Page 1 of 53

On Tuesday, April 23, the U.S. Department of Labor announced a rule to significantly increase the salary level needed to qualify for the FLSA’s overtime exemptions applicable to executive, administrative and professional employees to $844 per week ($43,888 annualized). The rule will also increase the total compensation needed to qualify for exemption under the test for highly compensated employees to $132,964 per year. These figures will be effective on July 1, 2024, but will increase again as of January 1, 2025. On that date, the rule will increase the salary basis threshold to $1,128 per week ($58,656 annualized), and the threshold for exemption for highly compensated employees to $151,164 per year.

Under the rule, these salary levels will be subject to automatic increases every three years. While legal challenges to the new rule are expected, employers should not wait for those challenges to be resolved before assessing the rule’s impact on their operations and considering potential changes.

This seminar is also approved for 2 Professional Development Credits (PDCs) with SHRM for all attendees.

Under a new Florida law, employers will need to turn to state and federal agencies – rather than local governments – for guidance on certain key workplace rules. On April 11th, Governor Ron DeSantis signed HB 433 which preempts local governments from passing laws related to workplace heat safety protocols and curbs their ability to use contracting power to influence private employer wage rates and employee benefits. The new law also prohibits local governments from making their own rules about workplace scheduling or “predictive scheduling” for private employers. Here are the three top takeaways for employers as you prepare for compliance.

1. Heat Safety Protocols

Florida falls under federal OSHA jurisdiction, which covers most private-sector workers in the state. The new statute bans counties and municipalities from requiring private employers to offer heat safety protections to employees beyond what’s required under the Occupational Health and Safety Act (OSH Act).

For example, the Miami-Dade County Commission recently withdrew a bill that would have required employers to provide outdoor construction and farm workers with 10-minute breaks in the shade every two hours. Going forward, Florida employers should continue to ensure their practices comply with the federal OSH Act.

To provide a safe workplace, consider taking the following steps before summer:

This part of the new law will take effect on July 1.

2. Wages and Employee Benefits

Under HB 433, local governments will be prohibited from using their purchasing or contracting power to control the wages or employment benefits of entities they do business with. They will also be barred from awarding preferences to entities that offer more favorable wages and benefits to employees. Additionally, HB 433 moves local governments’ ability to:

Notably, counties such as Broward and Miami-Dade – which have living wage ordinances mandating higher pay than the state minimum wage for service contractors and subcontractors – will be impacted the most by the wage requirement revisions.

These revisions to the Florida Statutes will go into effect for contracts entered after September 29, 2026.

3. Scheduling and Predictive Scheduling

Finally, HB 433 impacts a local government’s ability to force private employers to implement scheduling and predictive scheduling policies. Predictive scheduling laws require employers to provide work schedules to employees in advance. In some instances, predictive scheduling laws also require employers to provide additional benefits to employees. For instance, Oregon requires employers in the retail, hospitality, and food industries (with at least 500 employees worldwide) to provide schedules posted in an obvious location at least 14 days in advance, pay employees a penalty for shift changes with no notice, permit employees to provide input on availability and to reject shifts not on schedule, and allow employees at least 10 hours between shifts on back-to-back days.

Under Florida’s new legislation, effective July 1, any predictive scheduling requirement will have to be enacted by the Florida Legislature and Governor.

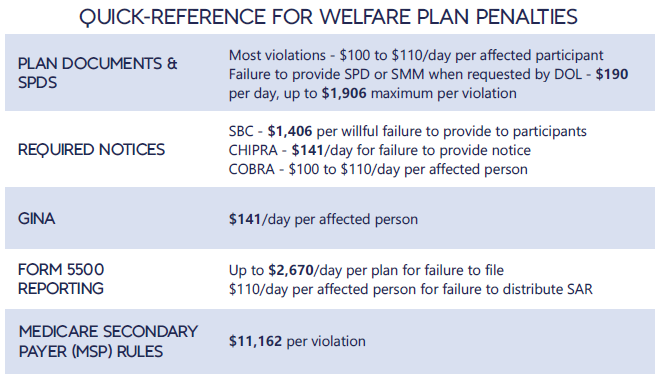

Each year in mid January, the Department of Labor (DOL) adjusts ERISA penalty amounts to account for inflation. This year’s increases are modest and amount to approximately 3%. Below summarizes a few of the penalty amounts that plan sponsors could see imposed on them for various federal law violations. The adjusted amounts apply to ERISA violations that occurred after November 2, 2015, if penalties are assessed after January 15, 2024, and before January 16, 2025.

*Notes: figures in bold are subject to annual adjustment

Below are the current inflation adjusted penalty amounts for failure to file forms 1094 and 1095 with the IRS and failure to provide form 1095 to applicable employees. Both penalties increase to $630 per form if failure is due to “intentional disregard” (criminal penalties may also apply).

The Equal Employment Opportunity Commission (EEOC) has issued final regulations and Interpretative Guidance to implement the Pregnant Workers Fairness Act (PWFA). The PWFA went into effect on June 27, 2023. The PWFA requires that employers with at least 15 employees provide reasonable accommodations, absent undue hardship, to qualified employees and applicants with known limitations related to, affected by, or arising out of pregnancy, childbirth, or related medical conditions.

The PWFA required the EEOC to publish final regulations by December 29, 2023. However, the EEOC did not issue final regulations until April 15, 2024. The final regulations are slated to be published in the Federal Register on April 19, and will go into effect 60 days after publication. The final regulations were issued after over 100,000 public comments were submitted in response to the proposed regulations.

In the final regulations the EEOC clarifies, and in some instances, expands upon the circumstances in which an employer must reasonably accommodate an employee, absent undue hardship. The following is a list of some of the issues addressed in the 400+ pages of final regulations.

If you have any questions about the PWFA or the implications of the regulations for your organization please let us know.

The Florida Legislature just passed a bill to loosen existing work restrictions for minors who are at least 16 years old. Governor DeSantis signed the bill on March 22, and it will take effect on July 1, 2024. You should note that both federal and state laws restrict the time of day and number of hours that minors can work, the type of work that minors can perform, and the equipment they can use. Although the federal Fair Labor Standards Act (FLSA) governs child labor and sets the minimum standards, states can enact more restrictive child labor laws. Florida is one of the states that has enacted more restrictive child labor laws — but the new legislation lightens up on restrictions for older teens, allowing those workers and their employers more flexibility. Here’s what employers need to know about HB 49 and the top five questions to consider when hiring teenagers.

The New Rules

5 Questions to Consider

If you’re thinking about hiring younger workers or increasing the hours that your minor employees work, you should ask yourself these five questions:

While HB 49 relaxes some work restrictions for minors, Florida employers should continue to ensure compliance with child labor laws by regularly reviewing hiring and employment practices with respect to minors, providing detailed training to managers, and performing internal audits to ensure compliance with both Florida and federal child labor laws.

More of your employees may be eligible for overtime pay under a new rule that is likely to be finalized in April 2024 and could take effect soon. As proposed in August, the Labor Department intends to significantly raise the exempt salary threshold from about $35K to about $55K – meaning your workers will need to earn at least the new threshold to even be considered exempt from OT pay. The White House budget office recently announced that it is reviewing the rule, which is the final step before it is shared with the public. Although the final rule will likely face legal challenges, you can’t bank on a court halting its implementation. Moreover, the higher exempt salary threshold is expected to impact 3.6 million workers, which means you should start planning now. Here’s an eight-step action plan to help you prepare as the rule is finalized.

1. Review Pay Practices and Prepare for Compliance

Under the federal Fair Labor Standards Act (FLSA), employees generally must be paid an overtime premium of 1.5 times their regular rate of pay for all hours worked beyond 40 in a workweek — unless they fall under an exemption. One of the criteria to qualify for an exemption is earning a weekly salary above a certain level.

Currently, the salary threshold for exempt employees is $684 a week ($35,568 annualized). The DOL’s proposal, if finalized in its current form, would raise the rate to $1,059 a week ($55,068 annualized) or high depending on cost-of-living adjustments. The proposed rule would also automatically update the salary threshold every three years, which means you’d have to adjust your budget accordingly. These are big changes that will require some planning if you have exempt employees who earn less than the proposed amount.

2. Work Through Your Decision Tree

Start by creating a list of your exempt employees who currently earn between $35,568 and $55,068 a year. You will have to decide whether to raise their salary to meet the new threshold or convert them to non-exempt status. If you decide to convert them, there are many considerations to take into account and you should work with legal counsel to review:

Additionally, you may want to start tracking their actual hours worked now to help you understand the potential impact of converting to non-exempt status as those individuals will need to be paid overtime.

3. Consider the Impact on Employee Morale

Reclassifying employees to non-exempt could have a negative impact on morale. Many employees associate prestige with being classified as an exempt-salaried employee, they like the flexibility that comes with being salaried, and they don’t want to track and record their hours worked. Therefore, employees may view a switch to non-exempt status as a demotion.

4. Plan to Provide Advance Notice of Changes

In addition to developing communications focused on employee relations and morale, you’ll want to provide a written communication to each employee about the specific changes to their compensation and what new responsibilities come with the changes, such as timekeeping and record keeping.

5. Review Your Policies on Company Equipment and Personal Devices

Do you have different policies for exempt and non-exempt employees when it comes to issuing company equipment and using personal devices? Exempt employees may have more leeway to use company laptops or their own personal devices – such as smartphones – to conduct business while traveling or outside of their regular office hours. You will have to determine how to address these policies moving forward.

6. Develop a Training Plan for Managers and Newly Non-Exempt Employees

It is recommended that you provide detailed training to newly reclassified employees and their managers prior to the changes taking effect. There’s a lot to learn. The specifics may vary from business to business, but you’ll want to cover scheduled hours, OT approval policies, timekeeping procedures, rules about meal and rest breaks, and more.

7. Ensure Exempt Employees Meet the Duties Test

Besides the salary test, exempt employees also need to satisfy certain duties requirements. Neither their job title nor job description alone determines whether an employee qualifies for a white-collar (or any other) exemption. This is a good opportunity to ensure they meet these standards as well.

8. Review Applicable State Laws

It is important to remember that other jurisdictions can have higher, stricter, or different wage and hour requirements. For example, some states already have a higher salary threshold for the white-collar exemptions than the FLSA’s $684 per week.

Conclusion

You can click here for a more detailed compliance plan and background about the federal overtime rule courtesy of Fisher Phillips LLP.

On February 12, 2024, the IRS released Rev. Proc. 2024-14 to provide the adjusted excise tax amounts under the Affordable Care Act’s Employer Shared Responsibility provisions (also known as the ACA Pay or Play Penalty) for 2025.

For background, employers with more than 50 full-time employees (including full-time equivalent employees) are subject to the ACA Pay or Play Penalty under Section 4980H of the Internal Revenue Code (the “Code”). Employers subject to ACA Pay or Play may be liable for a penalty if they do not offer minimum essential coverage to a sufficient number of full-time employees, or if minimum essential coverage is offered to the required number of full-time employees, but that coverage is not affordable.

2025 Adjusted Penalty Amounts

During this episode of Myra’s Minutes, we discuss ways to navigate the confusing world of insurance benefits and claims with AAG on your side.

You can view this short video here.

All OSHA 300A logs must be posted by February 1st in a visible location for employees to read. The logs need to remain posted through April 30th.

Please note the 300 logs must be completed for your records only as well. Be sure to not post the 300 log as it contains employee details.

The 300A log is a summary of all workplace injuries, including COVID cases, and does not contain employee specific details. The 300A log is the only log that should be posted for employee viewing.

Please contact our office if you need a copy of either the OSHA 300 or 300A logs.