Page 1 of 1

The Office of Management and Budget (OMB) announced late Tuesday (8/29/17) that it was implementing an immediate stay of the revised EEO-1 Report, putting a halt to long-awaited pay data reporting requirements. The stay creates much needed relief for employers, but is expected to further refocus pay equity discussions on a statewide and local level.

Quick Recap Of Pay Data Reporting

Historically, employers with 100 or more employees, and federal contractors with 50 or more employees, have been required to submit Employer Information Reports (EEO-1 Reports) disclosing the number of employees by job category, race, sex, and ethnicity annually. Last year, the EEOC finalized proposed changes to the EEO-1 Report which would require employers to include pay data and the number of hours worked in their reporting. The proposed reporting expansion was intended to identify pay gaps, which the agency could then use to target specific employers and investigate pay discrimination practices.

The revised form, revealed in October 2016, required employers to submit the newly requested data based on a “workforce snapshot” of any pay period between October 1, 2017 and December 31, 2017 and was due to be submitted by March 31, 2018.

The U.S. Chamber of Commerce and many other observers identified serious flaws in the proposed rule. Following pushback by numerous business groups, the EEOC announced it would issue a second set of revisions to the form. However, the revisions encompassed only two minor changes and failed to alleviate significant employer concerns. Businesses across the country had thus been preparing to usher in a new day when it came to having their pay practices placed under a federal microscope, and until yesterday, it appeared inevitable that the disclosure would proceed as planned.

Feds Press Pause On Pay Data Reporting

All of that changed yesterday with the announcement from the federal government. In issuing an immediate stay of the revised EEO-1 report, the OMB voiced its own concerns with the revised reporting requirements. The office announced: “…[we are] concerned that some aspects of the revised collection of information lack practical utility, are unnecessarily burdensome, and do not adequately address privacy and confidentiality issues.”

Employers are still required to submit EEO-1 Reports using the previously approved form. The deadline for submission of 2017 data remains March 31, 2018. However, employers can breathe a sigh of relief when it comes to the proposed expanded pay data reporting requirements – for now.

Whether this development foreshadows the ultimate demise of the revised EEO-1 Report is currently unclear. However, national attention on wage inequities remains despite yesterday’s announcement, and the focus on pay equity enforcement is increasingly shifting to state and local levels. States like California, New York, Massachusetts, Oregon, Nevada, and others have all passed pay equity legislation in the last year. Consequently, with each state acting as its own incubator for how to best address these disparities, pay equity analysis and related litigation is becoming more complicated.

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

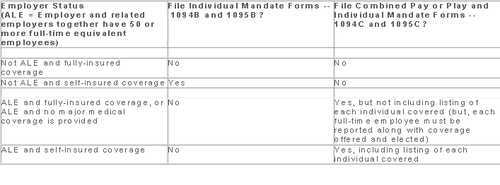

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.