Page 1 of 2

On July 4, 2025, President Donald Trump signed the One Big Beautiful Bill Act (“OBBB”) into law. The almost 900-page bill is a sweeping tax and spending package that President Trump regards as a fulfillment of campaign promises. In addition to tax and spending cuts, the OBBB includes several provisions that will impact employee benefit plans. Thankfully, the OBBB does not eliminate the tax exclusions for employer-provided health coverage.

The OBBB’s changes for employee benefit plans include enhancements for Health Savings Accounts (HSAs), permanent extension of the telehealth relief for high-deductible health plans (HDHPs), and an increase in the annual contribution limit for dependent care FSAs. Most of the OBBB changes for employee benefit plans are effective in 2026 and do not require immediate employer action. The permanent telehealth relief extension for HDHPs is effective retroactively for the 2025 tax year so plan sponsors need to decide how to handle charges for telehealth benefits received prior to satisfaction of the deductible. The purpose of this alert is to provide an overview of these and other changes below and how they may impact your employee benefit plans but you will need to check with your insurance carrier on specifics on how they will handle some of these provisions.

There are two notable enhancements for HSAs:

The permanent extension of telehealth relief is a huge win for plan sponsors and employees. Since this relief is retroactive to plan years beginning after Dec. 31, 2024, plan sponsors who began charging HDHP participants fair market value (FMV) for telehealth services received prior to the satisfaction of the deductible can either keep their decision in place or pivot by reimbursing the FMV assessments already charged with either cash or HSA contributions. Plan sponsors who decided not to charge for telehealth in hopes of extended relief can rely on the retroactive effect of this relief and do not need to take action.

Effective for tax years beginning after Dec. 31, 2025 (i.e., January 2026 and beyond), the dependent care FSA limit is increased to $7,500 ($3,750 for married couples filing separately). This limit is not indexed for inflation.

While this increase is not as substantial as working parents would like, it is welcome news given that the prior limits have been in place since 1986 (save for a temporary increase during the COVID-19 pandemic). Plan sponsors will want to communicate these changes for 2026 open enrollment and ensure that their FSA vendor has updated plan documents/SPDs as well as the vendor’s systems to accommodate this increased limit.

There are two notable changes:

Most of the OBBB changes for employee benefit plans are effective in 2026 and therefore do not require immediate employer action.

Some action items for employers to consider include:

Plan sponsors that offer high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) will no longer be permitted to cover telehealth services before the deductible is met, as Congress failed to extend the safe harbor allowing this benefit as part of the American Relief Act of 2025, the law passed in late December to fund the federal government for the next few months. The provision may be taken up in the next Congress, but current rules expire for plan years beginning on or after January 1, 2025.

The telehealth safe harbor for HSA-qualified HDHPs was originally created by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The CARES Act permitted HDHPs to cover telehealth or other remote-care services before the plan’s deductible is met, effective on March 27, 2020 for plan years beginning on or before December 31, 2021.

Legislation enacted in March 2022 extended this flexibility from April 1, 2022 through December 31, 2022 and subsequent legislation further extended the telehealth flexibility for plan years beginning after December 31, 2022, and before January 1, 2025.

President Biden signed the American Relief Act of 2025 on December 21, 2024. The law funds the government through March 14, 2025, and provides disaster relief appropriations and economic assistance to farmers. However, the bill does not include an extension of HDHP telehealth flexibility.

Congressional leadership had originally negotiated a bipartisan bill that would have extended the HDHP telehealth flexibility rule for an additional two years.

Sponsors of HDHPs that have HSAs with plan years beginning before January 1, 2025 may continue to reimburse individuals for telehealth services before the deductible for the remainder of that plan year. However, for HDHPs with a plan year of January 1, 2025 or later, plans may not reimburse individuals for telehealth services before they meet their deductible. If a plan permits reimbursement for telehealth services before the deductible is met, the HDHP would not be HSA-qualified, and therefore participants could not contribute to an HSA for that plan year.

Consequently, plans should assure that telehealth services provided before the deductible is met in an HDHP are subject to cost-sharing, unless the service is for a preventive benefit required under the ACA (e.g., a telehealth visit to obtain a prescription for a preventive service).

Telehealth services continue to be a popular benefit. Plan sponsors should contact their health plan administrator to determine how they will implement telehealth benefits in an HDHP and whether they will be communicating changes to plan participants. In some cases, plan documents may need to be amended concerning telehealth coverage.

It is possible that the telehealth provision could be revived in the new Congress, although it is likely those efforts would take several months.

However, it is unclear when or whether there will be action on the proposed legislation. Plan sponsors should monitor developments on this issue in the next Congress.

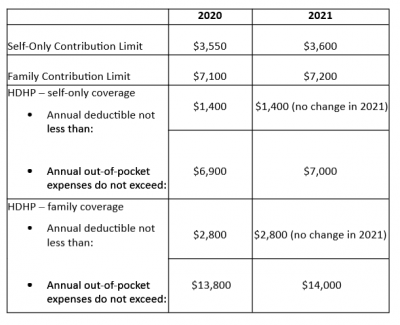

Employees will be able to sock away more money in their health savings accounts (HSAs) next year, thanks to rising inflation.

The annual limit on HSA contributions for self-only coverage in 2025 will be $4,300, a 3.6 percent increase from the $4,150 limit in 2024, the IRS announced May 9. For family coverage, the HSA contribution limit will jump to $8,550, up 3 percent from $8,300 in 2024.

Meanwhile, for 2025, a high-deductible health plan (HDHP) must have a deductible of at least $1,650 for self-only coverage, up from $1,600 in 2024, or $3,300 for family coverage, up from $3,200, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,300 for self-only coverage in 2025, up from $8,050 in 2024, or $16,600 for family coverage, up from $16,100.

The IRS also announced that the excepted-benefit HRA limit will be $2,150 in 2025, up from $2,100.

Many industry experts tout HSAs as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free.

The increased annual limits from the IRS come as HSA enrollment continues to grow, and as more employers offer contributions to employees’ accounts. HSA assets hit a record in 2023, surging to $123.3 billion last year, up nearly 19 percent from the previous record of $104 billion in 2022, according to an annual report by Devenir Group, an HSA research firm and investment consultant firm.

Jon Robb, senior vice president of research and technology at Devenir, said that growth of HSA assets “project a strong, upward trajectory for the future, indicating a steady and significant expansion of the HSA market.”

SHRM’s 2023 Employee Benefits Survey found that 64 percent of employer respondents offer a high-deductible health plan that is linked with a savings or spending account, like an HSA. That is the second most common type of health plan offered, behind a preferred provider organization plan, offered by 82 percent of employers. Among employers that do offer HSAs, 63 percent offer contributions to their employees’ accounts. The average individual-only annual contribution is $1,012, according to SHRM, while the average family annual contribution is $1,585.

Another recent report from the Employee Benefit Research Institute found that employer involvement in HSAs has a positive effect on employee’s account success. HSA holders who received employer contributions had higher balances and were more likely to invest.

HSA annual limits are released every April or May by the IRS—ahead of other limits such as flexible spending accounts and 401(k) contributions— giving employers and HSA administrators plenty of time to adjust their systems. Employers often promote HSAs and encourage employees to boost their contributions during open enrollment, though it would be a good idea for HR and benefits leaders to start that conversation now.

Thanks in part to persistent high inflation, employees will be able to sock away a lot more money in their health savings accounts (HSAs) next year.

Annual health savings account contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the IRS announced May 16: The annual limit on HSA contributions for self-only coverage will be $4,150 in 2023, a 7.8 percent increase from the $3,850 limit in 2023. For family coverage, the HSA contribution limit jumps to $8,300 in 2023, up 7.1 percent from $7,750 in 2023.

Participants 55 and older can still contribute an extra $1,000 to their HSAs.

