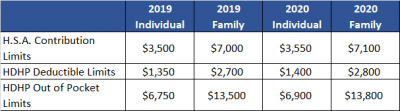

Late May 2019, the Internal Revenue Service (IRS) announced the 2020 limits for contributions to Health Savings Accounts (HSAs) and limits for High Deductible Health Plans (HDHPs). These inflation adjustments are provided for under Internal Revenue Code Section 223.

For the 2020 calendar year, an HDHP is a health plan with an annual deductible that is not less than $1,400 for self-only coverage and $2,800 for family coverage. 2020 annual out-of-pocket expenses (deductibles, copayments and other amounts, excluding premiums) cannot exceed $6,900 for self-only coverage and $13,800 for family coverage.

For individuals with self-only coverage under an HDHP, the 2020 annual contribution limit to an HSA is $3,550 and for an individual with family coverage, the HSA contribution limit is $7,100.

No change was announced to the HSA catch-up contribution limit. If an individual is age 55 or older by the end of the calendar year, he or she can contribute an additional $1,000 to his or her HSA. If married and both spouses are age 55, each individual can contribute an additional $1,000 into his or her individual account.

For married couples that have family coverage where both spouses are over age 55, each spouse can take advantage of the $1,000 catch-up, but in order to get the full $9,100 contribution, they will need to use two accounts. The contribution cannot be maximized with only one account. One individual would contribute the family coverage maximum plus his or her individual catch-up, and the other would contribute the catch-up maximum to his or her individual account.