Page 1 of 6

Earlier this week, President Obama signed the 21st Century Cures Act (“Act”). This Act contains provisions for “Qualified Small Business Health Reimbursement Arrangements” (“HRA”). This new HRA would allow eligible small employers to offer a health reimbursement arrangement funded solely by the employer that would reimburse employees for qualified medical expenses including health insurance premiums.

The maximum reimbursement that can be provided under the plan is $4,950 or $10,000 if the HRA provided for family members of the employee. An employer is eligible to establish a small employer health reimbursement arrangement if that employer (i) is not subject to the employer mandate under the Affordable Care Act (i.e., less than 50 full-time employees) and (ii) does not offer a group health plan to any employees.

To be a qualified small employer HRA, the arrangement must be provided on the same terms to all eligible employees, although the Act allows benefits under the HRA to vary based on age and family-size variations in the price of an insurance policy in the relevant individual health insurance market.

Employers must report contributions to a reimbursement arrangement on their employees’ W-2 each year and notify each participant of the amount of benefit provided under the HRA each year at least 90 days before the beginning of each year.

This new provision also provides that employees that are covered by this HRA will not be eligible for subsidies for health insurance purchased under an exchange during the months that they are covered by the employer’s HRA.

Such HRAs are not considered “group health plans” for most purposes under the Code, ERISA and the Public Health Service Act and are not subject to COBRA.

This new provision also overturns guidance issued by the Internal Revenue Service and the Department of Labor that stated that these arrangements violated the Affordable Care Act insurance market reforms and were subject to a penalty for providing such arrangements.

The previous IRS and DOL guidance would still prohibit these arrangements for larger employers. The provision is effective for plan years beginning after December 31, 2016. (There was transition relief for plans offering these benefits that ends December 31, 2016 and extends the relief given in IRS Notice 2015-17.)

Many employers offer affordable health coverage that meets or exceeds the minimum value requirements of the Affordable Care Act (ACA). However, if one or more of their full-time employees claims the coverage offered was not affordable, minimum value health coverage, the employee could (erroneously) get subsidized coverage on the public health exchange. This would cause problems for applicable large employers (ALEs), who potentially face employer shared responsibility penalties, and for employees, which may have to repay erroneous subsidies.

If an employee does receive subsidized coverage on the public exchange, most employers would want to know about it as soon as possible and appeal the subsidy decision if they believed they were offering affordable, minimum value coverage. There are two ways employers might be notified: (1) by the federally facilitated or state-based exchange or (2) by the Internal Revenue Service (IRS).

Employer notices from exchanges

The notices from the exchanges are intended to

be an early-warning system to employers. Ideally, the exchange would notify

employers when an employee receives an advance premium tax credit (APTC) subsidizing

coverage. The notice would occur shortly after the employee started receiving

subsidized coverage, and employers would have a chance to rectify the situation

before the tax year ends.

In a set of Frequently Asked Questions issued September 18, 2015, the Center for Consumer Information and Insurance Oversight (CCIIO) stated the federal exchanges will not notify employers about 2015 APTCs and will instead begin notifying some employers in 2016 about employees’ 2016 APTCs. The federal exchange employer notification program will not be fully implemented until sometime after 2016.

In 2016, the federal exchanges will only send APTC notices to some employers and will use the employer address given to the exchange by the employee at the time of application for insurance on the exchange. CCIIO realizes some employer notices will probably not reach their intended recipients. Going forward, the public exchanges will consider alternative ways of contacting employers.

Employers that do receive the notice have 90 days after receipt to send an appeal to the health insurance exchange.

Employers that do not receive early notice from the exchanges will not be able to address potential errors until after the tax year is over, when the IRS gets involved.

Employer notices from IRS

The IRS, which is responsible for assessing and

collecting shared responsibility payments from employers, will start notifying

employers in 2016 if they are potentially subject to shared responsibility

penalties for 2015. Likewise, the IRS will notify employers in 2017 of

potential penalties for 2016, after their employees’ individual tax returns

have been processed. Employers will have an opportunity to respond to the IRS

before the IRS actually assesses any ACA shared responsibility penalties.

Regarding assessment and collection of the employer shared responsibility payment, the IRS states on its website:

An employer will not be contacted by the IRS regarding an employer shared responsibility payment until after their employees’ individual income tax returns are due for that year—which would show any claims for the premium tax credit.

If, after the employer has had an opportunity to respond to the initial IRS contact, the IRS determines that an employer is liable for a payment, the IRS will send a notice and demand for payment to the employer. That notice will instruct the employer how to make the payment.

Bottom line

For 2015, and quite possibly for 2016 and future years, the

soonest an employer will hear it has an employee who received a subsidy on the

federal exchange will be when the IRS notifies the employer that the employer

is potentially liable for a shared responsibility payment for the prior year.

The employer will have an opportunity to respond to the IRS before any

assessment or notice and demand for payment is made. The “early-warning system”

of public exchanges notifying employers of employees’ APTCs in the year in

which they receive them is not yet fully operational.

The Patient-Centered Outcomes Research Institute (PCORI) fee was established under the Affordable Care Act (ACA) to advance comparative clinical effectiveness research. The PCORI fee is assessed on issuers of health insurance policies and sponsors of self-insured health plans. The fees are calculated using the average number of lives covered under the policy or plan, and the applicable dollar amount for that policy or plan year. The past PCORI fees were—

The new adjusted PCORI fee is—

Employers and insurers will need to file Internal Revenue Service (IRS) Form 720 and pay the updated PCORI fee by July 31, 2016

Transitional Reinsurance Fee

Like the PCORI fee, the transitional reinsurance fee was established under the ACA. It was designed to reinsure the marketplace exchanges. Contributing entities are required to make contributions towards these reinsurance payments. A “contributing entity” is defined as an insurer or third-party administrator on behalf of a self-insured group health plan. The past transitional reinsurance fees were

The new adjusted transition reinsurance fee is—

The Affordable Care Act (“ACA”), introduced in 2014 the Transitional Reinsurance Fee (“Fee”) in an effort to fund reinsurance payments to health insurance issuers that cover high-risk individuals in the individual market and to stabilize insurance premiums in the market for the 2014 through 2016 years. The Fee has also been instituted to pay administrative costs related to the Early Retiree Reinsurance Program.

BACKGROUND ON TRANSITIONAL REINSURANCE PROGRAM

The ACA established a transitional reinsurance program to provide payments to health insurance issuers that cover high risk individuals in an attempt to evenly spread the financial risk of issuers. The program is designed to provide issuers with greater payment stability as insurance market reforms are implemented and the state-based health insurance exchanges/marketplaces facilitate increased enrollment. It is expected that the program will reduce the uncertainty of insurance risk in the individual market by partially offsetting issuers’ risk associated with high-cost enrollees. In an effort to fund the program, the ACA created the Fee which is a temporary fee that is assessed on health insurance issuers and plan sponsors of self-funded health plans. The Fee is applicable for the 2014, 2015 and 2016 years and is deductible as an ordinary and necessary business expense.

The Fee is generally applicable to all health insurance plans providing major medical coverage including sponsors of self-insured group health plans. Major medical coverage is defined as health coverage for a broad range of services and treatments, including diagnostic and preventive services, as well as medical and surgical conditions in inpatient, outpatient and emergency room settings. Since COBRA continuation coverage generally qualifies as major medical coverage, the Fee will also apply in this instance. It does not, however, apply to employer provided major medical coverage that is secondary to Medicare.

The Fee, as currently structured, does not apply to various other types of plans including (but not limited to) health savings accounts (H.S.A.s), employee assistance plans (EAP) or wellness programs that do not provide major medical coverage, health reimbursement arrangements integrated with a group health plan (HRA), health flexible spending accounts (FSA) and coverage that consists of only excepted benefits (e.g. stand-alone dental and vision).

AMOUNT OF THE FEE

The Fee for the 2015 benefit year is equal to $44 per covered life. It is expected that the Fee for the 2015 benefit year will generate approximately $8 billion in revenue. The Fee for the 2016 year is expected to be $27 per covered life and will raise approximately $5 billion in revenue. Thereafter, the Fee is set to expire and no longer be applicable. The fee for 2014 was $63 per covered life.

REPORTING THE NUMBER OF COVERED LIVES AND PAYING THE FEE

The 2015 ACA Transitional Reinsurance Program Annual Enrollment and Contributions Submission Form will be available on www.pay.gov on October 1, 2015. The form for 2014 is also available on this website. Please note there is a separate form for each benefit year. For the 2015 year, the number of covered lives must be reported to the Department no later than November 16, 2015. The Department will then notify reporting organizations no later than December 15, 2015 the amount of the fee that will be due and payable.

As with the 2014 benefit year, the Department of Health and Human Services has given contributing entities two different options to make the payment. Under the first option, the first portion of the Fee ($33 per covered life) is due and payable no later than January 15, 2016 (30 days after issuance of the notice from the Department). This portion of the Fee will cover reinsurance payments and administrative expenses. The second portion of the Fee ($11 per covered life) will cover Treasury’s administrative costs associated with the Early Retiree Reinsurance Program and will be due no later than November 15, 2016.

Under the second payment option, contributing entities can opt to pay the full amount ($44 per covered life) by January 15, 2016.

As the number of covered lives is due to be reported no later than November 16th of this year, employers should review their types of health coverage and determine which plans are subject to the Fee. Employers that have fully insured plans should be on the lookout for potential increased premiums as the insurance carrier is responsible to report and pay the Fee on behalf of the plan in these instances. Those with self funded medical coverage need to be sure to report and pay the fe

In July 2015, President Obama signed into law the Trade Preferences Extension Act of 2015. Included in the bill was an important provision that affects welfare and retirement benefit plans. The Act sizably increases filing penalties for information return and statement failures under the Internal Revenue Code, effective for filings after December 31,2015. Employers now face significantly larger penalties for failing to correctly file and furnish the ACA forms 1094 and 1095 (shared responsibility reporting requirements) as well as Forms W-2 and 1099-R.

Background

Sections 6721 and 6722 of the IRC impose penalties associated with failures to file- or to file correct- information returns and statements. Section 6721 applies to the returns required to be filed with the IRS, and Section 6722 applies to statements required to be provided generally to employees.These penalty provisions apply to the ACA shared responsibility reporting Forms 1094-B, 1094-C, 1095-B, and 1095-C (Sections 6055 & 6056) failures as well as other information returns and statement failures, like those on Forms W-2 and 1099.

For ACA:

The Sections 6055 & 6056 reporting requirements are effective for medical coverage provided on or after January 1, 2015, with the first information returns to be filed with the IRS by February 29, 2016 (or March 31,2016 if filing electronically) and provided to individuals by February 1, 2016.

Increase in Penalties

The Trade Preferences Extension Act of 2015 (Act) contains several tax provisions in addition to the trade measures that were the focus of the bill. Provided as a revenue offset provision, the law significantly increases the penalty amounts under Sections 6721 and 6722. A failure includes failing to file or furnish information returns or statements by the due date, failing to provide all required information, as well as failing to provide correct information.

The law increases the penalty for:

Other penalty increase also apply, including those associated with timely filing a corrected return. Penalties could also provide a one-two punch under the ACA for employers and other responsible entities. For example, under Sec 6056, applicable large employers (ALE) must file information returns to the IRS (the 1094-B and 1094-C) as well as furnish statements to employees (the 1095-B and 1095-C). So incorrect information shared on those forms could result in a double penalty- one associated with the information return to the IRS and the other associated with individual statements to employees.

Final regulations on the ACA reporting requirements provide short-term relief from these penalties. For reports files in 2016 (for 2015 calendar year info), the IRS will not impose penalties on ALE members that can show they made a “good-faith effort” to comply with the information reporting requirements. Specifically, relief is provided for incorrect or incomplete info reported on the return or statement, including Social Security numbers, but not for failing to file timely.

In a 6-3 decision handed down June 25th by the U.S. Supreme Court, the IRS was authorized to issue regulations extending health insurance subsidies to coverage purchased through health insurance exchanges run by the federal government or a state (King v. Burwell, No. 14-114 ).

This means employers cannot avoid employer shared responsibility penalties under IRC section 4980H (“Code § 4980H”) with respect to an employee solely because the employee obtained subsidized exchange coverage in a state that has a health insurance exchange set up by the federal government instead of by the state. It also means that President Barack Obama’s 2010 health care reform law will not be unraveled by the Supreme Court’s decision in this case. The law’s requirements applicable to employers and group health plans continue to apply without change.

What Was the Case About?

IRC section 36B (“Code § 36B”), created by the Patient Protection and Affordable Care Act of 2010 (“ACA”), provides that an individual who buys health insurance “through an Exchange established by the State under section 1311 of the Patient Protection and Affordable Care Act” (emphasis added) generally is entitled to subsidies unless the individual’s income is too high. Thus, the words of the statute conditioned one’s right to an exchange subsidy on one’s purchase of ACA coverage in a state run exchange.

Since 2014, an individual who fails to maintain health insurance for any month generally is subject to a tax penalty unless the individual can show that no affordable coverage was available. The law defines affordability for this purpose in such a way that, without a subsidy, health insurance would be unaffordable for most people.

The plaintiffs in King, residents of one of the 34 states that did not establish a state run health insurance exchange argued that if subsidies were not available to them, no health insurance coverage would be affordable for them and they would not be required to pay a penalty for failing to maintain health insurance. The IRS, however, made subsidized federal exchange coverage available to them similar to coverage in a state run exchange.

It is ACA § 1311 that established the funding and other incentives for “the States” to each establish a state-run exchange through which residents of the state could buy health insurance. Section 1311 also provides that the Secretary of the Treasury will appropriate funds to “make available to each State” and that the “State shall use amounts awarded for activities (including planning activities) related to establishing an American Health Benefit Exchange.” Section 1311 describes an “American Health Benefit Exchange” as follows:

Each State shall, not later than January 1, 2014, establish an American Health Benefit Exchange (referred to in this title as an “Exchange”) for the State that (A) facilitates the purchase of qualified health plans; (B) provides for the establishment of a Small Business Health Options Program and © meets [specific requirements enumerated].

An entirely separate section of the ACA provides for the establishment of a federally-run exchange for individuals to buy health insurance if they reside in a state that does not establish a 1311 exchange. That section – ACA § 1321 – withholds funding from a state that has failed to establish a 1311 exchange.

Notwithstanding the statutory language Congress used in the ACA (i.e., literally conditioning an individual’s eligibility subsidized exchange coverage on the purchase of health insurance through a state’s 1311 exchange), the Supreme Court determined that the language is ambiguous. Having found that the text is ambiguous, the Court stated that it must determine what Congress really meant by considering the language in context and with a view to the placement of the words in the overall statutory scheme.

When viewed in this context, the Court concluded that the plain language could not be what Congress actually meant, as such interpretation would destabilize the individual insurance market in those states with a federal exchange and likely create the “death spirals” the ACA was designed to avoid. The Court reasoned that Congress could not have intended to delegate to the IRS the authority to determine whether subsidies would be available only on state run exchanges because the issue is of such deep economic and political significance. The Court further noted that “had Congress wished to assign that question to an agency, it surely would have done so expressly” and “[i]t is especially unlikely that Congress would have delegated this decision to the IRS, which has no expertise in crafting health insurance policy of this sort.”

What Now?

Regardless of whether one agrees with the Supreme Court’s King decision, the decision prevents any practical purpose for further discussion about whether the IRS had authority to extend taxpayer subsidies to individuals who buy health insurance coverage on federal exchanges.

The ACA’s next major compliance requirements for employers: Employers with fifty or more fulltime and fulltime equivalent employees need to ensure that they are tracking hours of service and are otherwise prepared to meet the large employer reporting requirements for 2015 (due in early 2016) ). Employers of any size that sponsor self-funded group health plans need to ensure that they are prepared to meet the health plan reporting requirements for 2015 (also due in early 2016). All employers that sponsor group health plans also should be considering whether and to what extent the so-called Cadillac tax could apply beginning in 2018.

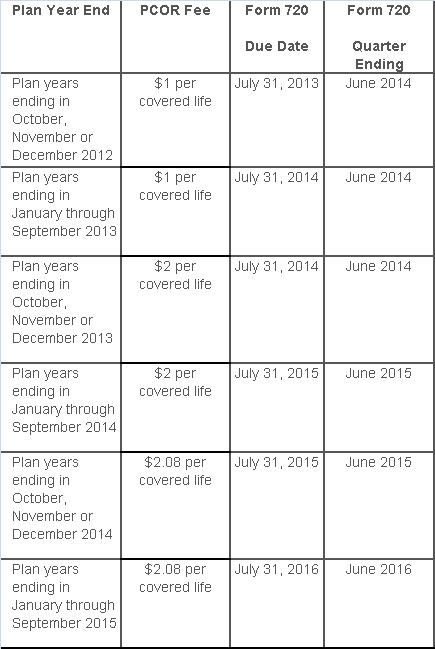

The Affordable Care Act added a patient-centered outcomes research (PCOR) fee on health plans to support clinical effectiveness research. The PCOR fee applies to plan years ending on or after Oct. 1, 2012, and before Oct. 1, 2019. The PCOR fee is due by July 31 of the calendar year following the close of the plan year. For plan years ending in 2014, the fee is due by July 31, 2015.

PCOR fees are required to be reported annually on Form 720, Quarterly Federal Excise Tax Return, for the second quarter of the calendar year. The due date of the return is July 31. Plan sponsors and insurers subject to PCOR fees but not other types of excise taxes should file Form 720 only for the second quarter, and no filings are needed for the other quarters. The PCOR fee can be paid electronically or mailed to the IRS with the Form 720 using a Form 720-V payment voucher for the second quarter. According to the IRS, the fee is tax-deductible as a business expense.

The PCOR fee is assessed based on the number of employees, spouses and dependents that are covered by the plan. The fee is $1 per covered life for plan years ending before Oct. 1, 2013, and $2 per covered life thereafter, subject to adjustment by the government. For plan years ending between Oct. 1, 2014, and Sept. 30, 2015, the fee is $2.08. The Form 720 instructions are expected to be updated soon to reflect this increased fee.

This chart summarizes the fee schedule based on the plan year end and shows the Form 720 due date. It also contains the quarter ending date that should be reported on the first page of the Form 720 (month and year only per IRS instructions). The plan year end date is not reported on the Form 720.

For insured plans, the insurance company is responsible for filing Form 720 and paying the PCOR fee. Therefore, employers with only fully- insured health plans have no filing requirement.

If an employer sponsors a self-insured health plan, the employer must file Form 720 and pay the PCOR fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720. A self-insured health plan is any plan providing accident or health coverage if any portion of such coverage is provided other than through an insurance policy.

Since the fee is a tax assessed against the plan sponsor and not the plan, most funded plans subject to ERISA must not pay the fee using plan assets since doing so would be considered a prohibited transaction by the U.S. Department of Labor (DOL). The DOL has provided some limited exceptions to this rule for plans with multiple employers if the plan sponsor exists solely for the purpose of sponsoring and administering the plan and has no source of funding independent of plan assets.

Plans sponsored by all types of employers, including tax-exempt organizations and governmental entities, are subject to the PCOR fee. Most health plans, including major medical plans, prescription drug plans and retiree-only plans, are subject to the PCOR fee, regardless of the number of plan participants. The special rules that apply to Health Reimbursement Accounts (HRAs) and Health Flexible Spending Accounts (FSAs) are discussed below.

Plans exempt from the fee include:

If a plan sponsor maintains more than one self-insured plan, the plans can be treated as a single plan if they have the same plan year. For example, if an employer has a self-insured medical plan and a separate self-insured prescription drug plan with the same plan year, each employee, spouse and dependent covered under both plans is only counted once for purposes of the PCOR fee.

The IRS has created a helpful chart showing how the PCOR fee applies to common types of health plans.

Health Reimbursement Accounts (HRAs) - Nearly all HRAs are subject to the PCOR fee because they do not meet the conditions for exemption. An HRA will be exempt from the PCOR fee if it provides benefits only for dental or vision expenses, or it meets the following three conditions:

Health Flexible Spending Accounts (FSAs) - A health FSA is exempt from the PCOR fee if it satisfies an availability condition and a maximum benefit condition.

Additional special rules for HRAs and FSAs . Once an employer determines that its HRA or FSA is subject to the PCOR fee, the employer should consider the following special rules:

The IRS provides different rules for determining the average number of covered lives (i.e., employees, spouses and dependents) under insured plans versus self-insured plans. The same method must be used consistently for the duration of any policy or plan year. However, the insurer or sponsor is not required to use the same method from one year to the next.

A plan sponsor of a self-insured plan may use any of the following three

methods to determine the number of covered lives for a plan year:

1. Actual count method. Count the covered lives on each day of the plan year and divide by the number of days in the plan year.

Example: An employer has 900 covered lives on Jan. 1, 901 on Jan. 2, 890 on

Jan. 3, etc., and the sum of the lives covered under the plan on each day of

the plan year is 328,500. The average number of covered lives is 900 (328,500 ÷

365 days).

2. Snapshot method. Count the covered lives on a single day in each quarter (or more than one day) and divide the total by the number of dates on which a count was made. The date or dates must be consistent for each quarter. For example, if the last day of the first quarter is chosen, then the last day of the second, third and fourth quarters should be used as well.

Example: An employer has 900 covered lives on Jan. 15, 910 on April 15, 890 on

July 15, and 880 on Oct. 15. The average number of covered lives is 895 [(900 +

910+ 890+ 880) ÷ 4 days].

As an alternative to counting actual lives, an employer can count the number of

employees with self-only coverage on the designated dates, plus the number of

employees with other than self-only coverage multiplied by 2.35.

3. Form 5500 method. If a Form 5500 for a plan is filed before the due date of the Form 720 for that year, the plan sponsor can determine the number of covered lives based on the Form 5500. If the plan offers just self-only coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) and divides by 2. If the plan also offers family or dependent coverage, the plan sponsor adds the participant counts at the beginning and end of the year (lines 5 and 6d on Form 5500) without dividing by 2.

Example: An employer offers single and family coverage with a plan year ending

on Dec. 31. The 2013 Form 5500 is filed on June 5, 2014, and reports 132

participants on line 5 and 148 participants on line 6d. The number of covered

lives is 280 (132 + 148).

To evaluate liability for PCOR fees, plan sponsors should identify all of their plans that provide medical benefits and determine if each plan is insured or self-insured. If any plan is self-insured, the plan sponsor should take the following actions:

According to recent news reports, nearly half of the 17 Exchanges run by states and the District of Columbia under the Affordable Care Act (ACA) are struggling financially:

Many of the online exchanges are wrestling with surging costs, especially for balky technology and expensive customer call centers — and tepid enrollment numbers. To ease the fiscal distress, officials are considering raising fees on insurers, sharing costs with other states and pressing state lawmakers for cash infusions. Some are weighing turning over part or all of their troubled marketplaces to the federal exchange, HealthCare.gov, which now works smoothly.

Of course, many states can’t solve their financial troubles easily. As independent entities, their income depends on fees imposed on insurers, which is then often passed on to the consumer signing up for health care. However, those fees are entirely contingent on how many people enroll in that particular Exchange; low enrollment invariably means higher costs.

Low enrollment is where the trouble thickens. The recently completed open enrollment period only rose 12 percent to 2.8 million sign-ups for state Exchanges, according to The Washington Post. Comparatively, the federal Exchange saw an increase of 61 percent to 8.8 million people.

According to the Post, state Exchanges have operating budgets between “$28 million and $32 million”. Most of the money tends to go to call centers, “Enrollment can be a lengthy process — and in several states, contractors are paid by the minute. An even bigger cost involves IT work to correct defective software that might, for example, make mistakes in calculating subsidies.”

However, The Fiscal Times contends that, “Some states may be misusing Obamacare grants in order to keep their state insurance exchanges operating—potentially flouting a provision in the law requiring them to cover the costs of the exchanges themselves starting this year.”

In fact, the ACA provided about $4.8 billion in grants to help states build and promote their Exchanges. As the article explains, before this year, states could use the grant money on overhead costs. However, a new provision that went into effect in January 2015 says that states can’t use the grants on maintenance and staffing costs; grant money must be spent on design, development and implementation costs.

The Fiscal Times spotlights California as a prime example of why state Exchanges are in troubled waters:

One of the worst examples comes from California, where the state’s exchange has been touted the most successful in the country for enrolling thousands of people. Covered California has already used up about $1.1 billion in federal funding to get its exchange up and running and is now expected to run a nearly $80 million deficit by the end of the year, according to the Orange County Register. The state has already set aside about $200 million to cover that, but the long-term sustainability of the program is very much in question.

In addition, state Exchanges like Hawaii might have to switch to the federal Exchange, Healthcare.gov, because of on-going financial solvency issues. “This is a contingency that is being imposed on any state-based exchange that doesn’t have a funded sustainability plan in play,” said Jeff Kissel, CEO of the Hawaii Health Connector.

According to the Post, states with the lowest enrollment are facing the biggest financial problems:

Turning operations over to the federal Exchange seems to be a popular alternative, but it doesn’t come without a cost: $10 million per Exchange, to be exact.

Although there are many options for state Exchanges to consider, it is likely that they will hold off on any final decisions until after the Supreme Court decides King v. Burwell. In this case, the Chief Justices will make a ruling in June that could either send a lifeline to ACA or remove a fundamental pillar of the law by under-cutting its ability to extend health insurance coverage to millions of Americans through its subsidy program.

The appellants in the King v. Burwell case say that IRS rule conflicts with the statutory language set forth in the ACA, which limits subsidy payments to individuals or families that enroll in the state-based Exchanges only. If the Court relies on a literal interpretation of the ACA’s language, millions of Americans who live in more than half of the states where the federal Exchange operates will not receive subsidies, thus undoing a fundamental pillar of the law. (Read more about the court case here.)

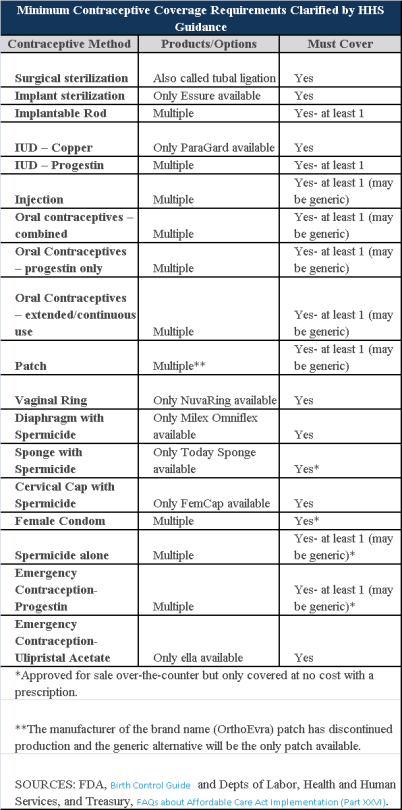

Plans and insurers must cover all 18 contraception methods approved by the U.S. Food and Drug Administration, according to a new set of questions and answers on the Affordable Care Act’s preventive care coverage requirements.

“Reasonable medical management” still may be used to steer members to specific products within those methods of contraception. A plan or insurer may impose cost-sharing on non-preferred items within a given method, as long as at least one form of contraception in each method is covered without cost-sharing.

However, an individual’s physician must be allowed to override the plan’s drug management techniques if the physician finds it medically necessary to cover without cost-sharing an item that a given plan or insurer has classified as non-preferred, according to one of the frequently asked questions from the U.S. Departments of Labor, Health and Human Services and the Treasury.

The ACA mandated all plans and insurers to cover preventive care items, as defined by the Public Health Service Act, without cost-sharing. Eighteen forms of female contraception are included under the preventive care list. The individual FAQs on contraception clarified the following requirements.

The FAQ comes just weeks after reports and news coverage detailed health plan violations of the women coverage provisions of the ACA.

Testing and Dependent Care Answers

In questions separate from contraception, plans and insurers were told they must cover breast cancer susceptibility (BRCA-1 or BRCA-2) testing without cost-sharing. The test identifies whether the woman has genetic mutations that make her more susceptible to BRCA-related breast cancer.

Another question stated that if colonoscopies are performed as preventive screening without cost-sharing, then plans could not impose cost-sharing on the anesthesia component of that service.

The U.S. Equal Employment Opportunity Commission (EEOC) recently issued proposed new rules clarifying its stance on the interplay between the Americans with Disabilities Act (ADA) and employer wellness programs. Officially called a “notice of proposed rulemaking” or NPRM, the new rules propose changes to the text of the EEOC’s ADA regulations and to the interpretive guidance explaining them.

If adopted, the NPRM will provide employers guidance on how they can use financial incentives or penalties to encourage employees to participate in wellness programs without violating the ADA, even if the programs include disability-related inquiries or medical examinations. This should be welcome news for employers, having spent nearly the past six years in limbo as a result of the EEOC’s virtual radio silence on this question.

A Brief History: How

Did We Get Here?

In 1990, the ADA was enacted to protect individuals with ADA-qualifying

disabilities from discrimination in the workplace. Under the ADA,

employers may conduct medical examinations and obtain medical histories as part

of their wellness programs so long as employee participation in them is

voluntary. The EEOC confirmed in 2000 that it considers a wellness

program voluntary, and therefore legal, where employees are neither required to

participate in it nor penalized for non-participation.

Then, in 2006, regulations were issued that exempted wellness programs from the nondiscrimination requirements of the Health Insurance Portability and Accountability Act (HIPAA) so long as they met certain requirements. These regulations also authorized employers for the first time to offer financial incentives of up to 20% of the cost of coverage to employees to encourage them to participate in wellness programs.

But between 2006 and 2009 the EEOC waffled on the legality of these financial incentives, stating that “the HIPAA rule is appropriate because the ADA lacks specific standards on financial incentives” in one instance, and that the EEOC was “continuing to examine what level, if any, of financial inducement to participate in a wellness program would be permissible under the ADA” in another.

Shortly thereafter, the 2010 enactment of President Obama’s Patient Protection and Affordable Care Act (ACA), which regulates corporate wellness programs, appeared to put this debate to rest. The ACA authorized employers to offer certain types of financial incentives to employees so long as the incentives did not exceed 30% of the cost of coverage to employees.

But in the years following the ACA’s enactment, the EEOC restated that it had not in fact taken any position on the legality of financial incentives. In the wake of this pronouncement, employers were left understandably confused and uncertain. To alleviate these sentiments, several federal agencies banded together and jointly issued regulations that authorized employers to reward employees for participating in wellness programs, including programs that involved medical examinations or questionnaires. These regulations also confirmed the previously set 30%–of-coverage ceiling and even provided for incentives of up to 50%of coverage for programs related to preventing or reducing the use of tobacco products.

After remaining silent about employer wellness programs for nearly five years, in August 2014, the EEOC awoke from its slumber and filed its very first lawsuit targeting wellness programs, EEOC v. Orion Energy Systems, alleging that they violate the ADA. In the following months, it filed similar suits against Flambeau, Inc., and Honeywell International, Inc. In EEOC v. Honeywell International, Inc., the EEOC took probably its most alarming position on the subject to date, asserting that a wellness program violates the ADA even if it fully complies with the ACA.

What’s In The NPRM?

According to EEOC Chair Jenny Yang, the purpose of the EEOC’s NPRM is to

reconcile HIPAA’s authorization of financial incentives to encourage

participation in wellness programs with the ADA’s requirement that medical

examinations and inquiries that are part of them be voluntary. To that

end, the NPRM explains:

Each of these parts of the NPRM is briefly discussed below.

What is an employee

wellness program?

In general, the term “wellness program” refers to a program or activity offered

by an employer to encourage its employees to improve their health and to reduce

overall health care costs. For instance, one program might encourage

employees to engage in healthier lifestyles, such as exercising daily, making

healthier diet choices, or quitting smoking. Another might obtain medical

information from them by asking them to complete health risk assessments or

undergo a screening for risk factors.

The NPRM defines wellness programs as programs that are reasonably designed to promote health or prevent disease. To meet this standard, programs must have a reasonable chance of improving the health of, or preventing disease in, its participating employees. The programs also must not be overly burdensome, a pretext for violating anti-discrimination laws, or highly suspect in the method chosen to promote health or prevent disease.

How is voluntary

defined?

The NPRM contains several requirements that must be met in order for

participation in wellness programs to be voluntary. Specifically,

employers may not:

Additionally, for wellness programs that are part of a group health plan, employers must provide a notice to employees clearly explaining what medical information will be obtained, how it will be used, who will receive it, restrictions on its disclosure, and the protections in place to prevent its improper disclosure.

What incentives may

you offer?

The NPRM clarifies that the offer of limited incentives is permitted and will

not render wellness programs involuntary. Under the NPRM, the maximum

allowable incentive employers can offer employees for participation in a

wellness program or for achieving certain health results is 30% of the total

cost of coverage to employees who participate in it. The total cost of

coverage is the amount that the employer and the employee pay, not just the

employee’s share of the cost. The maximum allowable penalty employers may

impose on employees who do not participate in the wellness program is the

same.

What about

confidentiality?

The NPRM does not change any of the exceptions to the confidentiality

provisions in the EEOC’s existing ADA regulations. It does, however, add

a new subsection that explains that employers may only receive information

collected by wellness programs in aggregate form that does not disclose, and is

not likely to disclose, the identity of the employees participating in it,

except as may be necessary to administer the plan.

Additionally, for a wellness program that is part of a group health plan, the health information that identifies an individual is “protected health information” and therefore subject to HIPAA. HIPAA mandates that employers maintain certain safeguards to protect the privacy of such personal health information and limits the uses and disclosure of it.

Keep in mind that the NPRM revisions discussed above only clarify the EEOC’s stance regarding how employers can use financial incentives to encourage their employees to participate in employer wellness programs without violating the ADA. It does not relieve employers of their obligation to ensure that their wellness programs comply with other anti-discrimination laws as well.

Is This The Law?

The NPRM is just a notice that alerts the public that the EEOC intends to

revise its ADA regulations and interpretive guidance as they relate to employer

wellness programs. It is also an open invitation for comments regarding

the proposed revisions. Anyone who would like to comment on the NPRM must

do so by June 19, 2015. After that, the EEOC will evaluate all of the

comments that it receives and may make revisions to the NPRM in response to

them. The EEOC then votes on a final rule, and once it is approved, it

will be published in the Federal Register.

Since the NPRM is just a proposed rule, you do not have to comply with it just yet. But our advice is that you bring your wellness program into compliance with the NPRM for a few reasons. For one, it is very unlikely that the EEOC, or a court, would fault you for complying with the NPRM until the final rule is published. Additionally, many of the requirements that are set forth in the NPRM are already required under currently existing law. Thus, while waiting for the EEOC to issue its final rule, in the very least, you should make sure that you do not:

In addition you should provide reasonable accommodations to employees with disabilities to enable them to participate in wellness programs and obtain any incentives offered (e.g., if an employer has a deaf employee and attending a diet and exercise class is part of its wellness program, then the employer should provide a sign language interpreter to enable the deaf employee to participate in the class); and ensure that any medical information is maintained in a confidential manner.