Page 1 of 1

Until very recently, employers were at risk of receiving steep fines if they reimbursed employees for non-employer sponsored medical care – the Affordable Care Act (ACA) included fines of up to $36,500 a year per employee for such an action. Late in 2016, however, President Obama signed the 21st Century Cures Act and established Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). As of January 1, 2017, small employers can offer these tax-free medical care reimbursements to eligible employees.

If an employee incurs a medical care expense, such as health insurance premiums or eligible medical expenses under IRC Section 213(d), the employer can reimburse the employee up to $4,950 for single coverage or $10,000 for family coverage. Employees may not make any contributions or salary deferrals to QSEHRAs.

The maximum amount must

be prorated for those not eligible for an entire year. For example, an employer

offering the maximum reimbursement amount should only reimburse up to $2,475 to

an employee who has been working for the company for six months. For a complete

list of medical expenses covered under IRC 213(d), see https://www.irs.gov/pub/irs-pdf/p502.pdf.

Employers may tailor which expenses they will reimburse to a certain extent,

and do not have to reimburse employees for all eligible medical expenses.

Much like other healthcare reimbursement arrangements, employees may have to provide substantiation before reimbursement. The IRS has discretion to establish requirements regarding this process, but has not yet done so. Although reimbursements may be provided tax-free, they must be reported on the employee’s W-2 in Box 12 using the code “FF.”

To offer QSEHRAs, an employer cannot be an applicable large employer (ALE) under the ACA. Only employers with fewer than 50 full-time equivalent employees can offer this benefit. Further, a group cannot offer group health plans to any employees to qualify.

Typically, an employer that chooses to offer a QSEHRA must offer it to all employees who have completed at least 90 days of work. The few exceptions to this rule include part-time or seasonal employees, non-resident aliens, employees under the age of 25, and employees covered by a collective bargaining agreement.

Employers may offer differing reimbursement amounts based on employee age or family size. However, such variances must be based on the cost of premiums of a reference policy on the individual market. It is currently unclear which reference policy will be selected or how permitted discrepancies will be calculated.

To be eligible for a tax-free reimbursement, employees must have proof of minimum essential coverage. It is uncertain how closely employers will have to scrutinize such proof, although guidance will hopefully be available soon.

Eligible employees must disclose to health exchanges the amount of QSEHRA benefits available to them. The exchanges will account for the reported amount, even if the employee does not utilize it, and will likely reduce the amount of the subsidies available. Employers should take this into account before adopting a QSEHRA.

In order to establish a QSEHRA, employers will have to set up and administer a plan. Group health plan requirements, such as ACA reporting and COBRA requirements, do not apply to QSEHRAs. But in order to properly provide reimbursements to employees, employers will likely have to establish reimbursement procedures.

Additionally, any eligible employees must be notified of the arrangements in writing at least 90 days before the first day they will be eligible to participate. For the current year, the IRS is giving employers who implement QSEHRAs an extension until March 13, 2017 to provide a notice. The notice must provide the amount of the maximum benefit, and that eligible employees inform health insurance exchanges this benefit is available to them. It also must inform eligible employees they may be subject to the individual ACA penalties if they do not have minimum essential coverage.

The Affordable Care Act (ACA) established Health Insurance Marketplaces (also called Exchanges) where individuals can shop and enroll in health coverage. Individuals who meet certain criteria are eligible for premium subsidies and cost-sharing reductions for coverage on the Marketplace.

For the first time, in 2016 some employers will receive a notice from a Marketplace indicating that one of their employees signed up for health coverage through the Marketplace and received advanced premium subsidies. Many employers are asking what these notices mean and what actions they should take if they receive one.

Premium subsidies and cost-sharing reductions are designed to expand healthcare coverage by making insurance, and its utilization, more affordable. Premium subsidies, more accurately referred to as a premium tax credit, are claimed on an individual’s income tax return at the end of the year. What is unique about this tax credit is that an individual can choose to have the expected premium tax credit advanced throughout the year, in which case the government makes payments directly to the health insurer on the individual’s behalf. Importantly, individuals who have access to health coverage through an employer that is affordable and meets minimum value are not eligible to receive the premium tax credit or advances of the premium tax credit for their coverage.

