Page 1 of 1

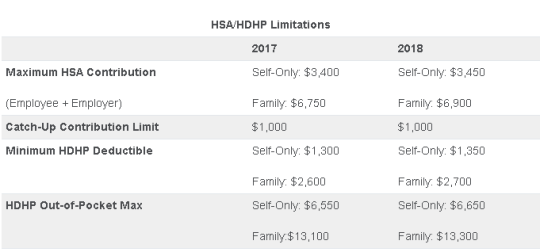

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.

Yesterday (May 4, 2017) , the House of Representatives narrowly passed the American Health Care Act of 2017 (AHCA), which contains major parts that would repeal and replace the Affordable Care Act (commonly referred to as Obamacare or ACA). The next obstacle the bill faces is making it through the Senate, which proves to be a formidable challenge.

The nonpartisan Congressional Budget Office has not had time yet to analyze the current version of the bill, but this is expected next week. The bill must now pass the Senate and could get pushed back to the House if it sees changes in the upper chamber.

In the meantime, here are some highlights we know about the bill based on how it is written today and how it would work:

We will continue to keep you up to date on the bill as it progress through legislation.

On December 22, 2014, the Departments of Health and Human Services (HHS) issued proposed regulations for changes to the Summary of Benefits and Coverage (SBC).

The proposed regulations clarify when and how a plan administrator or insurer must provide an SBC, shortens the SBC template, adds a third cost example, and revises the uniform glossary. The proposed regulations provide new information and also incorporate several FAQs that have been issued since the final SBC regulations were issued in 2012.

These proposed changes are effective for plan years and open enrollment period beginning on or after September 1, 2015. Comments on the proposed regulations will be accepted until March 2,2015 and are encourages on many of the provisions.

New Template

The new SBC template eliminates a significant amount of information that the Departments characterized as not being required by law and/or as having been identified by consumer testing as less useful for choosing coverage.

The sample completed SBC template for a standard group health plan has been reduced from four double-sided pages to two-and-a-half double-sided pages. Some of the other changes include:

Glossary Revisions

Revisions to the uniform glossary have also been proposed. The glossary must be available to plan participants upon request. Some definitions have been changed and new medical terms such as claim, screening, referral and specialty drug have been added. Additional terms related to health care reform such as individual responsibility requirement, minimum value and cost-sharing reductions have also been added.

Paper vs Electronic Distribution

SBCs may continue to be provided electronically to group plan participants in connection with their online enrollment or online renewal of coverage. SBCs may also be provided electronically to participants who request an SBC online. These individuals must also have the option to receive a paper copy upon request.

SBCs for self-insured non-federal government plans may continue to be provided electronically if the plan conforms to either the electronic distribution requirements that apply ERISA plan or the rules that apply to individual health insurance coverage.

Types of Plans to Which SBCs Apply

The regulations confirm that SBCs are not required for expatriate health plans, Medicare Advantage plans or plans that qualify as excepted benefits. Excepted benefits include:

SBCs are required for:

You may have heard a lot about how the Affordable Care Act (ACA) is going to change health insurance in the next year, but does it all apply to you? If you get your insurance from your employer, there may be a chance that you may be enrolled in a “grandfathered plan” and some of these changes may not affect you – yet.

Some health plans were allowed to be exempt from some of the ACA’s rules and protections in the interest of a smooth transition and to allow employers and individuals to keep their current policies in force without having to make substantial changes. Almost half of all Americans who get insurance through their jobs are enrolled in such plans, however that number is expected to continue to decline every year.

Consumers should know the status of their plans since that may determine whether they are eligible for certain protections and benefits created by ACA. For example, an employee at a large company may wonder why his employer provided coverage does not included the free preventative services that he has heard about on the news. In order to understand this, you must understand the status of your current medical plan and how grandfathering works.

What is a grandfathered plan?

Most health insurance plans that existed on March 23, 2013 are eligible for grandfathered status and therefore do not have to meet all of the requirements of the health care law. But if an insurer or employer makes significant changes to a plan’s benefits or how much members pay through premiums, copays, or deductibles, then the plan loses that status.

Both individual and group plans can be grandfathered. If you get coverage through an employer and they currently offer employees a grandfathered plan as part of their benefits package, you can enroll in this plan even if you were not enrolled on March 23, 2010.

What Rules Does a Grandfathered Plan Have to Follow?

A grandfathered plan has to follow some of the same rules other plans so under the ACA. For example, the plans can not impose lifetime limits on how much health care coverage an individual can receive, and they must offer dependent coverage for young adults until age 26.

There are many rules, however, that grandfather plans do not have to follow. For example, they are not required to provide preventative care without cost-sharing. In addition, they do not have to offer a package of “essential health benefits” that individual and small group plans must offer beginning 2014. Grandfathered individual plans can still impose annual dollar limits (such as capping key benefits at $750,000 in a given year) and they can deny coverage for children under age 19 if they have pre-existing conditions.

How Many People Are Enrolled in Grandfathered Plans?

In 2013, 36% of those who get coverage through their employer are enrolled in a grandfathered health plan. This number is down from 48% in 2012 and 56% in 2011, according to the Kaiser Family Foundation Employer Health Benefits Survey. Most plans are expected to lose grandfather status over time though.

How Do I Find Out If I’m Enrolled in a Grandfathered Plan?

If you want to know more about your coverage, it is best ask your insurance company or your employer’s human resource department about the status of your plan. If your employer is currently offering a grandfather plan, they are required to release a notice to you annually if they are offering benefits through a grandfathered medical plan.

Please contact our office for more information regarding if your current plan is considered “grandfathered” or for more information on ACA.