The Patient-Centered Outcomes Research Institute (PCORI) fee for 2018 is due by July 31, 2019. For groups whose plan year ended December 31, 2018 this will be the final PCORI payment they will have to make. Health plans whose plan year ended after December 31, 2018, but before October 1, 2019, will still have one final PCORI payment that will be due by July 31, 2020.

The PCORI fee is imposed under the Affordable Care Act (ACA) on issuers of certain health insurance policies and self-insured health plan sponsors to help fund the research institute. The fee amount is based on the average number of covered lives under the policy or plan, and the total (along with the fee) must be reported annually on the second quarter IRS Form 720 (Quarterly Federal Excise Tax Return) and paid by July 31. The fee due July 31, 2019 is calculated as $2.45 per covered life. Plan sponsors must pay the PCORI fee by July 31 of the calendar year immediately following the calendar year in which the plan year ends.

For fully insured health plans, the insurance carrier files Form 720 and pays the PCORI fee. So, employers with fully insured health plans have no filing requirement (but will be charged by the carrier for the fee). Employers that sponsor self-insured health plans are responsible for filing Form 720 and paying their due PCORI fee. For self-insured plans with multiple employers, the named plan sponsor is generally required to file Form 720.

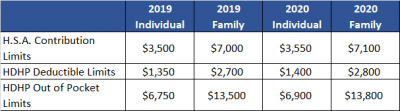

The fee may not be paid from plan assets, so it must be paid out of the sponsor’s general assets. According to the IRS, however, the fee is a tax-deductible business expense for employers with self-insured plans.Late May 2019, the Internal Revenue Service (IRS) announced the 2020 limits for contributions to Health Savings Accounts (HSAs) and limits for High Deductible Health Plans (HDHPs). These inflation adjustments are provided for under Internal Revenue Code Section 223.

For the 2020 calendar year, an HDHP is a health plan with an annual deductible that is not less than $1,400 for self-only coverage and $2,800 for family coverage. 2020 annual out-of-pocket expenses (deductibles, copayments and other amounts, excluding premiums) cannot exceed $6,900 for self-only coverage and $13,800 for family coverage.

For individuals with self-only coverage under an HDHP, the 2020 annual contribution limit to an HSA is $3,550 and for an individual with family coverage, the HSA contribution limit is $7,100.

No change was announced to the HSA catch-up contribution limit. If an individual is age 55 or older by the end of the calendar year, he or she can contribute an additional $1,000 to his or her HSA. If married and both spouses are age 55, each individual can contribute an additional $1,000 into his or her individual account.

For married couples that have family coverage where both spouses are over age 55, each spouse can take advantage of the $1,000 catch-up, but in order to get the full $9,100 contribution, they will need to use two accounts. The contribution cannot be maximized with only one account. One individual would contribute the family coverage maximum plus his or her individual catch-up, and the other would contribute the catch-up maximum to his or her individual account.

The Social Security Administration (SSA) recently resurrected its practice of issuing Employer Correction Request notices – also known as “no-match letters” – when it receives employee information from an employer that does not match its records. If you find yourself in receipt of such a letter, it is recommended that you take the following seven steps as well as considering consulting your legal counsel.

Step 1: Understand The Letter

The first and perhaps most obvious step is to read the letter carefully and understand what it says. Too often employers rush into action before taking the time to read and understand the no-match letter.

(more…)

The IRS recently released final forms and instructions for the 2018 employer reporting. The good news is that the process and instructions have not changed significantly from last year. However, the IRS has started to assess penalties on the 2015 forms. For that reason, employers should make sure they complete the forms accurately.

The final 2018 forms and instructions can be found at:

Employers with self-funded plans can use the B forms to report coverage for anyone their plan covers who is not an employee at any point during the year. The due dates for 2018 are as follows:

Be sure to file these forms on time. The IRS will assess late filing penalties if you file them after they are due. The instructions explain how to apply for extensions if you think you may miss the deadlines.

The 1095 C form can be sent to employees electronically with the employee’s consent, but that consent must meet specific requirements. The consent criteria include disclosing the necessary hardware and software requirements, the right to request a paper copy, and how to withdraw consent. They are the same consent requirements that apply to the W-2.

Employers must submit the forms electronically if they file 250 or more 1095 Cs. The instructions explain how to request a waiver of the electronic filing requirement.

(more…)

The IRS released its first piece of guidance on the newly added credit for paid family and medical leave in the form of FAQs. The FAQs provide helpful information as employers work to either implement conforming paid leave policies or ensure that their current policies are sufficient. However, the IRS acknowledged that additional guidance is needed.

Background

As part of the Tax Cuts and Jobs Act enacted and signed into law in late 2017, Congress added section 45S to the Internal Revenue Code. This section allows employers to claim a general business credit for providing paid family and medical leave to certain employees. In order to be eligible for the credit, the employer must have a written policy that allows no less than two weeks of paid family and medical leave annually. This amount is prorated for part-time employees. The written policy also must provide for payment of not less than 50 percent of the amount normally paid. Although section 45S references the Family and Medical Leave Act of 1993 (FMLA), the leave does not have to be provided under the FMLA provisions. Instead, it can simply be allowed under the employer’s policy. If, however, the employer is not covered by the FMLA, the employer’s written policy must include a non-retaliation clause.

(more…)

The Affordable Care Act (ACA) created PCORI to help patients, clinicians, payers and the public make informed health decisions by advancing comparative effectiveness research. PCORI’s research is to be funded, in part, by fees paid by either health insurers or sponsors of self-insured health plans. These fees are widely known as PCORI fees. Health insurers and self-insured plan sponsors are required to report and pay PCORI fees annually using IRS Form 720 (Quarterly Federal Excise Tax Return). The report and fees are due on July 31st with respect to the plan year that ended during the preceding calendar year. For instance, for calendar year plans, the fee that is due July 31, 2018 applies to the plan year that ended December 31, 2017.

Reporting PCORI fees on Form 720

Form 720 and completion instructions are posted on the IRS’ website. Insurers and self-insured plan sponsors must report the average number of lives covered under the plan. For fully insured plans, the carrier is responsible for reporting and paying the fee on the employers behalf. For a self-insured plan, the plan sponsor (employer) enters information for “self-insured health plans.” The number of covered lives is then multiplied by the applicable rate based on the plan year end date. Form 720 that is due July 31, 2018, will reflect payment for plan years ending in 2017. The applicable rate depends on the plan year end date:

The applicable rate may increase for inflation in future years. However, the program ends in 2019 and PCORI fees will not apply for plan years ending after September 30, 2019. Insurers or self-insured plan sponsors that file Form 720 only for the purpose of reporting PCORI fees do not need to file Form 720 for the first, third or fourth quarter of the year. Insurers or self-insured plan sponsors that file Form 720 to report quarterly excise tax liability (for example, to report the foreign insurance tax) should enter a PCORI fee amount only on the second quarter filing. See below for more information about affected plans and methods for calculating the number of participants and amount of the required PCORI fee.

(more…)

The IRS has created a webpage on understanding Letter 227, which certain applicable large employers (ALEs) may receive in connection with the assessment of employer shared responsibility penalties (aka Pay or Play penalties). As background, the IRS uses Letter 226J to notify an ALE of a proposed penalty assessment. ALEs have 30 days to respond, using Form 14764 to indicate their agreement or disagreement with the proposed penalty amount. Letter 227 acknowledges the ALE’s response to Letter 226J and explains the outcome of the IRS’s review and the next steps to fully resolve the penalty assessment. There are five different versions of the letter (samples are provided of each version on the IRS website):

Only Letters 227-L and 227-M call for a response, which must be provided by the date stated in the letter. The IRS stresses that the Letter 227 is not a bill. Notice CP 220J is used to collect the employer shared responsibility penalty payment.