Meanwhile, for 2024, a high-deductible health plan (HDHP) must have a deductible of at least $1,600 for self-only coverage, up from $1,500 in 2023, or $3,200 for family coverage, up from $3,000, the IRS noted. Annual out-of-pocket expense maximums (deductibles, co-payments and other amounts, but not premiums) cannot exceed $8,050 for self-only coverage in 2024, up from $7,500 in 2023, or $16,100 for family coverage, up from $15,000.

The increases are detailed in IRS Revenue Procedure 2023-23 and take effect in January 2024.

While expected, the increase in 2024 HSA limits is significant for passing certain symbolic financial thresholds. For the first time, including catch-up contributions for those age 55 and older, a couple on family coverage can now contribute more than $10,000, and a single person on self-only coverage can now contribute more than $5,000.

Many industry experts tout health savings accounts as a smart way for employees to save for medical expenses, even in retirement, citing their triple tax benefits: Contributions are made pretax, the money in the accounts grows tax free and withdrawals for qualified medical expenses are tax free. This is very good news to help more Americans understand and use HSAs as a powerful tool in their healthcare spending and long-term savings.

HSA enrollment continues to grow, and more employers also are offering contributions to employees’ accounts. At the end of 2022, Americans held $104 billion in 35.5 million health savings accounts, according to HSA advisory firm Devenir.

Despite the benefits, most holders aren’t taking full advantage of their accounts and are missing out on substantial rewards, according to the Employee Benefit Research Institute. The average account holder has a modest balance, contributes far less than the maximum and does not invest their HSA, recent EBRI data found.

The new 2023 limits are:

HSA – Single $3,850 / Family $7,750 per year

HDHP (self-only coverage) – $1,500 minimum deductible / $7,500 out-of-pocket limit

HDHP (family coverage) – $3,000 minimum deductible / $15,000 out-of-pocket limit

The IRS has released the 2022 contribution limits for FSA and several other benefits in Revenue Procedure 2021-45. The limits are effective for plan years that begin on or after January 1, 2022.

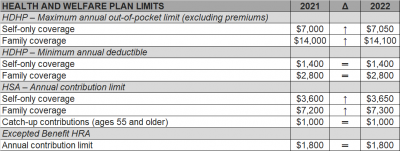

The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.

This week the IRS released two new sets of rules impacting Section 125 Cafeteria Plans. Notice 2020-33 provides permanent rule changes that include an increase in the amount of unused benefits that Health FSA plans may allow plan participants to rollover from one plan year to the next. Notice 2020-29 provides temporary rules designed to improve employer sponsored group health benefits for eligible employees in response to the coronavirus pandemic. The relief provided under each notice is optional for employers. Employers who choose to take advantage of any of the offered plan options will be required to notify eligible employees and will eventually be required to execute written plan amendments.

Notice 2020-33 modifies the amount of annual rollover of unused benefits that Health FSA plans may offer to Plan participants. Up until now, rollovers have been limited to $500 per Plan Year. The new rule sets the annual rollover limit to 20% of the statutory maximum annual employee Health FSA contribution for the applicable Plan Year. Because the statutory maximum is indexed for inflation, most years it increases (in mandated increments of $50).

The notice provides that the increased rollover amount may apply to Plan Years beginning on or after January 1, 2020. Because the corresponding annual Health FSA employee contribution limit for those Plan Years is $2,750, the annual rollover limit may be increased up to $550.

The relief provided under Notice 2020-29 falls into two major categories, both of which apply only for calendar year 2020. First, the IRS introduces several significant exceptions to the mid-year change of election rules generally applicable to Section 125 Cafeteria Plans. Second, the notice contains a special grace period which offers Health Flexible Spending Arrangement (FSA) and Dependent Care Assistance Program (DCAP) Participants additional time to incur eligible expenses during 2020.

The temporary exceptions to mid-year participant election change rules for 2020 authorize employers to allow employees who are eligible to participate in a Section 125 Cafeteria Plan to:

None of the above described election changes require compliance with the consistency rules which typically apply for mid-year Section 125 Cafeteria Plan election changes. They also do not require a specific impact from the coronavirus pandemic for the employee.

Employers have the ability to limit election changes that would otherwise be permissible under the exceptions permitted by Notice 2020-29 so long as the limitations comply with the Section 125 non-discrimination rules. For allowable Health FSA or DCAP election changes, employers may limit the amount of any election reduction to the amount previously reimbursed by the plan. Interestingly, even though new elections to make Health FSA and DCAP contributions may not be retroactive, Notice 2020-29 provides that amounts contributed to a Health FSA after a revised mid-year election may be used for any medical expense incurred during the first Plan Year that begins on or after January 1, 2020.

For the election change described in item 3 above, the enrolled employee must make a written attestation that any coverage being dropped is being immediately replaced for the applicable individual. Employers are allowed to rely on the employee’s written attestation without further documentation unless the employer has actual knowledge that the attestation is false.

The special grace period introduced in Notice 2020-29 allows all Health FSAs and DCAPs with a grace period or Plan Year ending during calendar year 2020 to allow otherwise eligible expenses to be incurred by Plan Participants until as late as December 31, 2020. This temporary change will provide relief to non-calendar year based plans. Calendar year Health FSA plans that offer rollovers of unused benefits will not benefit from this change.

The notice does clarify that this special grace period is permitted for non-calendar year Health FSA plans even if the plan provides rollover of unused benefits. Previous guidance had prohibited Health FSA plans from offering both grace periods and rollovers but Notice 2020-29 provides a limited exception to that rule.

The notice raises one issue for employers to consider before amending their plan to offer the special grace period. The special grace period will adversely affect the HSA contribution eligibility of individuals with unused Health FSA benefits at the end of the standard grace period or Plan Year for which a special grace period is offered. This will be of particular importance for employers with employees who may be transitioning into a HDHP group health plan for the first time at open enrollment.

As mentioned above, employers wishing to incorporate any of the allowable changes offered under Notices 2020-29 and 2020-33 will be required to execute written amendments to their Plan Documents and the changes should be reflected in the Plan’s Summary Plan Description and/or a Summary of Material Modification. Notice 2020-29 requires that any such Plan Amendment must be executed by the Plan Sponsor no later than December 31, 2021.

The IRS has recently issued Notice 2019-45, which increases the scope of preventive care that can be covered by a high deductible health plan (“HDHP”) without eliminating the covered person’s ability to maintain a health savings account (“HSA”).

Since 2003, eligible individuals whose sole health coverage is a HDHP have been able to contribute to HSAs. The contribution to the HSA is not taxed when it goes into the HSA or when it is used to pay health benefits. It can for example be used to pay deductibles or copays under the HDHP. But it can also be used as a kind of supplemental retirement plan to pay Medicare premiums or other health expenses in retirement, in which case it is more tax-favored than even a regular retirement plan.

As the name suggests, a HDHP must have a deductible that exceeds certain minimums ($1,350 for self-only HDHP coverage and $2,700 for family HDHP coverage for 2019, subject to cost of living changes in future years). However, certain preventive care (for example, annual physicals and many vaccinations) is covered without having to meet the deductible. In general, “preventive care” has been defined as care designed to identify or prevent illness, injury, or a medical condition, as opposed to care designed to treat an existing illness, injury, or condition.

Notice 2019-45 expands the existing definition of preventive care to cover medical expenses which, although they may treat a particular existing chronic condition, will prevent a future secondary condition. For example, untreated diabetes can cause heart disease, blindness, or a need for amputation, among other complications. Under the new guidance, a HDHP will cover insulin, treating it as a preventative for those other conditions as opposed to a treatment for diabetes.

The Notices states that in general, the intent was to permit the coverage of preventive services if:

The Notice is in general good news for those covered by HDHPs. However, it has two major limitations:

Given the expansion of the types of preventive coverage that a HDHP can cover, and the tax advantages of an HSA to employees, employers who have not previously implemented a HDHP or HSA may want to consider doing so now. However, as with any employee benefit, it is important to consider both the potential demand for the benefit and the administrative cost.