The ACA generally requires that applicable large employers – generally employers with 50 or more full-time employees, including full-time equivalents – offer health coverage that is affordable and of minimum value to their full-time employees (and their dependents) or face an Internal Revenue Service (IRS) tax. This is often referred to as the employer “pay or play” or employer mandate provision. Tax liability under this employer provision is triggered if one of the employer’s full-time employees receives a premium tax credit and the amount of the tax liability is determined by the number of full-time employees who received the premium tax credit.

During the Marketplace application process, individuals are asked a host of questions, including questions about access to health coverage through an employer. If the Marketplace determines that the individual does not have access through an employer to coverage that is affordable and meets the required minimum value, and assuming the individual meets other eligibility criteria, advance payments of the premium tax credit can begin.

In such an instance, the Marketplace is required to send the employer a Marketplace notice. This will be the first year the Federally Facilitated Marketplace (FFM) is sending out these notices. It is worth noting that there is not a commitment to send a notice to all employers, and the FFM has said it can send a notice only if the individual provides a complete employer address. Consequently, some employers expecting Marketplace notices may not receive them and notices may not be mailed to the preferred employer address.

The Marketplace notices will give employers advance warning that they may have potential tax liability under the employer mandate of the ACA. However, there are reasons that receiving a notice does not necessarily mean the IRS will be in hot pursuit, including:

The FFM recently posted a sample of its 2016 notice which can be found here.

Please note that the notice suggests that employers should call the IRS for more information if they have questions, however, IRS telephone assistors will be unable to provide information on the Marketplace process, including the appeals process, and will be unable to tell an employer whether they owe a tax under the employer mandate.

An employer who receives a Marketplace notice may want to appeal the decision that the individual was not offered employer coverage that was affordable and of minimum value. An employer has 90 days from the date of the notice to file an appeal, which is made directly to the Marketplace. Importantly, the IRS will independently determine whether an employer has a tax liability, and the employer will have the opportunity to dispute any proposed liability with the IRS. Similarly, an individual will have the opportunity to challenge an IRS denial of premium tax credit eligibility. Any contact by the IRS, however, will occur late in the game after the year’s tax liabilities have already been incurred. Therefore, although an appeal is not required, it may be advisable.

Regardless of whether an employer pursues an appeal, an employer, particularly one that offers affordable, minimum value health coverage, should communicate to its employees about its offering. Although an applicable large employer is required to furnish IRS Form 1095-C to full-time employees detailing the employer’s offer, a better option is providing employees with information before they enroll in Marketplace coverage.

In summary, the Marketplace notice serves as an advance warning that either the employer or the employee may have a tax liability. Given this exposure, employers should review Marketplace notices and their internal records and consider taking action.

In a first-of-its-kind decision, a federal court recently upheld the right of employees to sue their employer for allegedly cutting employee hours to less than 30 hours per week to avoid offering health insurance under the Affordable Care Act (ACA). Specifically, the District Court for the Southern District of New York denied a defense Motion to Dismiss in a case where a group of workers allege that Dave & Buster’s (a national restaurant and entertainment chain) “right-sized” its workforce for the purpose of avoiding healthcare costs.

Although this case is in the very early stages of litigation and is far from being decided, you should monitor this for developments to determine whether you need to take action to deter potential copycat lawsuits.

One of the initial concerns by ACA critics is that many employers would respond to the Employer Mandate by reducing full-time employee hours to avoid the coverage obligation and associated penalties, increasing the number of part-time workers in the national economy. This is because the ACA does not require an employer to offer affordable, minimum-value coverage to employees generally working less than 30 hours per week.

Although the initial economic data analyzing the national workforce suggests that the predictions of wide-scale reduction in employee hours have not materialized, some employers have increased their reliance on part-time employees as an ACA strategy to manage the costs of the Employer Mandate.

Section 510 of ERISA prohibits discrimination and retaliation against plan participants and beneficiaries with respect to their rights to benefits. More specifically, ERISA Section 510 prohibits employers from interfering “with the attainment of any right to which such participant may become entitled under the plan.” Because many employment decisions affect the right to present or future benefits, courts generally require that plaintiffs show specific employer intent to interfere with benefits if they want to successfully assert a cause of action under ERISA Section 510.

The court found that the class of plaintiffs showed sufficient evidence in support of their claim that their participation in the health insurance plan was discontinued because the employer acted with “unlawful purpose” in realigning its workforce to avoid ACA-related costs. In this regard, the employees claimed that the company held meetings during which managers explained that the ACA would cost millions of dollars, and that employee hours were being reduced to avoid that cost.

However, if you are considering reducing your employee hours, you should carefully consider how such reductions are communicated to your workforce. Employers often have varied reasons for reducing employee hours, and many of those reasons have legitimate business purposes. It is vital that any communications made to your employees about such reductions describe the underlying rationale with clarity.

Beginning in Spring 2016, the Affordable Care Act (ACA) Exchanges/Marketplaces will begin to send notices to employers whose employees have received government-subsidized health insurance through the Exchanges. The ACA created the “Employer Notice Program” to give employers the opportunity to contest a potential penalty for employees receiving subsidized health insurance via an Exchange.

The notices will identify any employees who received an advance premium tax credit (APTC). If a full-time employee of an applicable large employer (ALE) receives a premium tax credit for coverage through the Exchanges in 2016, the ALE will be liable for the employer shared responsibility payment. The penalty if an employer doesn’t offer full-time equivalent employees (FTEs) affordable minimum value essential coverage is $2,160 per FTE (minus the first 30) in 2016. If an employer offers coverage, but it is not considered affordable, the penalty is the lesser of $3,240 per subsidized FTE in 2016 or the above penalty. Penalties for future years will be indexed for inflation and posted on the IRS website. The Employer Notice Program does provide an opportunity for an ALE to file an appeal if employees claimed subsidies they were not entitled to.

The first batch of notices will be sent in Spring 2016 and additional notices will be sent throughout the year. For 2016, the notices are expected to be sent to employers if the employee received an APTC for at least one month in 2016 and the employee provided the Exchange with the complete employer address.

Last September, the Centers for Medicare and Medicaid Services (CMS) issued FAQs regarding the Employer Notice Program. The FAQs respond to several questions regarding how employers should respond if they receive a notice that an employee received premium tax credits and cost sharing reductions through the ACA’s Exchanges.

Employers will have an opportunity to appeal the employer notice by proving they offered the employee access to affordable minimum value employer-sponsored coverage, therefore making the employee ineligible for APTC. An employer has 90 days from the date of the notice to appeal. If the employer’s appeal is successful, the Exchange will send a notice to the employee suggesting the employee update their Exchange application to reflect that he or she has access or is enrolled in other coverage. The notice to the employee will further explain that failure to provide an update to their application may result in a tax liability.

An employer appeal request form is available on the Healthcare.gov website. For more details about the Employer Notice Program or the employer appeal request form visit www.healthcare.gov.

Although CMS has provided these guidelines to apply only to the Federal Exchange, it is likely that the state-based Exchanges will have similar notification programs.

Employers should prepare in advance by developing a process for handling the Exchange notices, including appealing any incorrect information that an employee may have provided to the Exchange. Advance preparation will enable you to respond to the notice promptly and help to avoid potential employer penalties.

Beginning January 1, 2015, employers have new reporting obligations for health plan coverage, to allow the government to administer the “pay or play” penalties to be assessed against employers that do not offer compliant coverage to their full-time employees.

Even though the penalties only apply if there are 100 or more employees for 2015, employers with 50 or more full-time equivalent employees are required to report for 2015. Also, note this reporting is required even if the employer does not maintain any health plan.

Employers that provide self-funded group health coverage also have reporting obligations, to allow the government to administer the “individual mandate” which results in a tax on individuals who do not maintain health coverage.

These reporting obligations will be difficult for most employers to implement. Penalties for non-compliance are high, so employers need to begin now with developing a plan on how they will track and file the required information.

Pay or Play Reporting. Applicable large employers (ALEs) must report health coverage offered to employees for each month of 2015 in an annual information return due early in 2016. ALEs are employers with 50 or more full-time equivalent (FTE) employees. Employees who average 30 hours are counted as one, and those who average less than 30 hours are combined into an equivalent number of 30 hour employees to determine if there are 50 or more FTE employees. All employees of controlled group, or 80% commonly owned employers, are also combined to determine if the 50 FTE threshold is met.

Individual Mandate Reporting. Self-funded employers, including both ALEs and small employers that are not ALEs, must report each individual covered for each month of the calendar year. For fully-insured coverage, the insurance carrier must report individual month by month coverage. The individual mandate reporting is due early in 2016 for each month of 2015.

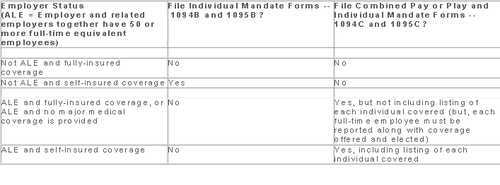

Which Form? ALE employers have one set of forms to report both the pay or play and the individual mandate information – Forms 1094C and 1095C. Insurers and self-insured employers that are not ALEs use Forms 1094B and 1095B to report the individual mandate information. Information about employee and individual coverage provided on these forms must also be reported by the employer to its employees as well as to COBRA and retiree participants. Forms 1095B and 1095C can be used to provide this information, or employers can provide the information in a different format.

The following chart summaries which returns are filed by employers:

Who Reports? While ALE status is determined on a controlled group basis, each ALE must file separate reports. Employers will need to provide insurance carriers, and third party administrators who process claims for self-funded coverage (if they will assist the employer with reporting), accurate data on the employer for whom each covered employee works. If an employee works for more than one ALE in a controlled group, the employer for whom the highest number of hours is worked does the reporting for that employee.

Due Date for Filing. The due date of the forms matches the due dates of Forms W-2, and employers may provide the required employee statements along with the W-2. Employee reporting is due January 31st and reporting to the IRS is due each February 28th, although the date is extended until March 31st if the forms are filed electronically. If the employer files 250 or more returns, the returns must be filed electronically. Reporting to employees can only be made electronically if the employee has specifically consented to receiving these reports electronically.

Penalties. Failure to file penalties can total $200 per individual for whom information must be reported, subject to a maximum of $3 million per year. Penalties will not be assessed for employers who make a good faith effort to file correct returns for 2015.

What Information is Required? For the pay or play reporting, each ALE must file a Form 1094C reporting the number of its full-time employees (averaging 30 hours) and total employees for each calendar month, whether the ALE is in a “aggregated” (controlled) group, a listing of the name and EIN of the top 30 other entities in the controlled group (ranked by number of full-time employees), and any special transition rules being used for pay or play penalties. ALE’s must also file a 1095C for each employee who was a full-time employee during any calendar month of the year. The 1095C includes the employee’s name, address and SSN, and month by month reporting of whether coverage was offered to the employee, spouse and dependents, the lowest premium for employee only coverage, and identification of the safe-harbor used to determine affordability. This information is used to determine pay or play penalty taxes and to verify the individuals’ eligibility for subsidies toward coverage costs on the Federal and state exchanges.

If the ALE provides self-funded coverage, the ALE must also report on the 1095C the name and SSN of each individual provided coverage for each calendar month. If an employer is not an ALE, but is self-funded, the name and SSN of each covered individual is reported on the 1095B and the 1094B is used to transmit the forms 1095B to the IRS.

A chart is available that sets out what data must be reported on each form, to help employers determine what information they need to track. Click here to access the chart.

Next Steps. Employers will need to determine how much help their insurance carrier or TPA can provide with the reporting, and then the employer’s HR, payroll and IT functions will need to work together to be sure the necessary information is being tracked and can be produced for reporting in January 2016.

The Affordable Care Act (ACA) imposes significant information reporting responsibilities on employers starting with the 2015 calendar year. One reporting requirement applies to all employer-sponsored health plans, regardless of the size of the employer. A second reporting requirement applies only to large employers, even if the employer does not provide health coverage. The IRS is currently developing new systems for reporting the required information and recently released draft forms, however instructions have yet to be released.

Information returns

The new information reporting systems will be similar to the current Form W-2 reporting systems in that an information return (Form 1095-B or 1095-C) will be prepared for each applicable employee, and these returns will be filed with the IRS using a single transmittal form (Form 1094-B or 1094-C). Electronic filing is required if the employer files at least 250 returns. Employers must file these returns annually by Feb. 28 (March 31 if filed electronically). Therefore, employers will be filing these forms for the 2015 calendar year by Feb. 28 or March 31, 2016 respectively. A copy of the Form 1095, or a substitute statement, must be given to the employee by Jan. 31 and can be provided electronically with the employee’s consent. Employers will be subject to penalties of up to $200 per return for failing to timely file the returns or furnish statements to employees.

The IRS released drafts of the Form 1095-B and Form 1095-C information returns, as well as the Form 1094-B and Form 1094-C transmittal returns, in July 2014 and is expected to provide instructions for the forms in August 2014. According to the IRS, both the forms and the instructions will be finalized later this year.

Health coverage reporting requirement

The health coverage reporting requirement is designed to identify employees and their family members who are enrolled in minimum essential health coverage. Employees who are offered coverage, but decline the coverage, are not reported. The IRS will use this information to determine whether the employees are exempt from the individual mandate penalty due to having health coverage for themselves and their family members.

Insurance companies will prepare Form 1095-B (Health Coverage) and Form 1094-B (Transmittal of Health Coverage Information Returns) for individuals covered by fully-insured employer-sponsored group health plans. Small employers with self-insured health plans will use Form 1095-B and Form 1094-B to report the name, address, and Social Security number (or date of birth) of employees and their family members who have coverage under the self-insured health plan. However, large employers (as defined below) with self-insured health plans will file Forms 1095-C and 1094-C in lieu of Forms 1095-B and 1094-B.

Large employer reporting requirement

“Applicable large employer members (ALE)” are subject to the reporting requirement if they offer an insured or self-insured health plan, or do not offer any group health plan. ALE members are those employers that are either an applicable large employer on their own or are members of a controlled or affiliated service group with an ALE (regardless of the number of employees of the group member). ALEs are those that had, on average, at least 50 full-time employees (including full-time equivalent “FTE” employees) during the preceding calendar year. Full-time employees are those who work, on average, at least 30 hours per week. Employers with fewer than 50 full-time employees and equivalents are not applicable large employers and, thus, are exempt from this health coverage reporting requirement.

As referenced above, an employer’s status as an ALE is determined on a controlled or affiliated service group basis. For example, if Company A and Company B are members of the same controlled group and Company A has 100 employees and Company B has 20 employees, then A and B are both members of an ALE. Consequently, Company A and Company B must each file the information returns.

Each ALE member must file Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) and Form 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns) with the IRS for each calendar year. The IRS will use this information to determine whether (1) the employer is subject to the employer mandate penalty, and (2) an employee is eligible for a premium tax credit on insurance purchased through the new health insurance exchange. ALEs with fewer than 100 full-time employees are generally eligible for transition relief from the employer mandate penalty for their 2015 plan year. Nonetheless, these employers are still required to file Forms 1095-C and 1094-C for the 2015 calendar year.

The employer mandate penalty can be imposed on any ALE member that does not offer affordable, minimum value health coverage to all of its full-time employees starting in 2015. Health coverage is affordable if the amount that the employer charges an employee for self-only coverage does not exceed 9.5 percent of the employee’s Form W-2 wages, rate of pay, or the federal poverty level for the year. A health plan provides minimum value if the plan is designed to pay at least 60 percent of the total cost of medical services for a standard population. In the case of a controlled or affiliated service group, the employer mandate penalties apply to each member of the group individually.

ALE members must prepare a Form 1095-C for each employee. The return will report the following information:

An ALE member will file with the IRS one Form 1094-C transmitting all of its Forms 1095-C. The Form 1094-C will report the following information:

As noted above, each ALE member is required to file Forms 1095-C and 1094-C for its own employees, even if it participates in a health plan with other employers (e.g., when the parent company sponsors a plan in which all subsidies participate). Special rules apply to multiemployer plans for collectively-bargained employees.

Action required

In light of the complexity of the new information reporting requirements, it is recommended that employers should begin taking steps now to prepare for the new reporting requirements:

Starting in 2015, the Affordable Care Act (ACA) requires applicable large employers to offer affordable, minimum value health coverage to their full time employees (and dependents) or pay a penalty. The employer penalty rules are also known as the employer mandate or the “pay or play” rules.

Effective in 2014, affordability of health coverage is used to determine whether an individual is:

On July 24, 2014, the IRS released Revenue Procedure 2014-37 to index the ACA’s affordability percentages for 2015.

For plan years beginning in 2015, an applicable large employer’s health coverage will be considered affordable under the pay or play rules if the employee’s requires contribution to the plan does not exceed 9.56 percent of the employee’s household income for the year. The current affordability percentage for 2014 is 9.5 percent.

Applicable large employers can use one of the IRS’ affordability safe harbors to determine whether their health plans will satisfy the 9.56 percent requirement for 2015 plan years, if requirements for the applicable safe harbor are met.

This adjusted affordability percentage will also be used to determine whether an individual is eligible for a premium tax credit for 2015. Individuals who are eligible for employer-sponsored coverage that is affordable and provides minimum value are not eligible for a premium tax credit in the Exchange.

Also, Revenue Procedure 2014-37 adjusts the affordability percentage for the exemption from the individual mandate for individuals who lack access to affordable minimum essential coverage. For plan years beginning in 2015, coverage is unaffordable for purposes of the individual mandate if it exceeds 8.05 percent of household income.

Employer Mandate

The pay or play rules apply only to applicable large employers. An “applicable large employer” is an employer with, on average, at least 50 full-time employees (including full-time equivalents) during the preceding calendar year. Many applicable large employers will be subject to the pay or play rules starting in 2015. However, applicable large employers with fewer than 100 full-time employees may qualify for an additional year, until 2016, to comply with the employer mandate.

Affordability Determination

The affordability of health coverage is a key point in determining whether an applicable large employers will be subject to a penalty.

For 2014, the ACA provides that an employer’s health coverage is considered affordable if the employee’s required contribution to the plan does not exceed 9.5 percent of the employee’s household income for the taxable year. The ACA provides that, for plan year beginning after 2014, the IRS must adjust the affordability percentage to reflect the excess of the rate of premium growth over the rate of income growth for the preceding calendar year.

As noted above, the IRS has adjusted the affordability percentage for plan years beginning in 2015 to 9.56 percent. The affordability text applies only to the portion of the annual premiums for self-only coverage and does not include any additional cost for family coverage. Also, if an employer offers multiple health coverage options, the affordability test applies to the lowest-cost option that also satisfies the minimum value requirement.

Affordability Safe Harbors

Because an employer generally will not know an employee’s household income, the IRS created three affordability safe harbors that employers may use to determine affordability based on information that is available to them.

The affordability safe harbors are all optional. An employer may choose to use one or more of the affordability safe harbors for all its employees or for any reasonable category of employees, provided it does so on a uniform and consistent basis for all employees in a category.

The affordability safe harbors are:

Individual Mandate

Beginning in 2014, the ACA requires most individuals to obtain acceptable health insurance coverage for themselves and their family members or pay a penalty. This rule is often referred to as the “individual mandate”. Individual may be eligible for an exemption from the penalty in certain circumstances.

Under the ACA, individuals who lack access to affordable minimum essential coverage are exempt from the individual mandate. For purposes of this exemption, coverage is considered affordable for an employee in 2014 if the required contribution for the lowest-cost, self-only coverage does not exceed 8 percent of household income. For family members, coverage is considered affordable in 2014 if the required contribution for the lowest-cost family coverage does not exceed 8 percent of household income. This percentage will be adjusted annually after 2014.

For plan years beginning in 2015, the IRS has increased this percentage from 8 percent to 8.05 percent.

For tax years 2010 – 2013, eligible small employers are entitled to a 35% tax credit for health insurance premiums they pay for employees. Tax-exempt entities are eligible for a 25% credit.

To qualify for the credit, an employer must:

Employers with less than 10 FTEs and average annual wages of $25,000 or less are eligible for the full credit. There is a phase-out of the credit for employers that have between 10 and 25 FTEs or average annual wages between $25,000 and $50,000.

All employers calculate the credit using IRS Form 8941, Credit for Small Employer Health Insurance Premiums. Taxable employers claim the credit on their federal tax return and can apply the credit to both regular and alternative minimum tax. Tax-exempt employers claim the credit by filing Form 990-T, Exempt Organization Business Income Tax Return, and can receive a refundable credit up to the amount of the employer’s payroll taxes.

In 2014, the credit will continue to be available, but with significant modifications. Employers will only be eligible for the credit if they purchase health insurance through the new Small Business Health Options Program (SHOP). The SHOP is one component of the internet-based health insurance marketplace, also known as an exchange, which launches on Oct. 1, 2013.

Other upcoming changes include: