induced stress this season.

You can view this short video here.

Under the Affordable Care Act, (ACA) a fund for a new nonprofit corporation to assist in clinical effectiveness research was created. To aid in the financial support for this endeavor, certain health insurance carriers and health plan sponsors are required to pay fees based on the average number of lives covered by welfare benefits plans. These fees are referred to as either Patient-Centered Outcome Research Institute (PCORI) or Clinical Effectiveness Research (CER) fees.

The applicable fee was $2.26 for plan years ending on or after October 1, 2016 and before October 1, 2017. For plan years ending on or after October 1, 2017 and before October 1, 2018, the fee is $2.39. Indexed each year, the fee amount is determined by the value of national health expenditures. The fee phases out and will not apply to plan years ending after September 30, 2019.

As a reminder, fees are required for all group health plans including Health Reimbursement Arrangements (HRAs), but are not required for health flexible spending accounts (FSAs) that are considered excepted benefits. To be an excepted benefit, health FSA participants must be eligible for their employer’s group health insurance plan and may include employer contributions in addition to employee salary reductions. However, the employer contributions may only be $500 per participant or up to a dollar for dollar match of each participant’s election.

HRAs exempt from other regulations would be subject to the CER fee. For instance, an HRA that only covered retirees would be subject to this fee, but those covering dental or vision expenses only would not be, nor would employee EAPs, disease management programs and wellness programs be required to pay CER fees.

The Affordable Care Act (“ACA”), introduced in 2014 the Transitional Reinsurance Fee (“Fee”) in an effort to fund reinsurance payments to health insurance issuers that cover high-risk individuals in the individual market and to stabilize insurance premiums in the market for the 2014 through 2016 years. The Fee has also been instituted to pay administrative costs related to the Early Retiree Reinsurance Program.

BACKGROUND ON TRANSITIONAL REINSURANCE PROGRAM

The ACA established a transitional reinsurance program to provide payments to health insurance issuers that cover high risk individuals in an attempt to evenly spread the financial risk of issuers. The program is designed to provide issuers with greater payment stability as insurance market reforms are implemented and the state-based health insurance exchanges/marketplaces facilitate increased enrollment. It is expected that the program will reduce the uncertainty of insurance risk in the individual market by partially offsetting issuers’ risk associated with high-cost enrollees. In an effort to fund the program, the ACA created the Fee which is a temporary fee that is assessed on health insurance issuers and plan sponsors of self-funded health plans. The Fee is applicable for the 2014, 2015 and 2016 years and is deductible as an ordinary and necessary business expense.

The Fee is generally applicable to all health insurance plans providing major medical coverage including sponsors of self-insured group health plans. Major medical coverage is defined as health coverage for a broad range of services and treatments, including diagnostic and preventive services, as well as medical and surgical conditions in inpatient, outpatient and emergency room settings. Since COBRA continuation coverage generally qualifies as major medical coverage, the Fee will also apply in this instance. It does not, however, apply to employer provided major medical coverage that is secondary to Medicare.

The Fee, as currently structured, does not apply to various other types of plans including (but not limited to) health savings accounts (H.S.A.s), employee assistance plans (EAP) or wellness programs that do not provide major medical coverage, health reimbursement arrangements integrated with a group health plan (HRA), health flexible spending accounts (FSA) and coverage that consists of only excepted benefits (e.g. stand-alone dental and vision).

AMOUNT OF THE FEE

The Fee for the 2015 benefit year is equal to $44 per covered life. It is expected that the Fee for the 2015 benefit year will generate approximately $8 billion in revenue. The Fee for the 2016 year is expected to be $27 per covered life and will raise approximately $5 billion in revenue. Thereafter, the Fee is set to expire and no longer be applicable. The fee for 2014 was $63 per covered life.

REPORTING THE NUMBER OF COVERED LIVES AND PAYING THE FEE

The 2015 ACA Transitional Reinsurance Program Annual Enrollment and Contributions Submission Form will be available on www.pay.gov on October 1, 2015. The form for 2014 is also available on this website. Please note there is a separate form for each benefit year. For the 2015 year, the number of covered lives must be reported to the Department no later than November 16, 2015. The Department will then notify reporting organizations no later than December 15, 2015 the amount of the fee that will be due and payable.

As with the 2014 benefit year, the Department of Health and Human Services has given contributing entities two different options to make the payment. Under the first option, the first portion of the Fee ($33 per covered life) is due and payable no later than January 15, 2016 (30 days after issuance of the notice from the Department). This portion of the Fee will cover reinsurance payments and administrative expenses. The second portion of the Fee ($11 per covered life) will cover Treasury’s administrative costs associated with the Early Retiree Reinsurance Program and will be due no later than November 15, 2016.

Under the second payment option, contributing entities can opt to pay the full amount ($44 per covered life) by January 15, 2016.

As the number of covered lives is due to be reported no later than November 16th of this year, employers should review their types of health coverage and determine which plans are subject to the Fee. Employers that have fully insured plans should be on the lookout for potential increased premiums as the insurance carrier is responsible to report and pay the Fee on behalf of the plan in these instances. Those with self funded medical coverage need to be sure to report and pay the fe

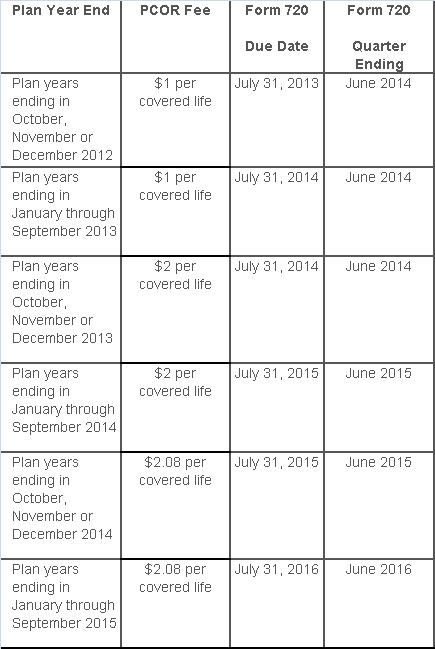

The Affordable Care Act added a patient-centered outcomes research (PCOR) fee on health plans to support clinical effectiveness research. The PCOR fee applies to plan years ending on or after Oct. 1, 2012, and before Oct. 1, 2019. The PCOR fee is due by July 31 of the calendar year following the close of the plan year. For plan years ending in 2014, the fee is due by July 31, 2015.

PCOR fees are required to be reported annually on Form 720, Quarterly Federal Excise Tax Return, for the second quarter of the calendar year. The due date of the return is July 31. Plan sponsors and insurers subject to PCOR fees but not other types of excise taxes should file Form 720 only for the second quarter, and no filings are needed for the other quarters. The PCOR fee can be paid electronically or mailed to the IRS with the Form 720 using a Form 720-V payment voucher for the second quarter. According to the IRS, the fee is tax-deductible as a business expense.

The PCOR fee is assessed based on the number of employees, spouses and dependents that are covered by the plan. The fee is $1 per covered life for plan years ending before Oct. 1, 2013, and $2 per covered life thereafter, subject to adjustment by the government. For plan years ending between Oct. 1, 2014, and Sept. 30, 2015, the fee is $2.08. The Form 720 instructions are expected to be updated soon to reflect this increased fee.

This chart summarizes the fee schedule based on the plan year end and shows the Form 720 due date. It also contains the quarter ending date that should be reported on the first page of the Form 720 (month and year only per IRS instructions). The plan year end date is not reported on the Form 720.

For insured plans, the insurance company is responsible for filing Form 720 and paying the PCOR fee. Therefore, employers with only fully- insured health plans have no filing requirement.

If an employer sponsors a self-insured health plan, the employer must file Form 720 and pay the PCOR fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720. A self-insured health plan is any plan providing accident or health coverage if any portion of such coverage is provided other than through an insurance policy.

Since the fee is a tax assessed against the plan sponsor and not the plan, most funded plans subject to ERISA must not pay the fee using plan assets since doing so would be considered a prohibited transaction by the U.S. Department of Labor (DOL). The DOL has provided some limited exceptions to this rule for plans with multiple employers if the plan sponsor exists solely for the purpose of sponsoring and administering the plan and has no source of funding independent of plan assets.

