The Internal Revenue Service (IRS) recently announced (See Revenue Procedure 2021-25) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2022. Many of the dollar limits currently in effect for 2021 will change for 2022. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

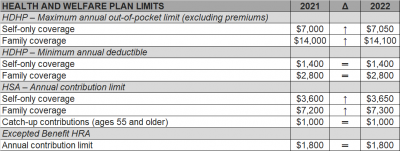

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2021 and 2022.