Page 3 of 3

The IRS has announced higher limits for 2014 contributions to health savings accounts (HSAs).The increased amounts reflect cost of living adjustments.

For 2014, the HSA contribution limit is $3300 for an individual and $6550 for a family. The HSA catch up contribution for those age 55 or older will remain at $1000. For an medical plan to be considered a qualified HDHP that can be paired with an HSA, it must have a minimum deductible of $1250 for an individual and $2500 for a family.

For those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses, they face a 20% penalty of 20% for nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

While the PPACA allows parents to add their adult children up to age 26 onto their medical plans, the IRS has not changed its definition of a dependent for HSAs. This means that an employee whose 24 year old child is covered on his HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bills. If HSA account holders can’t claim a child as a dependent on their tax returns, then they can not spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendent of these) who:

Please contact our office with questions on high deductible health plans (HDHPs) as well as Health Saving Accounts (HSAs).

The Internal Revenue Service recently announced higher contributions limits to health savings accounts (HSAs) and for out of pocket spending under qualified high deductible health plans (HDHPs) for 2014.

The IRS provided the inflation adjusted HSA contribution and HDHP minimum deductible and out of pocket limits effective for calendar year 2014. The higher rates reflect a cost of living adjustment (COLA) as well as rounding rules under the IRS Code Sec 223.

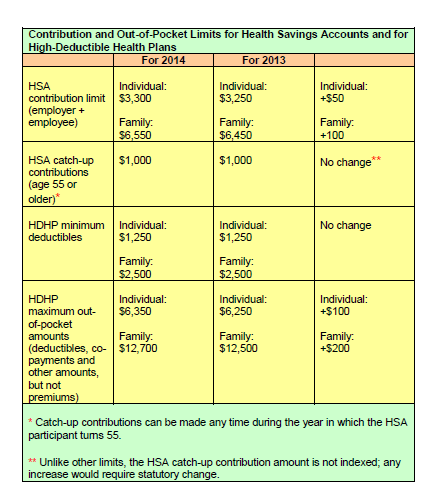

A comparison of the 2014 and 2013 limits are below:

The increases in contribution limits and out of pocket maximums from 2013 to 2014 were somewhat lower than increases in years prior.

Those under age 65 (unless totally and permanently disabled) who use HSA funds for nonqualified medical expenses face a penalty of 20% of the funds used for those nonqualified expenses. Funds spent for nonqualified purposes are also subject to income tax.

Adult Children Coverage

While the Patient Protection and Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans (and some state laws allow up to age 30 if certain requirements are met), the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose 24 year old child is covered on their HSA qualified high deductible health plan is not eligible to use HSA funds to pay for that child’s medical bill.

If account holders can’t claim a child as a dependent on their tax returns, then they can’t spend HSA dollars on services provided to that child. According to the IRS definition, a dependent is a qualifying child (daughter, son, stepchild, sibling or stepsibling, or any descendant of these) who:

According to a recent employer survey by the nonprofit National Business Group on Health and Fidelity Investments, corporate employers plan on spending an average of $521 per employee on wellness-based incentives in 2013. This marks a 13% increase from the average of $460 per employee in 2011 and almost doubles the per employee average from 2009.

The survey also found that the overall use of these incentives among corporate employers continues to increase. 86% of employers surveyed indicated that they offered wellness-based incentives.

The most populate wellness-based incentives continue to be:

A large majority of employers (54%) have also expanded their wellness-based incentives to include dependents as well. As part of the wellness incentives, employer are requiring employees to complete a health activity- like an employer sponsored biometric screening or health risk assessment- in order to determine their eligibility for the company’s health plans in 2013. Some employers are even taking steps as far informing employees that their failure to complete a health risk assessment may result in the employee being moved automatically into a less attractive medical plan offered by the company or even completely being removing them from the health coverage.

Forty-one percent of employers include, or plan to include, an outcomes based metrics as part of their incentive program. This will give both the employer and employees a measurable goal that can be used to reward behavior or results in certain health categories, such as lowering cholesterol or blood pressure or their waist line.