Plans sponsored by all types of employers, including tax-exempt organizations and governmental entities, are subject to the PCOR fee. Most health plans, including major medical plans, prescription drug plans and retiree-only plans, are subject to the PCOR fee, regardless of the number of plan participants. The special rules that apply to Health Reimbursement Accounts (HRAs) and Health Flexible Spending Accounts (FSAs) are discussed below.

Plans exempt from the fee include:

If a plan sponsor maintains more than one self-insured plan, the plans can be treated as a single plan if they have the same plan year. For example, if an employer has a self-insured medical plan and a separate self-insured prescription drug plan with the same plan year, each employee, spouse and dependent covered under both plans is only counted once for purposes of the PCOR fee.

The IRS has created a helpful chart showing how the PCOR fee applies to common types of health plans.

Health Reimbursement Accounts (HRAs) - Nearly all HRAs are subject to the PCOR fee because they do not meet the conditions for exemption. An HRA will be exempt from the PCOR fee if it provides benefits only for dental or vision expenses, or it meets the following three conditions:

Health Flexible Spending Accounts (FSAs) - A health FSA is exempt from the PCOR fee if it satisfies an availability condition and a maximum benefit condition.

Additional special rules for HRAs and FSAs . Once an employer determines that its HRA or FSA is subject to the PCOR fee, the employer should consider the following special rules:

The IRS provides different rules for determining the average number of covered lives (i.e., employees, spouses and dependents) under insured plans versus self-insured plans. The same method must be used consistently for the duration of any policy or plan year. However, the insurer or sponsor is not required to use the same method from one year to the next.

A plan sponsor of a self-insured plan may use any of the following three

methods to determine the number of covered lives for a plan year:

1. Actual count method. Count the covered lives on each day of the plan year and divide by the number of days in the plan year.

Example: An employer has 900 covered lives on Jan. 1, 901 on Jan. 2, 890 on

Jan. 3, etc., and the sum of the lives covered under the plan on each day of

the plan year is 328,500. The average number of covered lives is 900 (328,500 ÷

365 days).

2. Snapshot method. Count the covered lives on a single day in each quarter (or more than one day) and divide the total by the number of dates on which a count was made. The date or dates must be consistent for each quarter. For example, if the last day of the first quarter is chosen, then the last day of the second, third and fourth quarters should be used as well.

Example: An employer has 900 covered lives on Jan. 15, 910 on April 15, 890 on

July 15, and 880 on Oct. 15. The average number of covered lives is 895 [(900 +

910+ 890+ 880) ÷ 4 days].

As an alternative to counting actual lives, an employer can count the number of

employees with self-only coverage on the designated dates, plus the number of

employees with other than self-only coverage multiplied by 2.35.

3. Form 5500 method. If a Form 5500 for a plan is filed before the due date of the Form 720 for that year, the plan sponsor can determine the number of covered lives based on the Form 5500. If the plan offers just self-only coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) and divides by 2. If the plan also offers family or dependent coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) without dividing by 2.

Example: An employer offers single and family coverage with a plan year ending

on Dec. 31. The 2013 Form 5500 is filed on June 5, 2014, and reports 132

participants on line 5 and 148 participants on line 6d. The number of covered

lives is 280 (132 + 148).

To evaluate liability for PCOR fees, plan sponsors should identify all of their plans that provide medical benefits and determine if each plan is insured or self-insured. If any plan is self-insured, the plan sponsor should take the following actions:

The IRS and the Treasury Department issued a notice on the so-called “Cadillac Tax”—a 40 percent excise tax to be imposed on high-cost employer-sponsored health plans beginning in 2018 under the Affordable Care Act (ACA).

Notice 2015-16, released on Feb. 23, 2015, discusses a number of issues concerning the tax and requests comments on the possible approaches that ultimately could be incorporated in proposed regulations. Specifically, the guidance states that the agencies anticipate that pretax salary reduction contributions made by employees to health savings accounts (HSAs) will be subject to the Cadillac tax.

Background

In 2018, the ACA provides that a nondeductible 40 percent excise tax be imposed on “applicable employer-sponsored coverage” in excess of statutory thresholds (in 2018, $10,200 for self-only, $27,500 for family). As 2018 approaches, the benefit community has long awaited guidance on this tax. While many employers have actively managed their plan offerings and costs in anticipation of the impact of the tax, those efforts have been hampered by the lack of guidance. Among other things, employers are uncertain what health coverage is subject to the tax and how the tax is calculated.

Particularly, Notice 2015-16 addresses:

The agencies are requesting comments on issues

discussed in this notice by May 15, 2015. They intend to issue another notice

that will address other areas of the excise tax and anticipates issuing

proposed regulations after considering public comments on both notices.

Applicable Coverage

Of most immediate interest to plan sponsors is the specific type of coverage (i.e., “applicable coverage”) that will be subject to the excise tax, particularly where the statute is unclear.

Employee Pretax HSA

Contributions

The ACA statute provides that employer contributions to an HSA are subject to

the excise tax, but did not specifically address the treatment of employee

pretax HSA contributions. The notice says that the agencies “anticipate that

future proposed regulations will provide that (1) employer contributions to

HSAs, including salary reduction contributions to HSAs, are included in

applicable coverage, and (2) employee after-tax contributions to HSAs are

excluded from applicable coverage.”

Note: This anticipated treatment of employee pretax contributions to HSAs will have a significant impact on HSA programs. If implemented as the agencies anticipate, it could mean many employer plans that provide for HSA contributions will be subject to the excise tax as early as 2018, unless the employer limits the amount an employee can contribute on a pretax basis.

Self-Insured Dental

and Vision Plans

The ACA statutory language specifically excludes fully insured dental and

vision plans from the excise tax. The treatment of self-insured dental and

vision plans was not clear. The notice states that the agencies will consider

exercising their “regulatory authority” to exclude self-insured plans that

qualify as excepted benefits from the excise tax.

Employee Assistance

Programs

The agencies are also considering whether to exclude excepted-benefit employee

assistance programs (EAPs) from the excise tax.

Onsite Medical Clinics

The notice discusses the exclusion of certain onsite medical clinics that offer

only de

minimis care to employees,

citing a provision in the COBRA regulations, and anticipates excluding such

clinics from applicable coverage. Under the COBRA regulations an onsite clinic

is not considered a group health plan if:

The agencies are also asking for comment on

the treatment of clinics that provide certain services in addition to first

aid:

In Closing

With the release of this initial guidance, plan sponsors can gain some insight into the direction the government is likely to take in proposed regulations and can better address potential plan design strategie

On December 22, 2014, the Departments of Health and Human Services (HHS) issued proposed regulations for changes to the Summary of Benefits and Coverage (SBC).

The proposed regulations clarify when and how a plan administrator or insurer must provide an SBC, shortens the SBC template, adds a third cost example, and revises the uniform glossary. The proposed regulations provide new information and also incorporate several FAQs that have been issued since the final SBC regulations were issued in 2012.

These proposed changes are effective for plan years and open enrollment period beginning on or after September 1, 2015. Comments on the proposed regulations will be accepted until March 2,2015 and are encourages on many of the provisions.

New Template

The new SBC template eliminates a significant amount of information that the Departments characterized as not being required by law and/or as having been identified by consumer testing as less useful for choosing coverage.

The sample completed SBC template for a standard group health plan has been reduced from four double-sided pages to two-and-a-half double-sided pages. Some of the other changes include:

Glossary Revisions

Revisions to the uniform glossary have also been proposed. The glossary must be available to plan participants upon request. Some definitions have been changed and new medical terms such as claim, screening, referral and specialty drug have been added. Additional terms related to health care reform such as individual responsibility requirement, minimum value and cost-sharing reductions have also been added.

Paper vs Electronic Distribution

SBCs may continue to be provided electronically to group plan participants in connection with their online enrollment or online renewal of coverage. SBCs may also be provided electronically to participants who request an SBC online. These individuals must also have the option to receive a paper copy upon request.

SBCs for self-insured non-federal government plans may continue to be provided electronically if the plan conforms to either the electronic distribution requirements that apply ERISA plan or the rules that apply to individual health insurance coverage.

Types of Plans to Which SBCs Apply

The regulations confirm that SBCs are not required for expatriate health plans, Medicare Advantage plans or plans that qualify as excepted benefits. Excepted benefits include:

SBCs are required for: