Page 1 of 1

In a proposed regulation, federal agencies suggest a rule that would require employer-sponsored group health plans to provide plan enrollees with estimates of their out-of-pocket expenses for services from different health care providers. Plans would make this information available through an online self-service tool so enrollees could shop and compare costs for services before receiving care.

Comments are due by Jan. 14, 2020, on the transparency-in-coverage rule issued by the departments of Health and Human Services, Labor and the Treasury. The unpublished rule was released on Nov. 15, when the agencies also posted a fact sheet summarizing the proposal.

Some feel that the rule, if finalized, would be the most dramatic expansion of disclosure obligations for group health plans since the ERISA was passed in 1974.

The proposal is part of the Trump administration’s attempt to create price competition in the health care marketplace. It follows the November release of a final rule requiring hospitals to publish their prices online for standard charges, including negotiated rates with providers. That rule, to take effect Jan. 1, 2021, is expected to be challenged in court by hospital industry groups.

The new proposal would apply to all health plans except those that are grandfathered under the Affordable Care Act. Among other obligations, group health plans and health insurance carriers would be required to do the following:

Information about employees’ out-of-pocket expenses and cost-sharing under employer plans is already disclosed in pre-service and post-service benefit claim determinations. However, “the proposed rules would take these disclosure requirements a step further by requiring individually tailored cost estimates prior to the receipt of services,” noted Susan Nash, a partner at law firm Winston & Strawn in Chicago.

While transparency in health care pricing is generally welcomed by employers, she observed, “employers may balk at the cost of preparing the online or mobile app-based cost-estimator tools, or purchasing such tools from vendors.”

In addition, because much of the information required to be disclosed is specific to the participant and the benefit option in which the participant is enrolled, the disclosures “will require greater coordination among employers and third-party administrators, pharmacy benefit managers, [and] disease management, behavioral health, utilization review, and other specialty vendors and will require amendments to existing agreements,” Nash explained.

The rules around public disclosure will likely be opposed by health insurance carriers who view their price negotiation as confidential and part of the service that they provide as carriers, and insurers are likely to challenge them in court, as hospital systems are expected to do with the final rule on disclosing their prices.

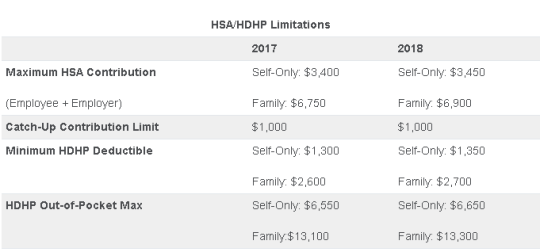

On May 4, 2017, the IRS released Revenue Procedure 2017-37 setting dollar limitations for health savings accounts (HSAs) and high-deductible health plans (HDHPs) for 2018. HSAs are subject to annual aggregate contribution limits (i.e., employee and dependent contributions plus employer contributions). HSA participants age 55 or older can contribute additional catch-up contributions. Additionally, in order for an individual to contribute to an HSA, he or she must be enrolled in a HDHP meeting minimum deductible and maximum out-of-pocket thresholds. The contribution, deductible and out-of-pocket limitations for 2018 are shown in the table below (2017 limits are included for reference).

Note that the Affordable Care Act (ACA) also applies an out-of-pocket maximum on expenditures for essential health benefits. However, employers should keep in mind that the HDHP and ACA out-of-pocket maximums differ in a couple of respects. First, ACA out-of-pocket maximums are higher than the maximums for HDHPs. The ACA’s out-of-pocket maximum was identical to the HDHP maximum initially, but the Department of Health and Human Services (which sets the ACA limits) is required to use a different methodology than the IRS (which sets the HSA/HDHP limits) to determine annual inflation increases. That methodology has resulted in a higher out-of-pocket maximum under the ACA. The ACA out-of-pocket limitations for 2018 were announced are are $7350 for single and $14,700 for family.

Second, the ACA requires that the family out-of-pocket maximum include “embedded” self-only maximums on essential health benefits. For example, if an employee is enrolled in family coverage and one member of the family reaches the self-only out-of-pocket maximum on essential health benefits ($7,350 in 2018), that family member cannot incur additional cost-sharing expenses on essential health benefits, even if the family has not collectively reached the family maximum ($14,700 in 2018).

The HDHP rules do not have a similar rule, and therefore, one family member could incur expenses above the HDHP self-only out-of-pocket maximum ($6,650 in 2018). As an example, suppose that one family member incurs expenses of $10,000, $7,350 of which relate to essential health benefits, and no other family member has incurred expenses. That family member has not reached the HDHP maximum ($14,700 in 2018), which applies to all benefits, but has met the self-only embedded ACA maximum ($7,350 in 2018), which applies only to essential health benefits. Therefore, the family member cannot incur additional out-of-pocket expenses related to essential health benefits, but can incur out-of-pocket expenses on non-essential health benefits up to the HDHP family maximum (factoring in expenses incurred by other family members).

Employers should consider these limitations when planning for the 2018 benefit plan year and should review plan communications to ensure that the appropriate limits are reflected.